2025 CD Rates Update: Top 1-Year CD at 5.80% APY & Jumbo CDs Yielding 5.85%

Discover the latest nationwide CD rates for 2025, featuring The Federal Savings Bank's leading 1-year CD at 5.80% APY and jumbo deposits earning up to 5.85%. Stay informed on the best rates and market trends.

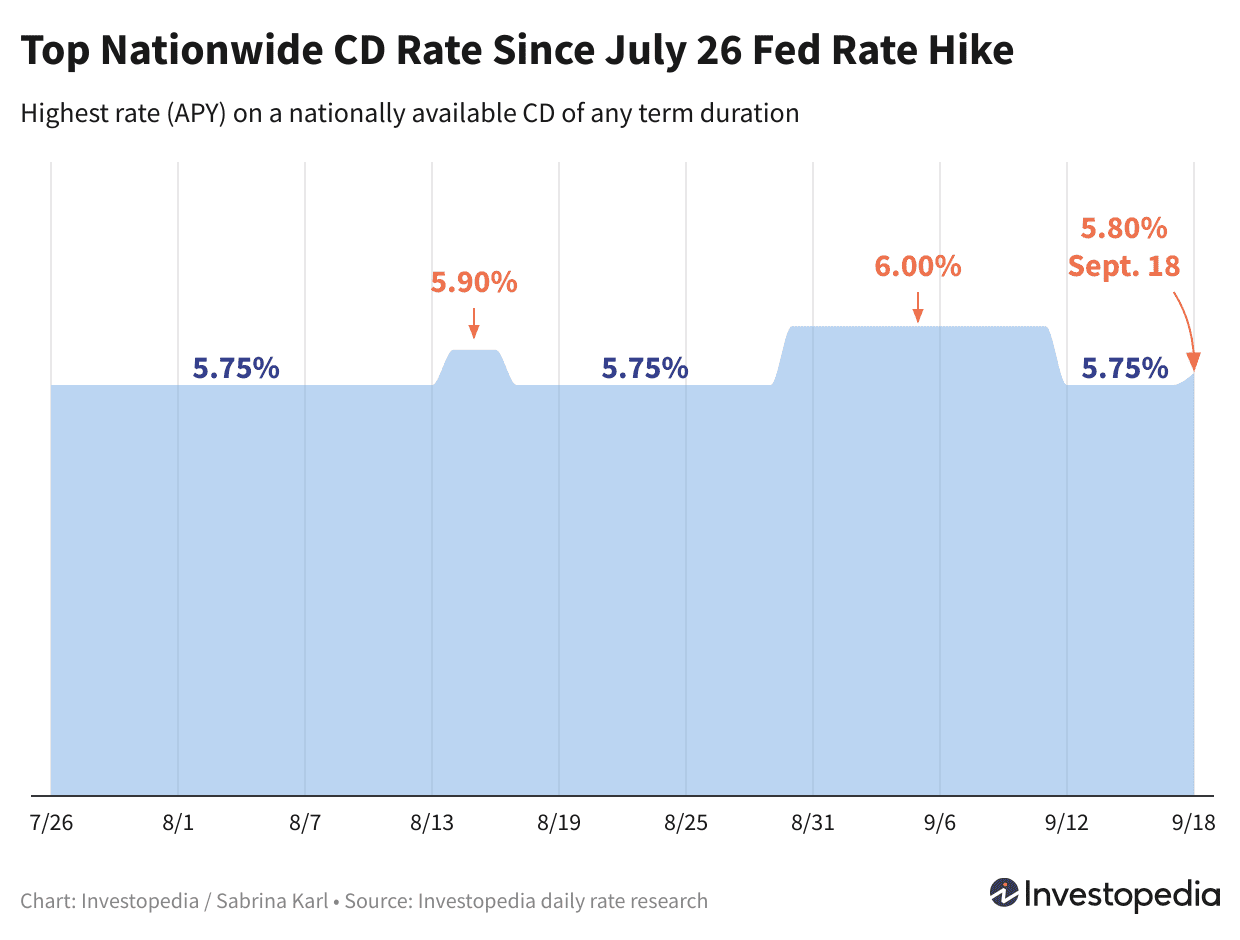

As of 2024, The Federal Savings Bank leads the national CD market with an impressive 5.80% APY on a 1-year certificate, an increase from last week's 5.75%. This top-tier rate sets a new benchmark for savers seeking short-term, high-yield certificates of deposit.

However, the landscape for 2-year CDs has shifted slightly. The premier 2-year CD rate has decreased from 5.55% to 5.50% APY, with Vibrant Credit Union offering this rate on a 23-month term. Despite this dip, competitive options remain available for mid-term investors.

Highlights:

- The leading nationwide CD rate reached 5.80% APY for a 1-year term.

- Seventeen institutions now offer CDs paying 5.65% APY or higher.

- The top 2-year CD rate slightly decreased to 5.50% APY.

- Jumbo CDs (minimum $100,000 deposit) offer up to 5.85% APY, notably on 6-month terms.

- The Federal Reserve is expected to maintain current rates this week, with a 30-40% chance of hikes in November or December.

For those interested in longer commitments, the best 3-year CD yields 5.23% APY, while 4- and 5-year CDs offer competitive rates of 4.82% and 4.89% APY, respectively.

Jumbo deposits present a lucrative opportunity, with the highest jumbo CD rate at 5.85% APY requiring a $100,000 minimum on a 6-month certificate. Those with $50,000 can still access 5.80% APY on 13- or 15-month CDs.

Important Note:

Jumbo CDs do not always guarantee higher returns than standard CDs. It's essential to compare both options across terms to secure the best yield before committing funds.

Will CD Rates Continue Rising in 2024?

The Federal Reserve has been actively combating inflation through a series of rate hikes since early 2022, culminating in a benchmark rate of 5.25%—the highest since 2001. This environment has created historically attractive yields for CDs, high-yield savings, and money market accounts.

Market consensus suggests the Fed will likely hold rates steady in its upcoming meeting. However, persistent inflation—evidenced by consecutive monthly increases and core inflation slightly exceeding forecasts—keeps the possibility of additional hikes in November or December between 30% and 40%.

Fed Chair Jerome Powell has indicated that further rate increases remain on the table if inflation does not sufficiently decline. Upcoming Fed projections will provide insight into the duration of current high rates and potential future adjustments.

Any additional hikes would likely push CD rates even higher, but the expected September pause leaves savers and investors anticipating whether this is a temporary halt or a signal that peak rates have been reached.

Current Best Rates for May 2025:

- Top CDs: Up to 4.50% APY

- High-Yield Savings Accounts: Two offers at 5.00% APY

- Money Market Accounts: Up to 4.40% APY

Methodology:

These top rates represent the highest nationally available yields identified through daily research of over 200 federally insured banks and credit unions. Unlike national averages, which include many low-yield large banks, these rates reflect competitive offerings accessible to consumers nationwide.

Rate Tracking Process

Investopedia compiles daily rankings by analyzing rates from institutions with FDIC or NCUA insurance, requiring minimum deposits of $25,000 or less. Banks must operate in at least 40 states. Credit unions with donation requirements exceeding $40 are excluded to ensure broad accessibility. For full details, see our comprehensive methodology.

Discover engaging topics and analytical content in Personal Finance News as of 23-09-2023. The article titled " 2025 CD Rates Update: Top 1-Year CD at 5.80% APY & Jumbo CDs Yielding 5.85% " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 2025 CD Rates Update: Top 1-Year CD at 5.80% APY & Jumbo CDs Yielding 5.85% " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.