Top CDs in the Market Now: Leading Nationwide Rates at 6.18%, 6.14%, and 5.80%

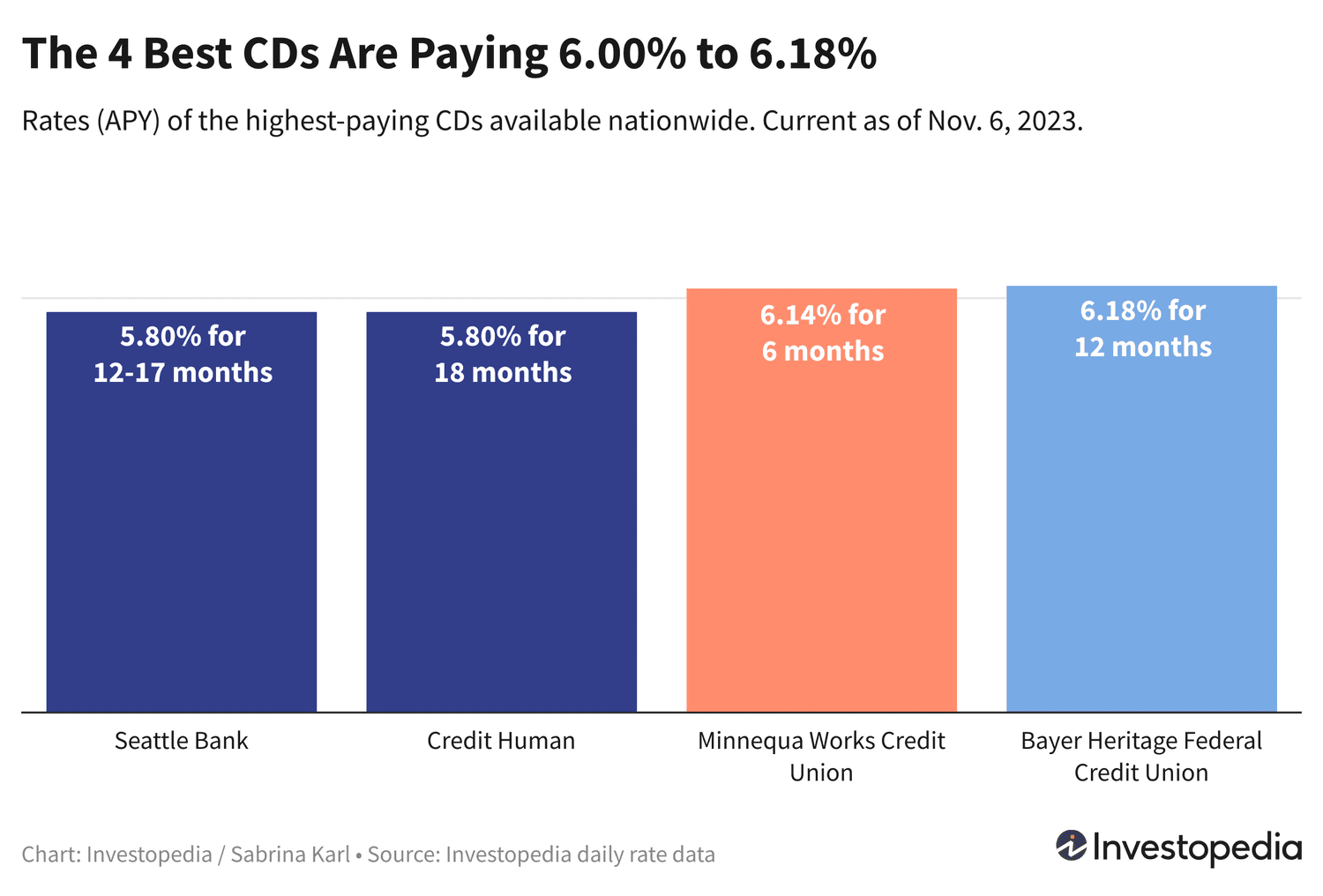

Explore the highest CD rates available nationwide, featuring 6.18% APY from Bayer Heritage Federal Credit Union, 6.14% APY from Minnequa Works Credit Union, and two competitive 5.80% APY offers.

Although a prominent CD offering recently exited the market, investors still have four excellent nationwide CDs yielding above 5.75%, with top rates reaching 6.18% APY.

While the 6.00% APY 13-month CD offer has ended, Bayer Heritage Federal Credit Union continues to lead with a 6.18% APY on a 1-year CD. Meanwhile, Minnequa Works Credit Union offers a strong 6.14% APY on a 6-month CD.

Key Highlights

- Four top nationwide CDs currently offer rates above 5.75%, with the highest at 6.18% APY.

- The previous leader offering 6.00% APY on a 13-month term is no longer available.

- Seventeen CDs nationwide provide rates of at least 5.75% APY.

- Even long-term CDs up to 5 years yield 5.00% APY.

- The Federal Reserve recently paused rate hikes but left open the possibility of future increases.

Below are featured rates from our partners, followed by a comprehensive list of the best nationwide CDs.

For those seeking longer-term investments, the top 2-year CD offers 5.60% APY. Additionally, 30-month CDs yield 5.37% APY, and 36- or 40-month CDs pay 5.25% APY, all listed in our daily best 3-year CD rankings.

Investors with $100,000 or more can access jumbo CDs, boosting the 2-year rate to 5.68% APY or the 30-month rate to 5.52% APY.

Investor Insight

A recent Investopedia survey revealed that nearly 20% of respondents would place an unexpected $10,000 windfall into a CD, making it the most popular choice over stocks, money market funds, and index funds.

Important Consideration

Jumbo CDs do not always guarantee higher returns compared to standard CDs. In fact, for six out of eight terms reviewed, standard CDs offer comparable or superior rates. It is advisable to compare both before deciding.

Outlook: How High Will CD Rates Rise This Year?

The Federal Reserve has aggressively raised interest rates since March last year to combat inflation, resulting in historically attractive CD rates and high-yield savings and money market accounts.

Last week, the Fed paused rate hikes, maintaining the benchmark rate at its highest since 2001. However, Fed Chair Jerome Powell emphasized that this pause does not preclude future increases.

"Inflation has eased since mid-last year, and recent data is encouraging. However, sustained progress is necessary to ensure inflation moves toward our target," Powell stated.

He also noted that decisions will be made on a meeting-by-meeting basis, keeping options open for potential hikes if inflation remains above target. The next rate announcement is scheduled for December 13.

While predicting Fed moves is challenging, CD rates are expected to hold steady at elevated levels, with the possibility of modest increases if further hikes occur.

Current top rates available include: CDs up to 4.50% APY for May 2025, high-yield savings accounts offering 5.00% APY, and money market accounts up to 4.40% APY.

Note on Rate Data

The "top rates" highlighted here represent the highest nationally available rates identified by Investopedia from hundreds of banks and credit unions, differing significantly from national averages, which are much lower due to inclusion of many large banks offering minimal interest.

Rate Collection Methodology

Investopedia monitors rates daily from over 200 federally insured banks and credit unions with nationwide availability, focusing on CDs with initial deposits up to $25,000. Banks must operate in at least 40 states, and credit unions with donation requirements exceeding $40 are excluded.

For full details on our selection process, see our methodology page.

Correction (Nov. 17, 2023): A previously nationwide CD was removed from this list after becoming geographically restricted. The highest nationwide CD rate as of Nov. 6 remains 6.18% APY.

Discover the latest news and current events in Personal Finance News as of 11-11-2023. The article titled " Top CDs in the Market Now: Leading Nationwide Rates at 6.18%, 6.14%, and 5.80% " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Top CDs in the Market Now: Leading Nationwide Rates at 6.18%, 6.14%, and 5.80% " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.