2025 CD Rates Update: Top 1-Year CD Rate Drops to 5.56%, Best Overall CD Still at 5.75%

Explore the latest CD rates in 2025 with Andrews Federal Credit Union leading at 5.75% APY for 6 months, while top 1-year CDs have eased to 5.56%. Lock in competitive rates today before expected Fed cuts.

Essential Highlights for 2024 CD Rates

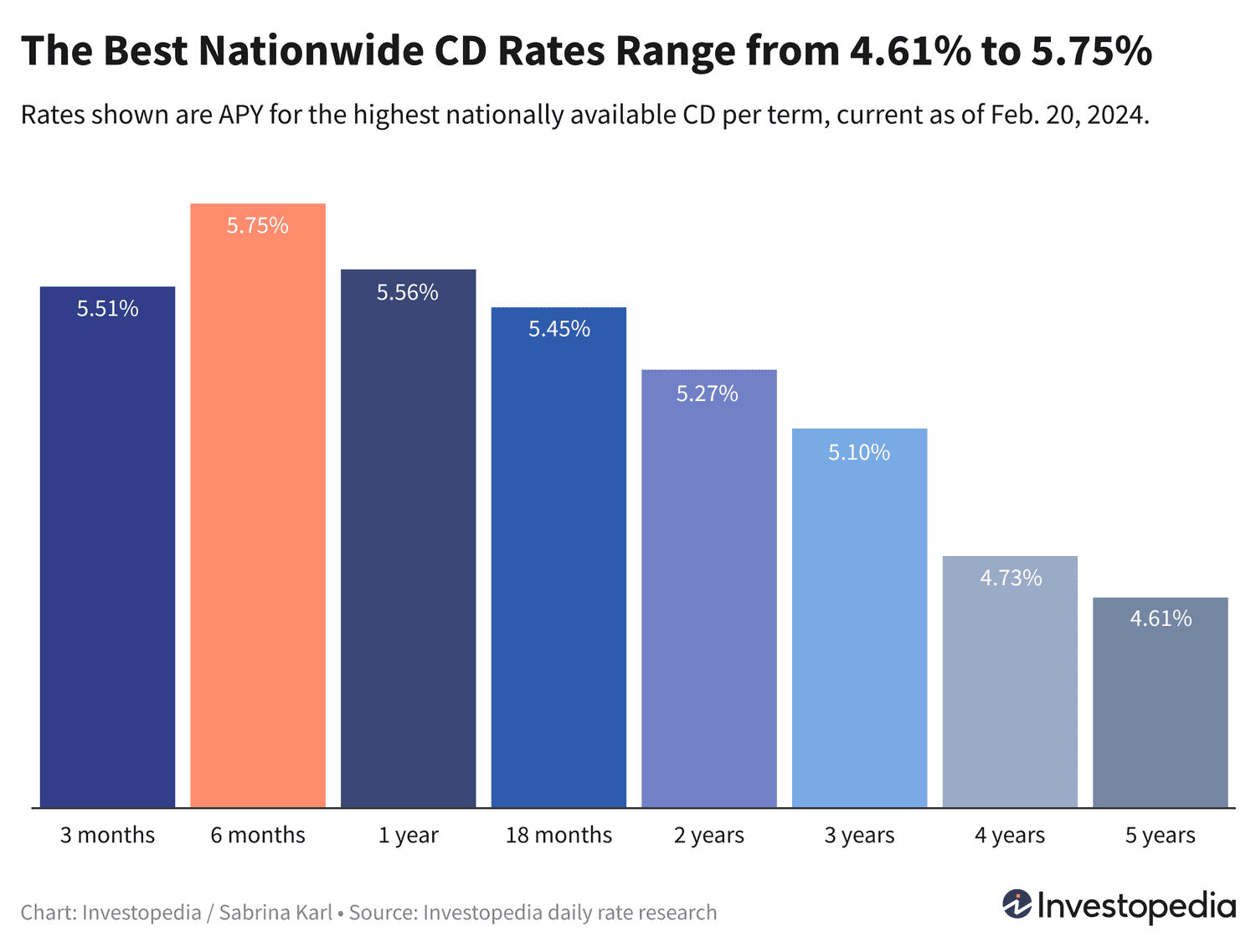

- The highest 1-year CD rate has decreased to 5.56% APY after a brief peak of 5.65% last week.

- Andrews Federal Credit Union continues to offer the nation’s top CD rate at 5.75% APY for a 6-month term.

- Competitive rates of 5% or higher are available for terms extending up to 3 years.

- Currently, 21 nationwide CDs offer at least 5.50% APY, down from 30 options earlier this year.

- CD rates are expected to decline more rapidly once the Federal Reserve signals impending rate cuts anticipated in 2024.

After peaking at a historic 6.50% in October, CD rates have gradually softened but remain attractive by historical standards. More than 20 CDs nationwide now offer yields above 5.50% APY, with multiple options locking in rates above 5% through 2027.

Below is an overview of the best CDs available across the country, including exclusive partner rates.

Top CD Rates Still Offer Strong Returns in 2024

Andrews Federal Credit Union holds the leading position with a 5.75% APY on a 6-month CD, maintaining this top spot for several weeks. For longer commitments, Lafayette Federal Credit Union offers 5.56% APY on a 12-month CD, closely followed by Salem Five at 5.55% APY for the same term.

Despite a recent decline in rates, 21 CDs currently pay at least 5.50% APY, with terms ranging from 3 to 13 months. This is a reduction from 30 such offerings at the start of February, indicating a gradual downward trend.

While chasing the highest APY is appealing, locking in a solid rate for over a year can be a savvy strategy given the anticipated rate cuts. For example, XCEL Federal Credit Union provides 5.45% APY for 18 months, and Pelican State Credit Union offers 5.27% APY for 24 months. Several 3-year CDs also exceed 5%, allowing for rate security through 2027.

Securing a favorable CD rate now is prudent before the Federal Reserve potentially lowers the federal funds rate, which would exert downward pressure on CD yields. The Fed’s December 2023 projections indicate up to three rate cuts totaling 0.75% may occur during 2024.

Current Jumbo, Bank, and Credit Union CD Rates

The best jumbo CD rate stands at 5.65% APY for a 17-month term from Hughes Federal Credit Union. However, jumbo CDs do not always outperform standard CDs, so comparing both options is essential before committing.

Forecast for CD Rates in 2024

The Federal Reserve has held interest rates steady through early 2024 after aggressive hikes from 2022 to mid-2023 aimed at combating inflation. This environment has produced historically high CD rates and attractive yields for savers.

However, with inflation easing and the Fed pausing rate increases, many institutions have begun lowering CD rates. The Fed has signaled the end of its rate-hike cycle and is now considering the timing of rate cuts, which remain contingent on sustained inflation progress.

Recent economic data, including strong employment and persistent inflation, suggest the Fed may maintain higher rates longer than expected, delaying cuts beyond the first quarter of 2024.

Market expectations for the first Fed rate cut have shifted from May to June 2024, implying CD rates may continue to decline until that point.

In summary, CD rates are likely to drift downward in the near term but locking in competitive rates now can offer valuable protection against future declines.

Important Notes

The "top rates" listed represent the highest nationally available offers identified through daily research across hundreds of banks and credit unions. These differ significantly from national averages, which include many institutions offering minimal interest. Savvy shoppers can find rates 5 to 15 times higher than averages by comparing options.

Our Methodology for Finding the Best CD Rates

Each business day, we analyze rate data from over 200 federally insured banks and credit unions nationwide. To qualify, institutions must be FDIC or NCUA insured, offer CDs with minimum deposits of $25,000 or less, and be accessible in at least 40 states. Credit unions requiring donations over $40 for membership are excluded.

For a detailed explanation of our selection process, please refer to our full methodology.

Explore useful articles in Personal Finance News as of 26-02-2024. The article titled " 2025 CD Rates Update: Top 1-Year CD Rate Drops to 5.56%, Best Overall CD Still at 5.75% " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " 2025 CD Rates Update: Top 1-Year CD Rate Drops to 5.56%, Best Overall CD Still at 5.75% " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.