2025 CD Rates Update: Top APY at 5.75% with 7 More Offers at 5.60%+

Discover the latest 2025 CD rates where INOVA Federal Credit Union leads with 5.75% APY for 8 months. Explore 7 additional top offers paying 5.60% APY or higher, plus insights on future rate trends and smart investment choices.

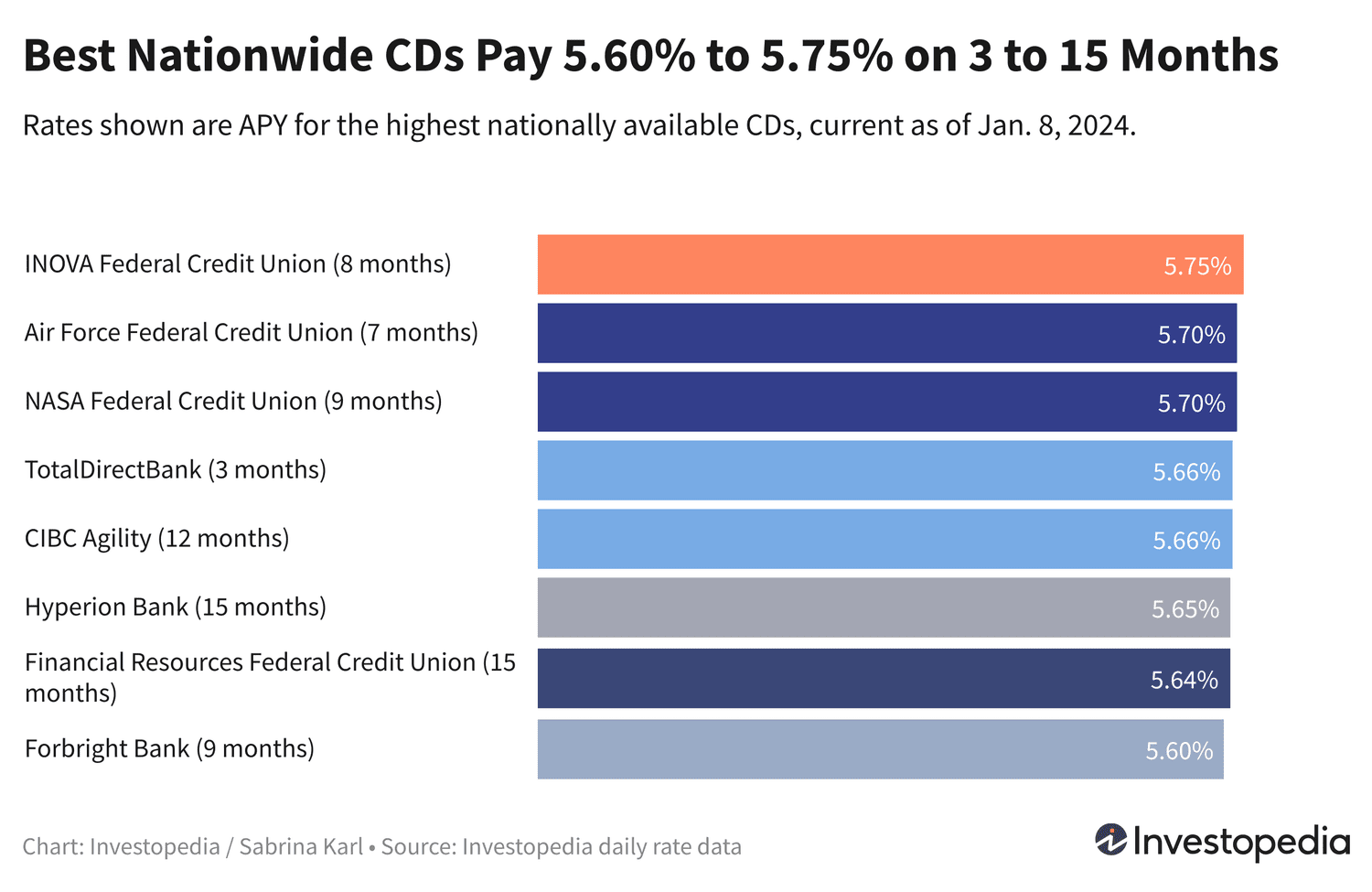

As of 2024, the highest annual percentage yield (APY) on nationwide certificates of deposit (CDs) remains steady at 5.75%, presented by INOVA Federal Credit Union for an 8-month term. Close behind, Air Force Federal Credit Union and NASA Federal Credit Union offer competitive rates of 5.70% APY for 7 and 9 months respectively. Additionally, five other CDs provide attractive yields ranging from 5.60% to 5.66% APY.

While CD rates have slightly eased from their historic highs seen last fall, the Federal Reserve's pause in interest rate hikes has maintained stable top-tier rates. Investors can still capitalize on eight different CDs offering 5.60% APY or better, making this an opportune time to lock in strong returns.

Highlights

- The top CD rate remains at 5.75% APY for an 8-month term, with all term leaders holding steady.

- Eight nationally accessible CDs currently yield 5.60% APY or higher.

- Although today's rates are below October’s peak of 6.50%, they remain historically elevated.

- Potential Federal Reserve rate cuts in 2024 may influence CD yields downward.

Below are featured offers from our partners, followed by a comprehensive ranking of the best CDs nationwide.

After a peak of 18 CDs offering at least 5.75% APY in early November, only one remains at that level as 2024 begins. However, seven additional options pay 5.60% or higher, with terms from 3 to 15 months.

Longer-term CDs offer slightly lower yields but can be strategic as interest rates may decline. The highest 2-year CD yields 5.39% APY, and a 3-year CD offers 5.23%. Rates for 4- and 5-year CDs have dipped below 5% but still provide solid returns up to 4.89% APY.

Locking in these longer-term rates now ensures attractive earnings through 2026 and beyond, even if market rates fall.

Investor Insight

A December survey showed 28% of Investopedia readers favor CDs amid recent market volatility, just behind money market funds. Moreover, 11% would open a CD if they had an extra $10,000 to invest, ranking third after individual stocks and ETFs.

For jumbo deposits, slightly higher yields are available on 3-, 4-, and 5-year CDs. Hughes Federal Credit Union offers the top jumbo rate of 5.65% APY for 17 months, which matches rates available on standard 15-month CDs.

Note on Jumbo CDs

Jumbo CDs do not always outperform standard CDs. Currently, in five of eight terms, standard CDs offer comparable or better rates. It’s wise to compare both types before choosing.

Outlook for CD Rates in 2024

The Federal Reserve paused rate hikes in late 2023 after aggressive increases since early 2022 to combat inflation. This environment has created historically favorable yields for CDs and high-yield savings accounts.

Inflation has eased recently, and while the Fed has not ruled out future hikes, discussions are underway about potential rate cuts in 2024. The median forecast anticipates three rate reductions totaling 0.75% in the coming year.

Nonetheless, uncertainty remains regarding timing and necessity of further hikes, especially after stronger-than-expected job reports. The next Fed meeting is scheduled for January 31, 2024.

Fed decisions heavily influence CD rates, as banks and credit unions align deposit rates with the federal funds rate. While predicting Fed moves is challenging, CD rates are expected to gradually decline from record highs.

Current Best Rates: 2025 CDs up to 4.50% APY, high-yield savings accounts with offers at 5.00%, and money market accounts up to 4.40% APY.

Important Reminder

The "top rates" presented reflect the highest nationally available APYs found through daily research of hundreds of banks and credit unions. These rates differ significantly from national averages, which include many institutions offering minimal interest. By shopping around, savers can find rates 5 to 15 times higher than averages.

Our Methodology for Finding Top CD Rates

Each business day, we analyze rates from over 200 federally insured banks and credit unions offering CDs nationwide. To qualify, institutions must have FDIC or NCUA insurance, offer CDs with minimum deposits under $25,000, and be accessible in at least 40 states. Credit unions requiring donations over $40 for membership are excluded. For detailed criteria, see our full methodology.

Discover engaging topics and analytical content in Personal Finance News as of 13-01-2024. The article titled " 2025 CD Rates Update: Top APY at 5.75% with 7 More Offers at 5.60%+ " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 2025 CD Rates Update: Top APY at 5.75% with 7 More Offers at 5.60%+ " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.