Top CD Rates in 2025: Earn Up to 5.75% APY for 6 Months or Lock 5% for 3 Years

Discover the highest CD rates for 2025, including 5.75% APY from Andrews Federal Credit Union for 6 months, 5.65% from T Bank for 13 months, and 5.56% from Lafayette Federal Credit Union for 12 months. Secure your savings with top-performing certificates of deposit today.

Key Highlights

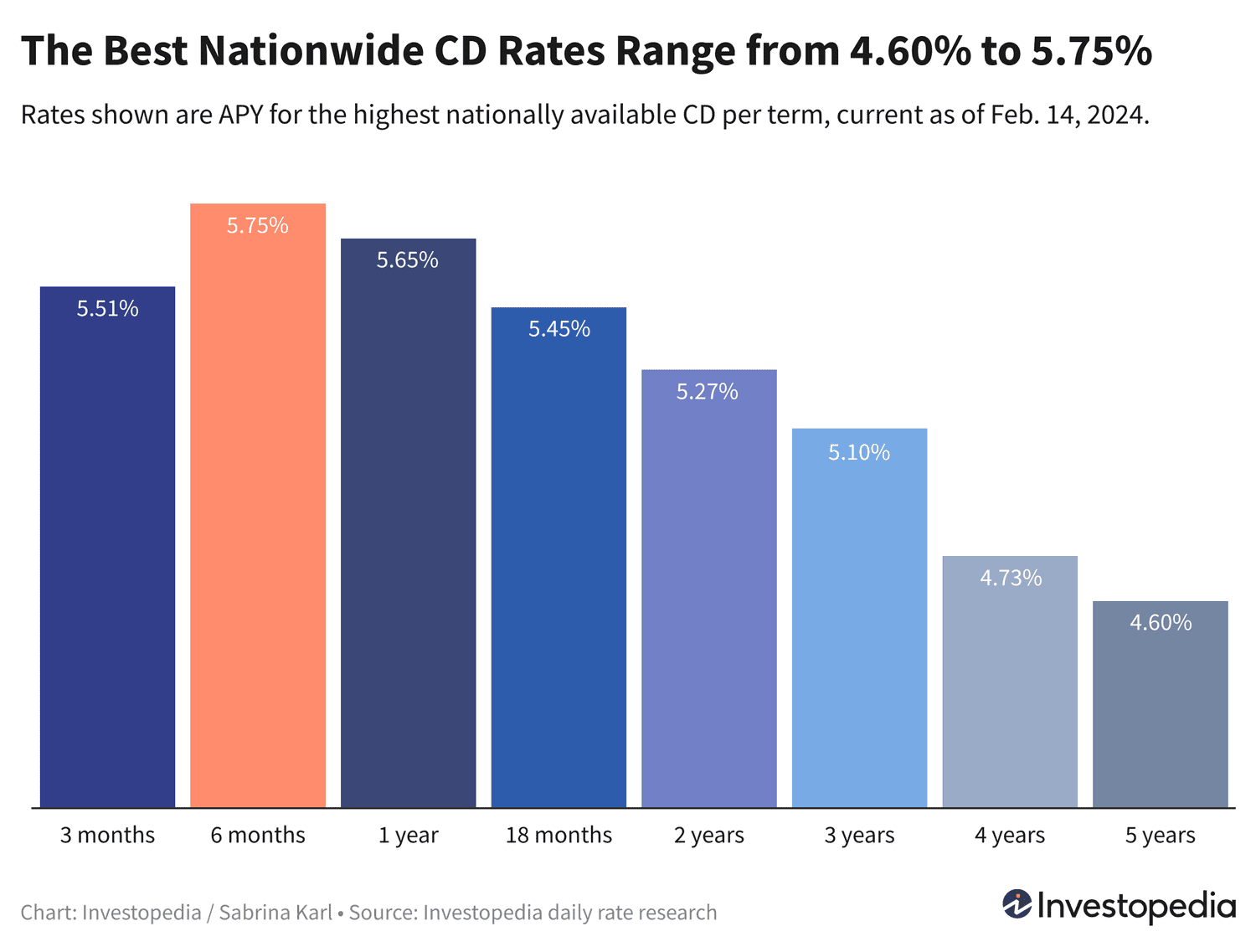

- Andrews Federal Credit Union offers the nation’s top CD rate at 5.75% APY for a 6-month term.

- T Bank provides a competitive 5.65% APY for a 13-month CD, while Lafayette Federal Credit Union offers 5.56% APY for 12 months.

- Our updated nationwide CD rankings feature 25 options paying between 5.50% and 5.75% APY with terms up to 13 months.

- Longer-term CDs up to 3 years guarantee rates of at least 5%, ideal for locking in returns through 2027.

Despite a slight dip since the record 6.50% APY peak in October, current CD rates remain historically high. Savvy savers can lock in attractive yields for terms extending several years, protecting against future rate declines.

Why 2024 CD Rates Remain Attractive

Andrews Federal Credit Union continues to lead with a 5.75% APY on a 6-month CD, holding the highest nationwide return for over two weeks. Newly added top contenders include T Bank’s 5.65% APY for 13 months and Lafayette Federal Credit Union’s 5.56% APY for 12 months. Newtek Bank also offers a strong 5.55% APY on a 6-month certificate.

Even with recent rate adjustments, many institutions still offer CDs paying 5.50% APY or more across terms from 3 to 13 months.

For those prioritizing long-term security, options like XCEL Federal Credit Union’s 5.45% APY for 18 months and Pelican State Credit Union’s 5.27% APY for 24 months provide excellent opportunities. Several top 3-year CDs yield above 5%, enabling rate locks through 2027.

Strategic Timing Before Fed Rate Cuts

With expectations of Federal Reserve rate reductions in 2024, locking in current high rates is a smart financial move. The Fed’s December 2023 projections suggest up to three rate cuts totaling 0.75% this year, potentially putting downward pressure on CD yields.

Current Jumbo and Standard CD Rates

Hughes Federal Credit Union offers the best jumbo CD rate at 5.65% APY for 17 months. However, jumbo CDs don’t always outperform standard CDs, so comparing both types is essential before committing.

Outlook for CD Rates in 2024

Since January 2024, the Federal Reserve has held rates steady after aggressive hikes from 2022 to mid-2023. This environment created historically favorable CD rates, peaking in late 2023. However, recent economic data, including strong job growth and persistent inflation, may delay rate cuts, keeping CD rates elevated longer than anticipated.

Fed Chair Jerome Powell indicated no imminent rate cuts, with markets now expecting the first reduction in June 2024. Until then, CD rates may decline gradually but remain attractive for the foreseeable future.

Important Note

These top CD rates reflect the highest nationally available offers identified through daily research of hundreds of banks and credit unions. They differ significantly from national averages, which include many low-yielding large banks.

Our Methodology for Identifying Top CD Rates

We analyze rate data daily from over 200 federally insured banks and credit unions nationwide, focusing on institutions available in at least 40 states. To qualify, CDs must have a maximum initial deposit of $25,000. Credit unions requiring donations over $40 for membership are excluded to ensure accessibility.

Explore useful articles in Personal Finance News as of 19-02-2024. The article titled " Top CD Rates in 2025: Earn Up to 5.75% APY for 6 Months or Lock 5% for 3 Years " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Top CD Rates in 2025: Earn Up to 5.75% APY for 6 Months or Lock 5% for 3 Years " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.