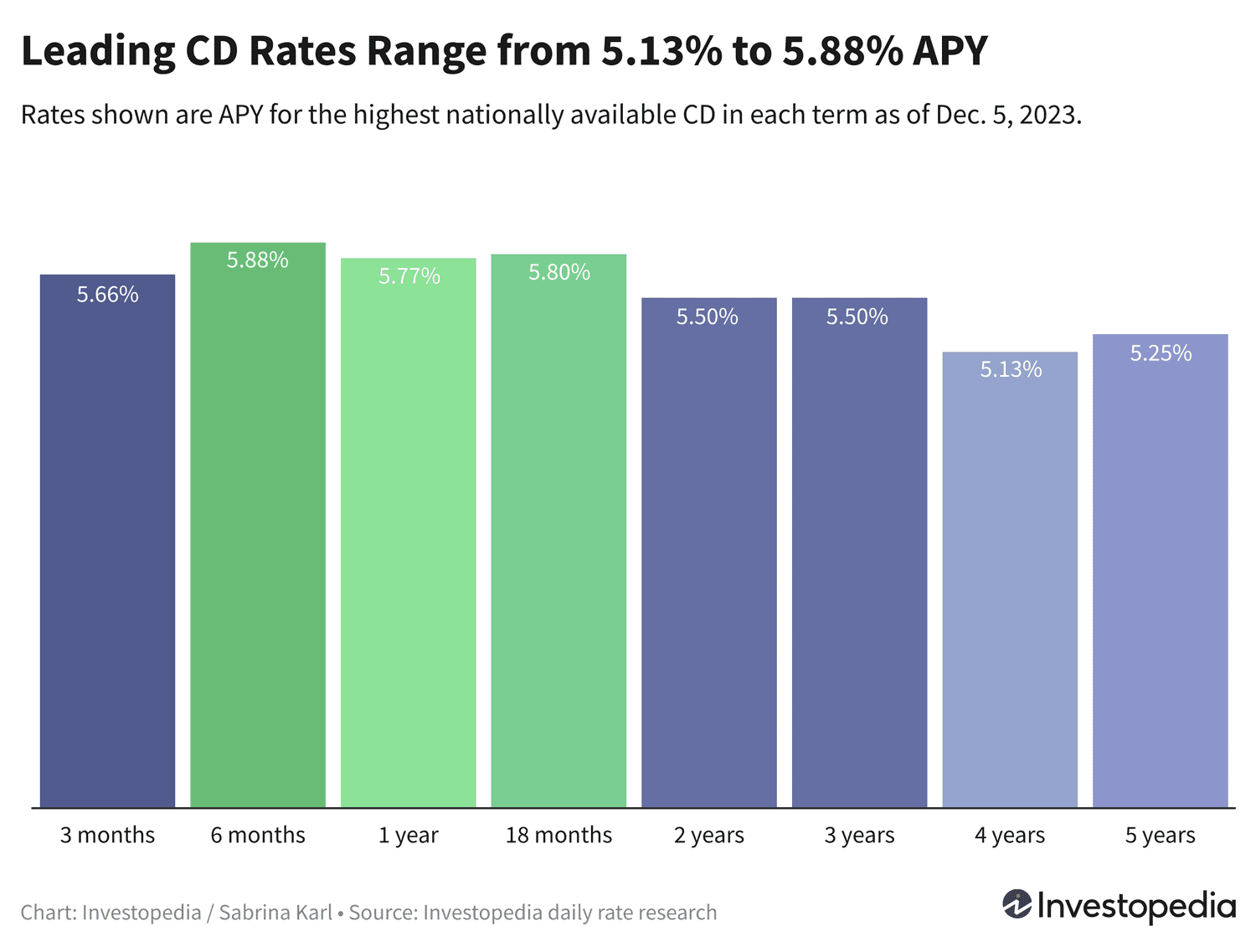

Best CD Rates in December 2023: 7-Month Top Yield at 5.88%, 4-Year Rate Drops to 5.13%

Explore the latest top CD rates for December 2023, featuring a 5.88% APY for 7 months from West Town Bank & Trust and a slight decline in the 4-year rate to 5.13% APY from Wellby Financial. Discover where to lock in the best returns today.

As we move through December 2023, the likelihood of additional Federal Reserve rate hikes has significantly decreased. For the second consecutive day, the highest CD rates for longer terms have experienced a modest decline. The 4-year CD rate recently dropped from 5.20% to 5.13% APY, signaling a good opportunity for savers to secure top yields before any further decreases.

Previously, BMO, one of the nation's largest banks, offered the leading 4-year CD rate at 5.20% through its online platform, BMO Alto. Following their rate adjustment, Wellby Financial now offers the highest 4-year rate at 5.13% APY. For short-term investors, West Town Bank & Trust remains the leader with a 7-month CD at an impressive 5.88% APY.

Highlights:

- The highest overall CD rate available nationwide is 5.88% APY for a 7-month term with West Town Bank & Trust.

- Seattle Bank offers an 18-month CD at 5.80% APY, ideal for investors seeking longer terms.

- A total of nine CDs currently provide rates of 5.75% APY or higher, down from twelve last week.

- Jumbo CD rates have shifted, with All In Credit Union leading at 5.80% APY for an 18-month jumbo certificate.

- While markets suggest the Fed may pause rate hikes, Fed Chair Jerome Powell indicates further increases remain possible if inflation does not stabilize.

For investors eyeing longer durations, 2- and 3-year CDs offer competitive rates around 5.50% APY. Even with the recent decline, the 4-year CD at 5.13% APY and a 5-year CD at 5.25% APY provide solid options for locking in returns.

Investor Insight:

A recent survey of ZAMONA readers revealed 28% are favoring CDs amid current market conditions, making them the top investment choice. Additionally, 14% would open a CD with an extra $10,000, highlighting growing interest in secure, high-yield savings options.

Federal Reserve Outlook and CD Rate Trends:

The Federal Reserve has been actively addressing inflation with multiple rate hikes since 2022, boosting CD yields to historically attractive levels. After maintaining rates steady in November 2023, the Fed's future moves remain uncertain but suggest a plateau in CD rates for now. Inflation easing to its lowest levels since early 2021 supports this outlook.

Investors should note that jumbo CDs don’t always outperform standard CDs, as seen in most terms currently. It’s advisable to compare both before committing.

How ZAMONA Finds the Best CD Rates:

ZAMONA evaluates over 200 federally insured banks and credit unions nationwide daily, focusing on institutions available in at least 40 states and CDs requiring initial deposits under $25,000. Our methodology ensures you receive the most competitive rates for your investment needs.

Explore useful articles in Personal Finance News as of 10-12-2023. The article titled " Best CD Rates in December 2023: 7-Month Top Yield at 5.88%, 4-Year Rate Drops to 5.13% " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Best CD Rates in December 2023: 7-Month Top Yield at 5.88%, 4-Year Rate Drops to 5.13% " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.