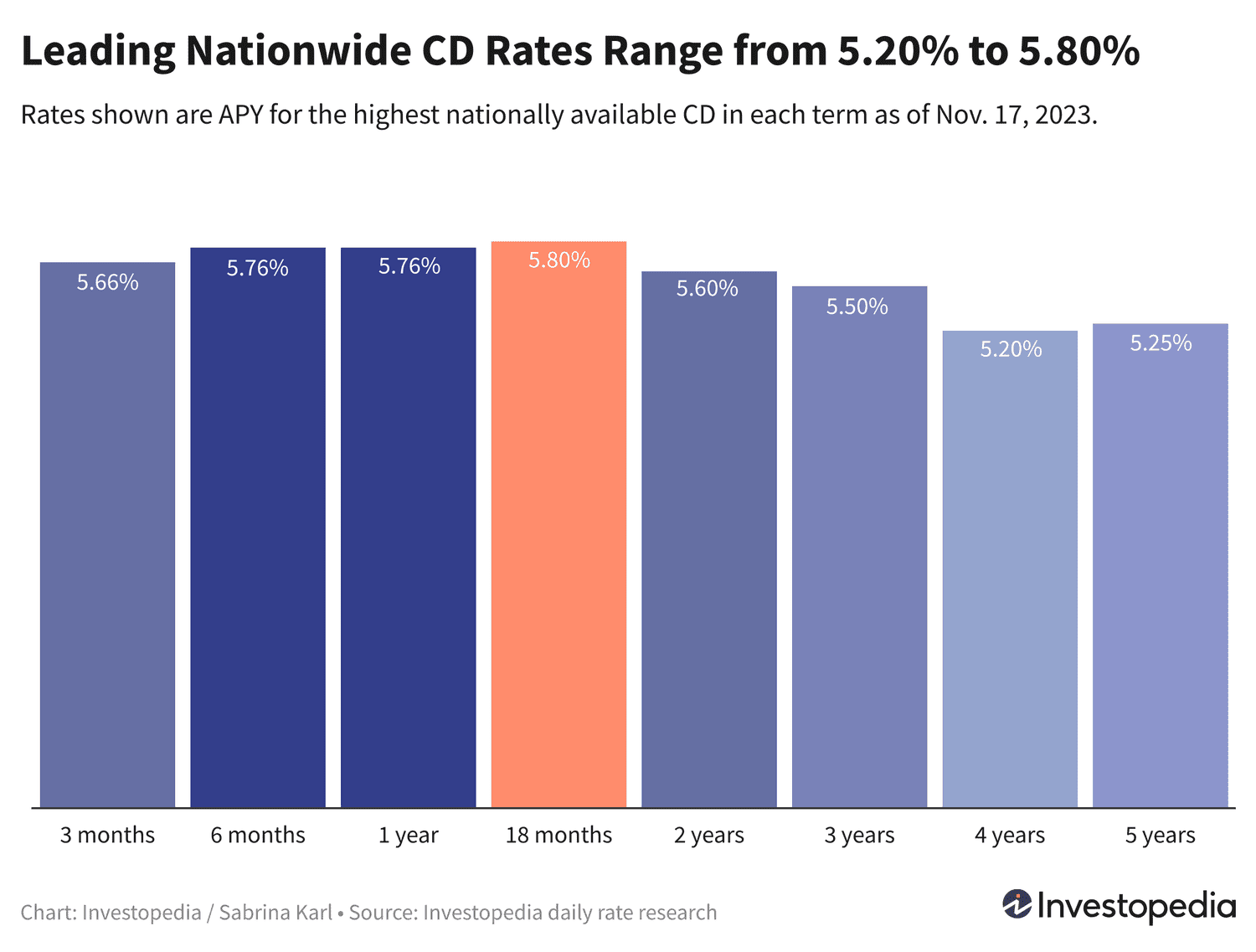

Top CD Rates November 2023: Seattle Bank Leads with 5.80% APY, Jumbo CDs Hit 5.85%

Explore the latest nationwide CD rates for November 2023, featuring Seattle Bank’s leading 5.80% APY on an 18-month term and jumbo CDs offering up to 5.85%. Discover how inflation trends and Federal Reserve decisions impact your investment choices.

After weeks of positive momentum in CD rates, the market has recently shifted. The previous six leaders offering 6% or higher have exited, and one of the two banks offering the top 5.80% rate has also withdrawn its offer.

Currently, Seattle Bank holds the top spot with a 5.80% APY on an 18-month certificate. Following closely are TotalDirectBank and Dow Credit Union, each providing 5.76% APY on 6- and 13-month terms respectively. For deposits of $50,000 or more, jumbo CDs offer an even better rate of 5.85% for a 1-year term.

Key Highlights

- Seattle Bank leads with a stable top nationwide CD rate of 5.80% APY.

- Eleven other competitive offers provide rates of at least 5.75% APY.

- Jumbo CDs from State Bank of Texas and All In Credit Union deliver the highest yields at 5.85% for 1-year terms.

- Recent favorable inflation data suggest the Federal Reserve may pause rate hikes, potentially stabilizing or lowering CD rates.

Below are featured partner rates and a comprehensive ranking of the best nationwide CDs.

Nationwide CDs offering at least 5.75% APY span up to 18 months. For longer commitments, options include 5.60% APY for 2 years and 5.50% APY for 3 years. Additionally, 4-year CDs pay 5.20%, and 5-year CDs offer 5.25% APY.

Jumbo deposits of $50,000 or $100,000 can increase yields by at least 0.05%, with 1-year jumbo CDs paying 5.85% and 2-year jumbo CDs reaching 5.68% APY.

Investor Insights

In November, 28% of Investopedia readers reported choosing CDs amid market fluctuations, slightly down from 29% in October. Moreover, 14% would open a CD if they had an extra $10,000 to invest, just behind the 15% preferring individual stocks.

Important Note

Jumbo CDs do not always guarantee higher returns than standard certificates. In some terms, standard CDs offer equal or better rates. It's advisable to compare both before deciding.

Outlook for CD Rates in 2023

The Federal Reserve has aggressively raised rates since early 2022 to combat inflation, resulting in historically high yields for CDs and other cash instruments.

On November 1, the Fed paused rate hikes, keeping the benchmark rate at its highest since 2001. Fed Chair Jerome Powell emphasized that this pause does not rule out future increases, stating, "We’re going meeting by meeting." However, recent inflation data below expectations have led markets to predict no further hikes at upcoming meetings.

While predicting Fed moves is uncertain, current indicators suggest CD rates may plateau or decline from their historic highs.

Current Best Rates

- May 2025 CDs: Up to 4.50% APY

- High-Yield Savings: Two offers at 5.00% APY

- Money Market Accounts: Up to 4.40% APY

Rate Disclosure

The "top rates" listed reflect the highest nationally available offers identified through daily research of over 200 federally insured banks and credit unions. These rates significantly exceed national averages, which include many institutions with minimal yields.

Methodology

Investopedia tracks rates daily from federally insured institutions available in at least 40 states. CDs must have minimum deposits of $25,000 or less to qualify. Credit unions requiring donations of $40 or more for membership are excluded. For full details, see our methodology page.

Discover engaging topics and analytical content in Personal Finance News as of 23-11-2023. The article titled " Top CD Rates November 2023: Seattle Bank Leads with 5.80% APY, Jumbo CDs Hit 5.85% " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Top CD Rates November 2023: Seattle Bank Leads with 5.80% APY, Jumbo CDs Hit 5.85% " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.