Top CD Rates in March 2025: Earn Between 4.60% and 5.75% APY with Leading Certificates

Discover the highest CD rates available nationwide in March 2025, featuring returns up to 5.75% APY for 6-month terms and competitive yields over 5% for 1 to 3-year CDs. Lock in your savings with top banks and credit unions today.

Highlights to Know

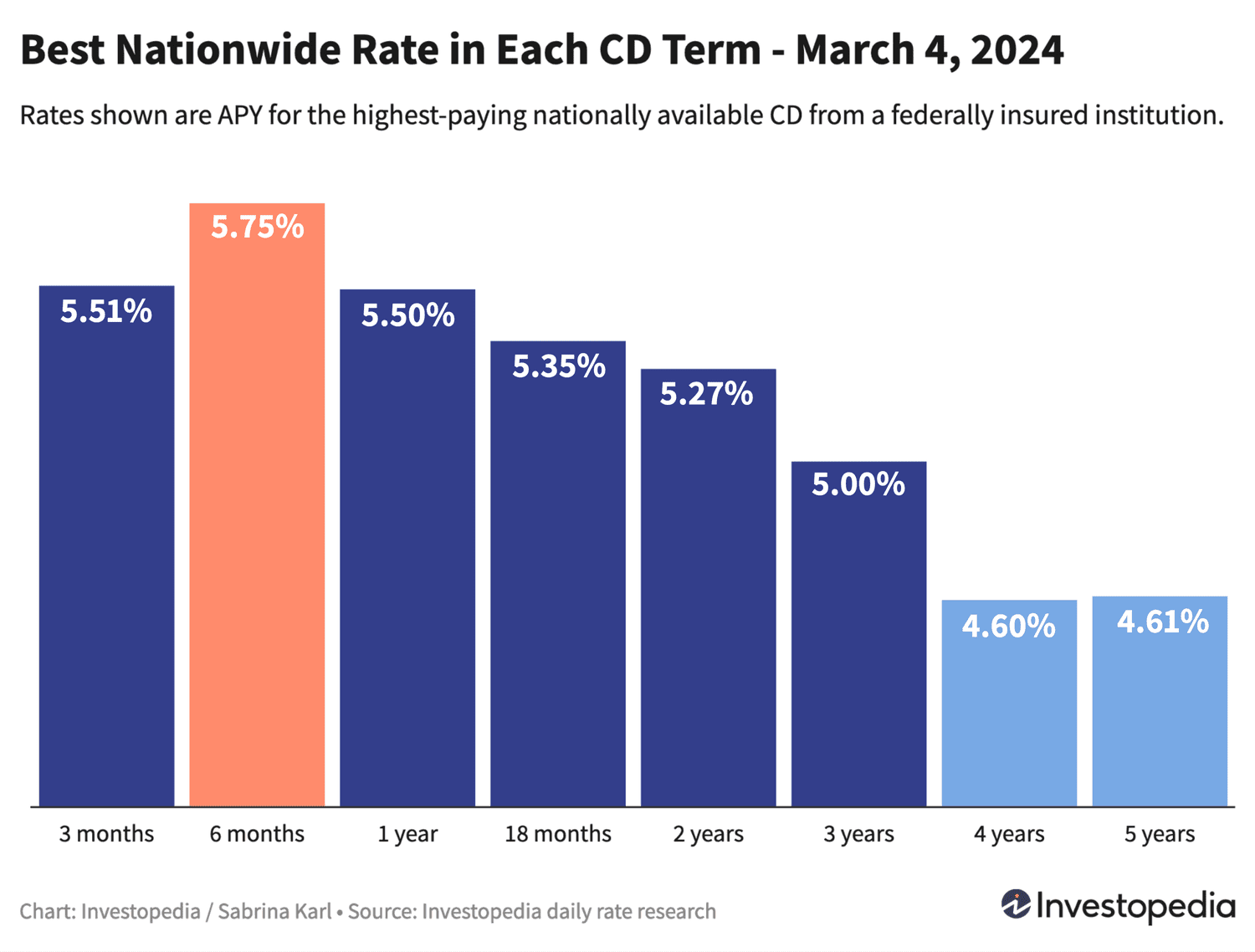

- Andrews Federal Credit Union continues to dominate with a 5.75% APY on a 6-month CD, maintaining its position as the top nationwide rate.

- For jumbo deposits, Hughes Federal Credit Union offers an impressive 5.65% APY on a 17-month term, the second-best rate available.

- Guaranteed rates of 5% or higher remain accessible across all CD terms up to 3 years.

- Longer-term CDs of 4 to 5 years currently yield rates in the mid-4% range.

- Although CD rates have decreased slightly over recent months, further declines may accelerate if the Federal Reserve moves forward with rate cuts anticipated later in 2024.

Below are the best CD rates you can find nationwide today, along with featured offers from our trusted partners.

CD Rates Remain Historically High Despite Recent Softening

After peaking at an unprecedented 6.50% in October, CD rates have eased somewhat, with the number of top-tier offers (5.50% APY or higher) dropping from 30 in early February to 13 today. However, these yields remain significantly above the average of the past two decades.

Andrews Federal Credit Union still leads the pack with its 5.75% APY on a 6-month certificate, holding strong for over a month. For those seeking longer commitments, rates of up to 5.50% for 12 months, 5.35% for 18 months, and 5.27% for 24 months are available. CDs with terms from 30 to 36 months offer a solid 5.00% APY, while 4- and 5-year CDs provide competitive mid-4% returns.

Remember, securing the absolute highest APY isn't the only strategy—locking in a strong rate that extends beyond a year may prove advantageous, especially if rates decline throughout 2024.

Best Jumbo, Bank, and Credit Union CD Rates Today

The top jumbo CD rate remains at 5.65% APY for a 17-month term from Hughes Federal Credit Union.

Note that jumbo CDs do not always offer higher returns than standard CDs. Currently, standard certificates outperform jumbo CDs in five out of eight terms, so comparing both types before deciding is wise.

Outlook for CD Rates in 2024

At its January 31 meeting, the Federal Reserve held interest rates steady for the fourth consecutive time, after aggressive hikes between March 2022 and July 2023 that brought rates to a 22-year high to combat inflation.

This environment created exceptional opportunities for savers, with CD rates reaching two-decade highs last fall.

Since July, inflation has cooled, prompting the Fed to pause rate hikes and signal that rate increases are likely complete. The central bank is now focusing on the timing of its first rate cut, which depends on sustained inflation reduction.

Fed Chair Jerome Powell emphasized that while progress is evident, inflation remains too high to justify immediate cuts. Recent inflation data has shown some acceleration, adding uncertainty to the timeline.

Financial markets have adjusted expectations, pushing the anticipated first rate cut from May to June 2024, according to CME Group’s FedWatch Tool.

This suggests CD rates may continue a gradual decline until a clear signal of rate cuts emerges, after which banks and credit unions will likely reduce rates more sharply.

Important Notes

The "top rates" highlighted here represent the highest APYs found through daily research of hundreds of federally insured banks and credit unions nationwide, not national averages. National averages include many institutions with minimal yields, so top rates you find by shopping around can be 5 to 15 times higher.

How We Identify the Best CD Rates

Each business day, we analyze rate data from over 200 federally insured banks and credit unions offering CDs nationwide. To qualify, institutions must be FDIC or NCUA insured, offer CDs with minimum deposits of $25,000 or less, and be accessible in at least 40 states.

Credit unions requiring donations exceeding $40 for membership are excluded. For full details on our methodology, please refer to our comprehensive guide.

Explore useful articles in Personal Finance News as of 10-03-2024. The article titled " Top CD Rates in March 2025: Earn Between 4.60% and 5.75% APY with Leading Certificates " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Top CD Rates in March 2025: Earn Between 4.60% and 5.75% APY with Leading Certificates " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.