Best CD Rates in 2025: Top 1-Year CDs Paying Up to 5.75% APY

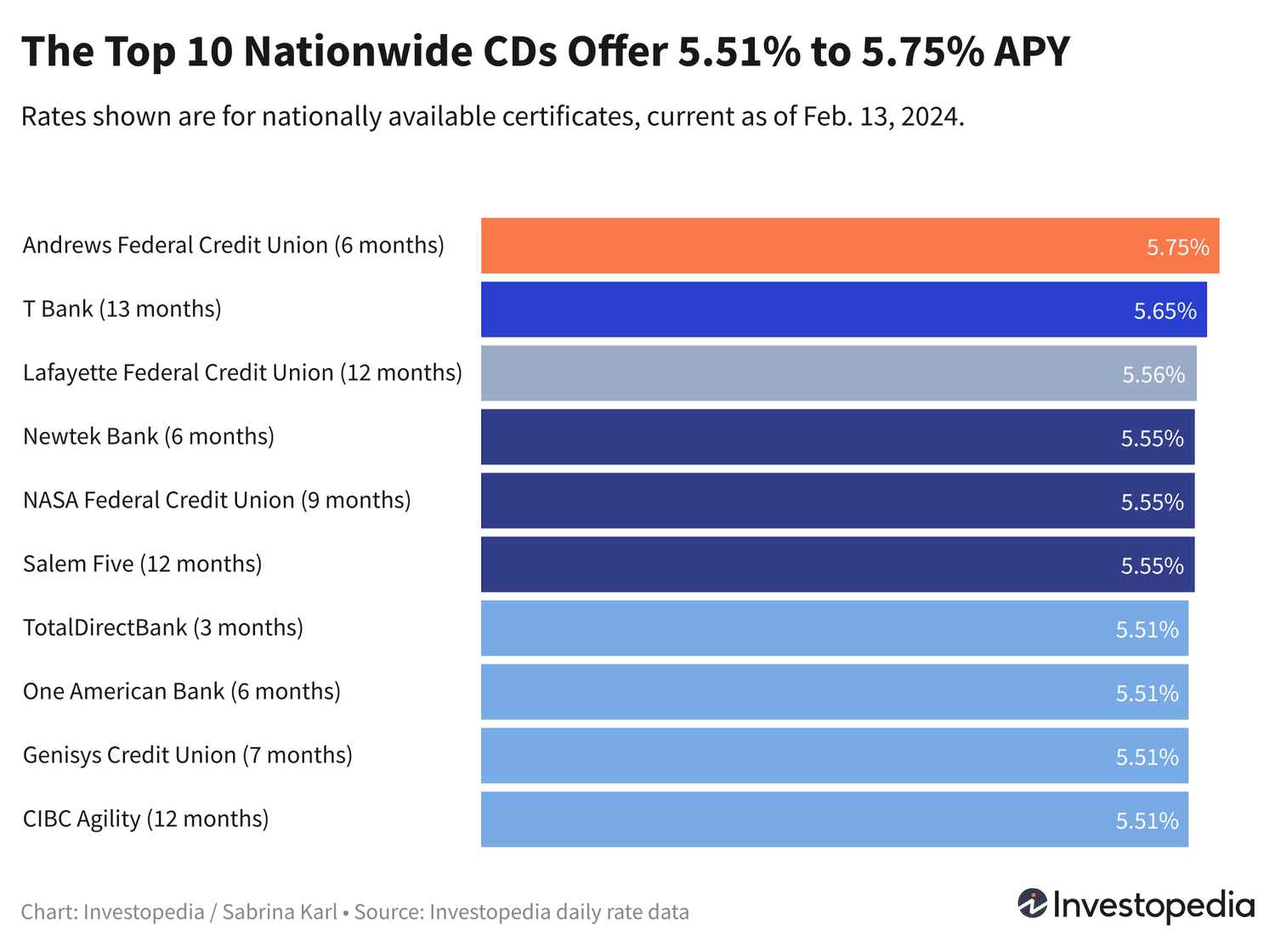

Explore the highest CD rates available nationwide in 2025, featuring top offers from Andrews Federal Credit Union, T Bank, and Lafayette Federal Credit Union with rates ranging from 5.56% to 5.75% APY.

Key Highlights

- The leading 1-year CD rate has climbed to 5.65% APY at T Bank for a 13-month term, surpassing the previous 5.56% rate.

- Andrews Federal Credit Union holds the top overall CD rate at 5.75% APY for a 6-month certificate.

- Our comprehensive daily ranking features 24 CDs nationwide offering between 5.50% and 5.75% APY, with terms up to 13 months.

- Longer-term CDs with rates above 5% are available for up to 3 years, securing your earnings through 2027.

Though CD rates have slightly declined from their October peak of 6.50%, current offers remain historically high. Many institutions provide opportunities to lock in 5% or better rates for multiple years, making this an excellent time to invest.

Below is an overview of the best CD rates nationwide, along with featured partner offers.

Outstanding CD Rates Continue in 2024

T Bank now leads the 1-year CD category with a 5.65% APY on a 13-month term, edging out the previous top rate of 5.56%. Meanwhile, Andrews Federal Credit Union maintains the highest overall CD rate at 5.75% APY for a 6-month term.

Newtek Bank has emerged as a new contender for the best 6-month bank CD rate, offering 5.55% APY. Despite recent rate declines, 24 CDs nationwide still offer at least 5.50% APY with terms ranging from 3 to 13 months.

Securing a slightly lower rate for a longer term is a savvy strategy given anticipated rate cuts in 2024. For example, XCEL Federal Credit Union offers 5.45% APY for 18 months, and Pelican State Credit Union provides 5.27% APY for 24 months. Several 3-year CDs also yield above 5%, locking in favorable returns until 2027.

Locking in these rates now is wise, as the Federal Reserve is expected to reduce the federal funds rate during 2024, which will likely drive CD rates lower.

Top Jumbo, Bank, and Credit Union CD Rates

The highest jumbo CD rate is 5.65% APY for a 17-month term at Hughes Federal Credit Union. However, jumbo CDs don't always outperform standard CDs; in some terms, standard CDs offer better yields, so comparing both types is recommended.

Outlook for CD Rates in 2024

The Federal Reserve has held interest rates steady since late 2023 after aggressive hikes to combat inflation. This has created historically favorable conditions for CD investors, with rates reaching two-decade highs.

As inflation cools and the Fed prepares for potential rate cuts, many banks and credit unions have started lowering CD rates. However, the timing of these cuts remains uncertain, as inflation is still above target and economic indicators like strong job growth may delay rate reductions.

Fed Chair Jerome Powell has indicated that rate cuts are unlikely in the near term, suggesting a gradual decline in CD rates until a clear signal of easing monetary policy emerges.

Additional Resources

- Best High-Yield Savings Accounts for 2025: Offers up to 5.00%

- Top CD Rates for 2025: Up to 4.50%

- Leading Money Market Accounts for 2025: Up to 4.40%

How We Identify the Best CD Rates

Our daily research covers over 200 federally insured banks and credit unions nationwide, focusing on CDs with minimum deposits up to $25,000. We prioritize institutions available in at least 40 states and exclude credit unions requiring donations over $40 for membership. Our methodology ensures you access the highest possible rates beyond national averages, which are often significantly lower.

Explore useful articles in Personal Finance News as of 19-02-2024. The article titled " Best CD Rates in 2025: Top 1-Year CDs Paying Up to 5.75% APY " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Best CD Rates in 2025: Top 1-Year CDs Paying Up to 5.75% APY " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.