Top CD Rates February 27, 2025: Lock in Up to 5.75% APY Before Rates Drop

Explore the highest CD rates available nationwide in 2025. Andrews Federal Credit Union leads with 5.75% APY, followed by strong offers from Lafayette Federal Credit Union and Newtek Bank. Secure your savings with top yields today.

Essential Highlights

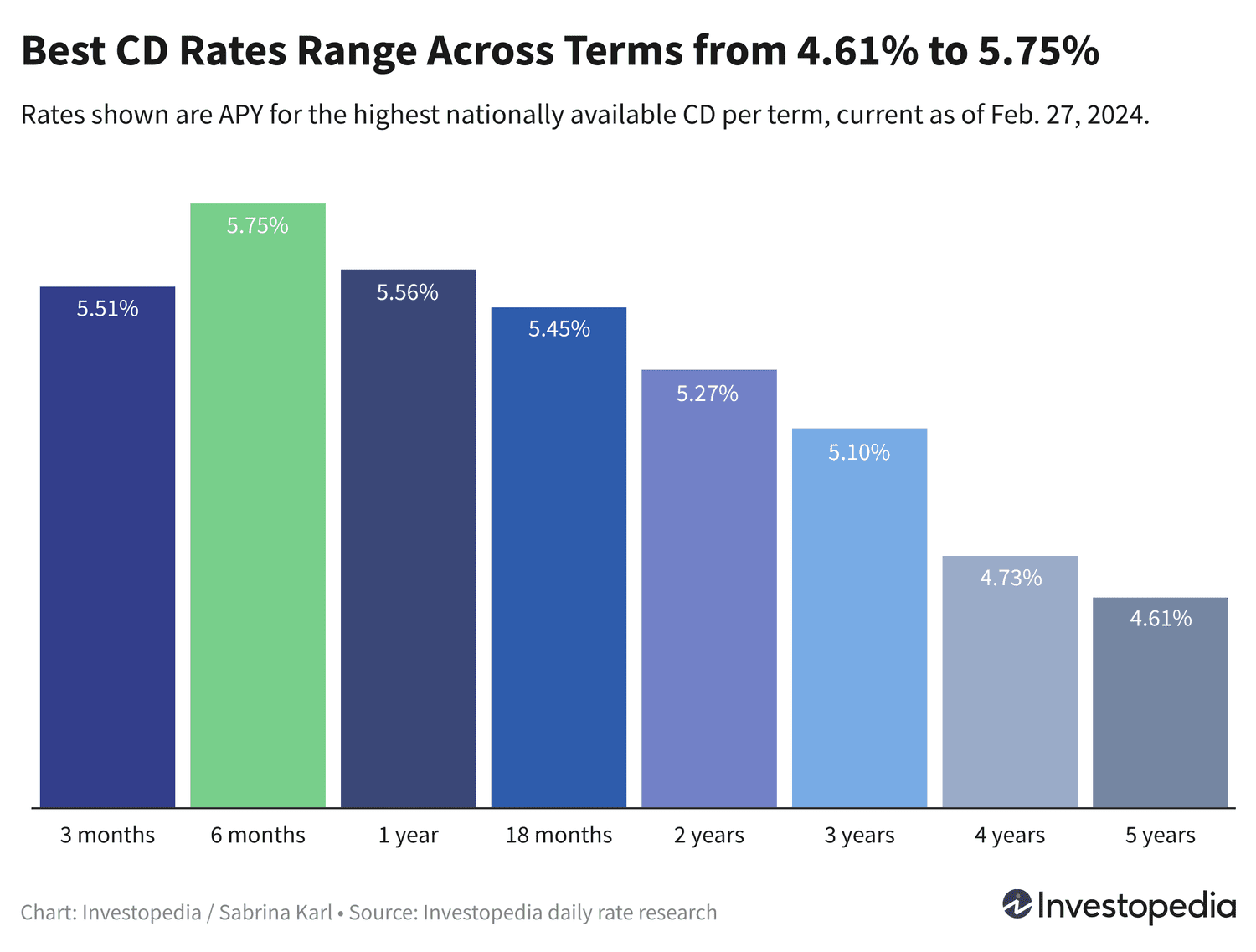

- Andrews Federal Credit Union offers the nation’s best CD rate at 5.75% APY for a 6-month term.

- Lafayette Federal Credit Union provides a competitive 5.56% APY on a 1-year CD.

- Hughes Federal Credit Union features a jumbo CD with 5.65% APY for 17 months.

- Multi-year CDs guarantee rates above 5% up to 3 years, with 4- and 5-year terms yielding mid to high 4% APY.

- CD rates have been gradually declining but may drop more sharply once the Federal Reserve initiates rate cuts anticipated in 2024.

Despite a decline from the October peak of 6.50%, top CD rates remain near historic highs. Our daily review highlights 16 CDs nationwide offering 5.50% APY or higher, with options extending through 2027 at 5% or above.

Leading the market, Andrews Federal Credit Union’s 6-month CD at 5.75% APY has held the top spot for four weeks. Lafayette Federal Credit Union’s 12-month CD offers 5.56% APY, while Newtek Bank’s 6-month CD yields 5.55% APY.

Though yields have softened over the past quarter, numerous CDs still pay 5.50% or more across terms from 3 to 13 months. Earlier this month, 30 CDs offered these elite rates, signaling a gradual rate slide.

For those seeking longer commitments, XCEL Federal Credit Union’s 18-month CD at 5.45% APY and Pelican State Credit Union’s 24-month CD at 5.27% APY provide attractive options. Several 3-year CDs exceed 5%, locking in rates through 2027, while 4- and 5-year CDs offer solid mid-to-upper 4% APYs.

Locking in rates now is advisable before the Federal Reserve lowers benchmark rates, which typically drives CD yields down. The Fed’s December 2023 projections suggest up to three rate cuts totaling 0.75% during 2024.

Top Jumbo, Bank, and Credit Union CD Rates Today

Hughes Federal Credit Union leads jumbo CDs with 5.65% APY for 17 months. However, jumbo CDs don’t always outperform standard CDs, so comparing both types is crucial before committing.

Outlook for CD Rates in 2024

The Federal Reserve held rates steady at its January 31 meeting, marking the fourth consecutive pause after aggressive hikes from March 2022 to July 2023, which pushed rates to a 22-year high. This environment created exceptional yields on CDs and high-yield savings accounts.

With inflation easing and the Fed pausing rate hikes, many institutions have started lowering CD rates—a trend likely to continue. The Fed now focuses on the timing of its first rate cut, contingent on sustained inflation decline.

Recent economic data, including strong job growth and persistent inflation, may delay rate reductions, pushing market expectations for the first cut from May to June 2024.

Consequently, CD rates may keep declining until a clear Fed rate cut is imminent, after which banks and credit unions typically reduce rates more aggressively.

Important Note

The "top rates" featured reflect the highest nationally available offers from federally insured institutions, not national averages, which are considerably lower due to inclusion of many low-yielding banks. Savvy shoppers can find rates 5 to 15 times higher than averages by comparing options.

How We Identify the Best CD Rates

Each business day, we analyze rates from over 200 federally insured banks and credit unions nationwide to rank the highest-yielding CDs across all major terms. Eligible institutions must have FDIC or NCUA insurance and offer CDs with initial deposits up to $25,000. Banks must serve at least 40 states; credit unions requiring donations over $40 for membership are excluded. For full details, see our methodology.

Discover the latest news and current events in Personal Finance News as of 04-03-2024. The article titled " Top CD Rates February 27, 2025: Lock in Up to 5.75% APY Before Rates Drop " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Top CD Rates February 27, 2025: Lock in Up to 5.75% APY Before Rates Drop " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.