Top CD Rates in 2025: Earn Up to 5.88% APY for 7 Months & 5.80% for 18 Months

Discover the highest CD rates available nationwide in 2025. Lock in 5.88% APY for 7 months with West Town Bank & Trust or 5.80% APY for 18 months with Seattle Bank. Jumbo deposits can earn up to 5.85%. Explore top CD options to maximize your savings today.

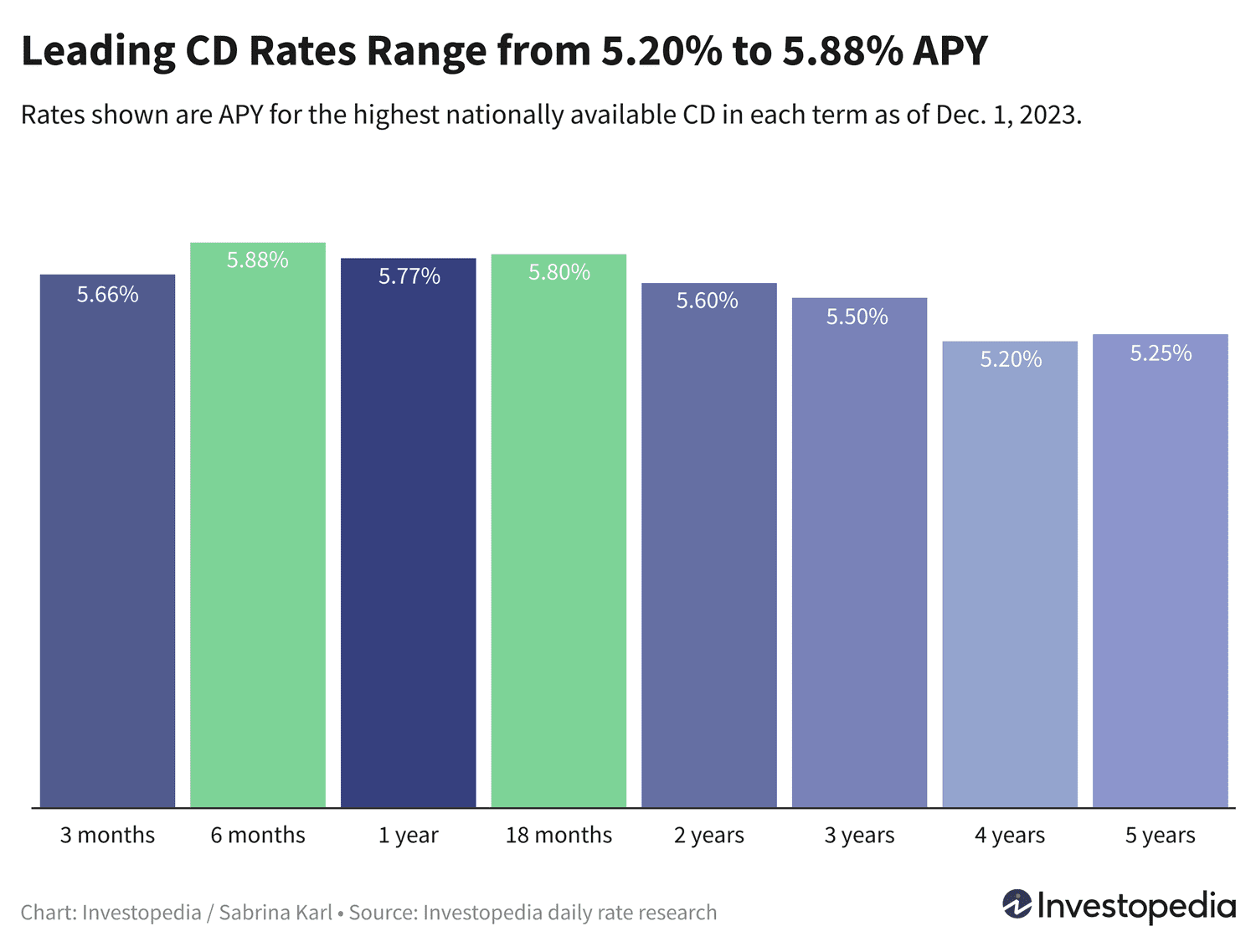

After the recent expiration of the last 6% CD that dominated our nationwide rankings, the spotlight now shines on the leading CDs offering competitive rates close to 6%. Currently, West Town Bank & Trust leads with an impressive 5.88% APY for a 7-month term, making it the top short-term option for savvy savers. For those seeking longer commitments, Seattle Bank offers a strong 5.80% APY for an 18-month term, providing excellent returns over a more extended period.

Additionally, if you can make a jumbo deposit, there’s an attractive 5.85% APY available on a 12-month certificate through State Bank of Texas or All In Credit Union. This option is ideal for investors looking to maximize earnings on larger sums.

Key Highlights

- Nationwide top CD rate stands at 5.88% APY for a 7-month term.

- Longer 18-month CDs offer up to 5.80% APY.

- More than 10 CDs pay 5.75% APY or higher across various terms.

- 2- to 5-year CDs provide competitive rates ranging from 5.20% to 5.60% APY.

- Jumbo CDs can yield up to 5.85% APY on select 12-month certificates.

- Market forecasts suggest the Federal Reserve may pause rate hikes, but further increases remain possible depending on inflation trends.

For investors aiming to secure a top rate on CDs, the maximum term with the highest yields is currently 18 months. However, for those who prefer longer durations, competitive rates of 5.60% APY for 2 years and 5.50% APY for 3 years are available. Even 4- and 5-year CDs offer solid returns at 5.20% and 5.25% APY respectively.

Jumbo depositors, with minimum investments of $50,000 or $100,000, can enhance their earnings by opting for jumbo CDs that deliver up to 5.85% APY for a 12-month term or 5.63% APY for 2 years.

Investor Insights

Recent surveys reveal that 28% of investors prefer CDs during volatile market periods, reflecting a slight decline from 29% in the previous month. Moreover, 14% of investors would consider opening a CD if they had an additional $10,000 to invest, closely following the 15% who favor individual stocks.

Important Considerations

Note that jumbo CDs don’t always guarantee higher returns compared to standard CDs. In many cases, standard certificates offer equal or better rates. Therefore, it’s wise to compare both options before deciding.

Forecast for CD Rates in 2024

The Federal Reserve’s aggressive rate hikes since early 2022 have created historically favorable environments for CD investors, pushing yields to levels unseen in decades. Although the Fed paused rate increases recently, Chairman Jerome Powell indicated that future hikes remain possible if inflation does not stabilize.

Inflation has recently eased to its lowest point since March 2021, leading markets to anticipate no further rate hikes. However, the Fed’s stance remains cautious, suggesting that CD rates may hold steady or gradually decline unless new rate increases occur.

Current Best Rates

- Top CD rates as of May 2025: up to 4.50% APY

- Best high-yield savings accounts: two offers at 5.00% APY

- Premier money market accounts: yields up to 4.40% APY

How We Find the Best CD Rates

Our daily research tracks over 200 federally insured banks and credit unions nationwide, focusing on institutions available in at least 40 states. We identify the highest-yielding CDs with reasonable minimum deposits (up to $25,000) to provide a comprehensive ranking of the best certificates across all terms. We exclude credit unions requiring donations over $40 to join, ensuring accessible options for most savers.

Explore useful articles in Personal Finance News as of 07-12-2023. The article titled " Top CD Rates in 2025: Earn Up to 5.88% APY for 7 Months & 5.80% for 18 Months " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Top CD Rates in 2025: Earn Up to 5.88% APY for 7 Months & 5.80% for 18 Months " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.