Top CD Rates March 2025: Earn Up to 5.75% APY with Best CDs Across Terms

Discover the highest CD rates available nationwide in March 2025, featuring yields up to 5.75% APY on 6-month terms and competitive rates over 3 years. Learn where to find the best standard and jumbo CDs to maximize your returns while navigating the evolving interest rate landscape.

Essential Insights

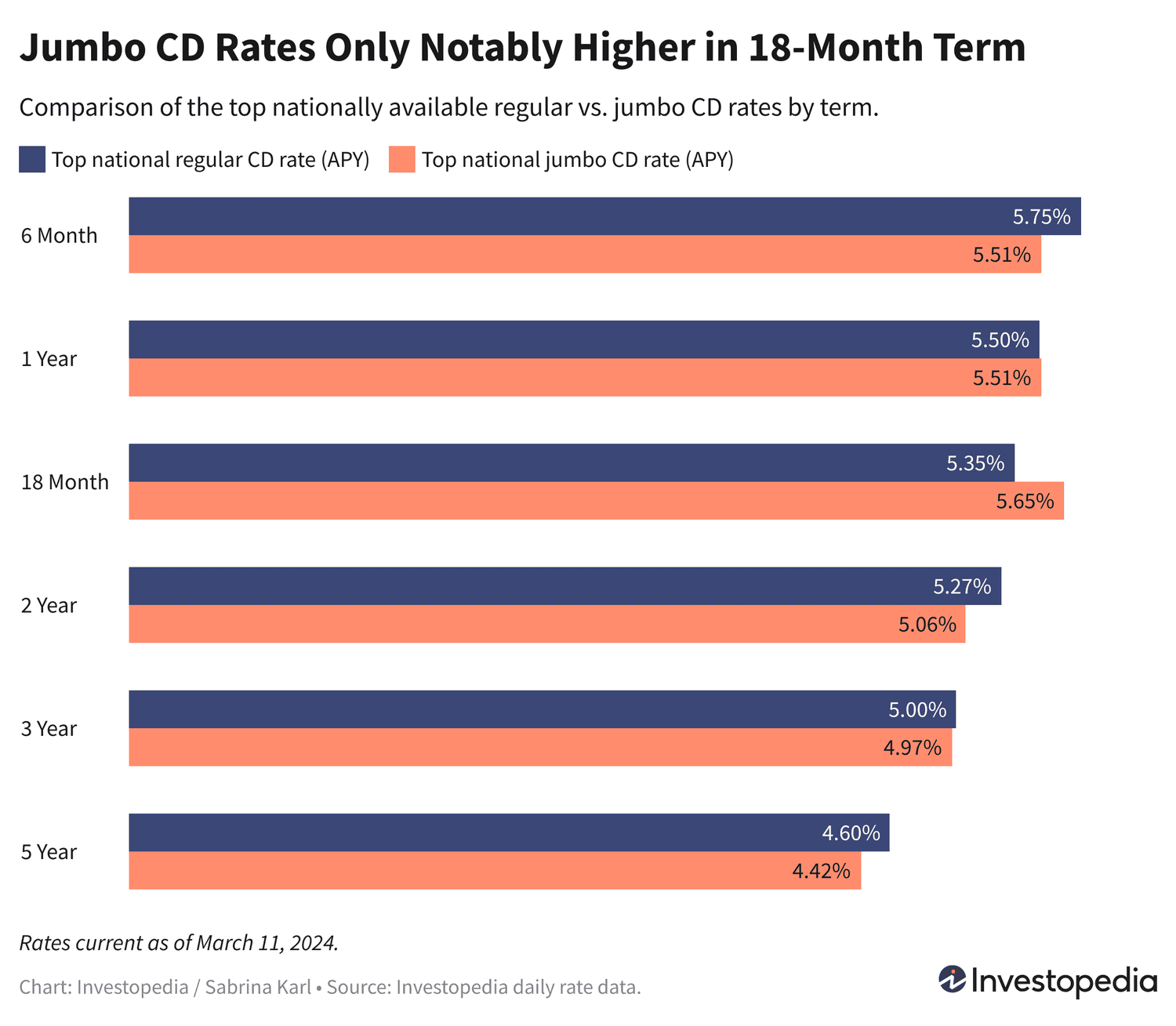

- Jumbo CD rates have declined across several terms, from 2 to 5 years, while regular CDs maintain strong yields.

- Only the 18-month jumbo CD offers a notably higher APY (5.65%) compared to standard CDs.

- Andrews Federal Credit Union continues to lead nationally with a 5.75% APY on 6-month CDs.

- CD rates have been gradually decreasing but may drop faster if the Federal Reserve signals rate cuts.

Explore today’s top CD rates available nationwide along with exclusive offers from our partners.

CD Rates Remain Historically Attractive in 2024

Standard CDs are holding steady with impressive yields: 6-month CDs offer up to 5.75% APY, 1- to 3-year terms range from 5.00% to 5.50%, and 4- to 5-year CDs peak at 4.60% APY. Although rates have softened from their October 2023 peak of 6.50%, current returns still surpass two decades of historical averages.

Locking in rates between 4% and 5% for longer terms remains an excellent opportunity amid ongoing market uncertainties. Securing a guaranteed rate now could be a wise move as CD yields might decline further in 2024 and beyond.

Current Top Bank, Credit Union, and Jumbo CD Rates

While regular CD rates remain stable, jumbo CD rates have fallen in the 2-, 3-, 4-, and 5-year terms. Consequently, standard CDs now offer better returns in most terms except the 18-month and 1-year periods, where jumbo CDs still slightly lead.

Since jumbo CDs don't always offer a premium, comparing both standard and jumbo options before investing is advisable to maximize your earnings.

Outlook for CD Rates in 2024

The Federal Reserve has held interest rates steady since January 2024 after a series of hikes aimed at curbing inflation. This pause has created favorable conditions for savers, with CD rates reaching two-decade highs last year.

With inflation cooling and the Fed signaling a potential rate cut later this year, financial markets anticipate one or more reductions by mid-2024. However, the timing remains uncertain, and economic data may delay cuts.

As a result, CD rates are expected to either plateau or gradually decline until the Fed initiates rate cuts, after which banks and credit unions may lower their rates more noticeably.

Important Considerations

The "top rates" highlighted represent the highest nationally available APYs identified through daily research across hundreds of institutions, not the national average, which tends to be much lower. Shopping around can reveal rates 5 to 15 times higher than typical averages.

Our Methodology for Finding the Best CD Rates

We monitor rates from over 200 federally insured banks and credit unions nationwide, focusing on CDs with minimum deposits up to $25,000. Banks must operate in at least 40 states, and credit unions with high membership donation requirements are excluded to ensure accessibility.

For a detailed explanation of our selection process, please refer to our full methodology.

Discover engaging topics and analytical content in Personal Finance News as of 16-03-2024. The article titled " Top CD Rates March 2025: Earn Up to 5.75% APY with Best CDs Across Terms " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Top CD Rates March 2025: Earn Up to 5.75% APY with Best CDs Across Terms " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.