2025 Mortgage Rates: 30-Year at 6.08% & 15-Year at 5.13% Hit Lowest in 19 Months

Discover how 2025 mortgage rates for 30-year and 15-year loans have dropped to their lowest levels since February 2023, offering homebuyers more affordable financing options.

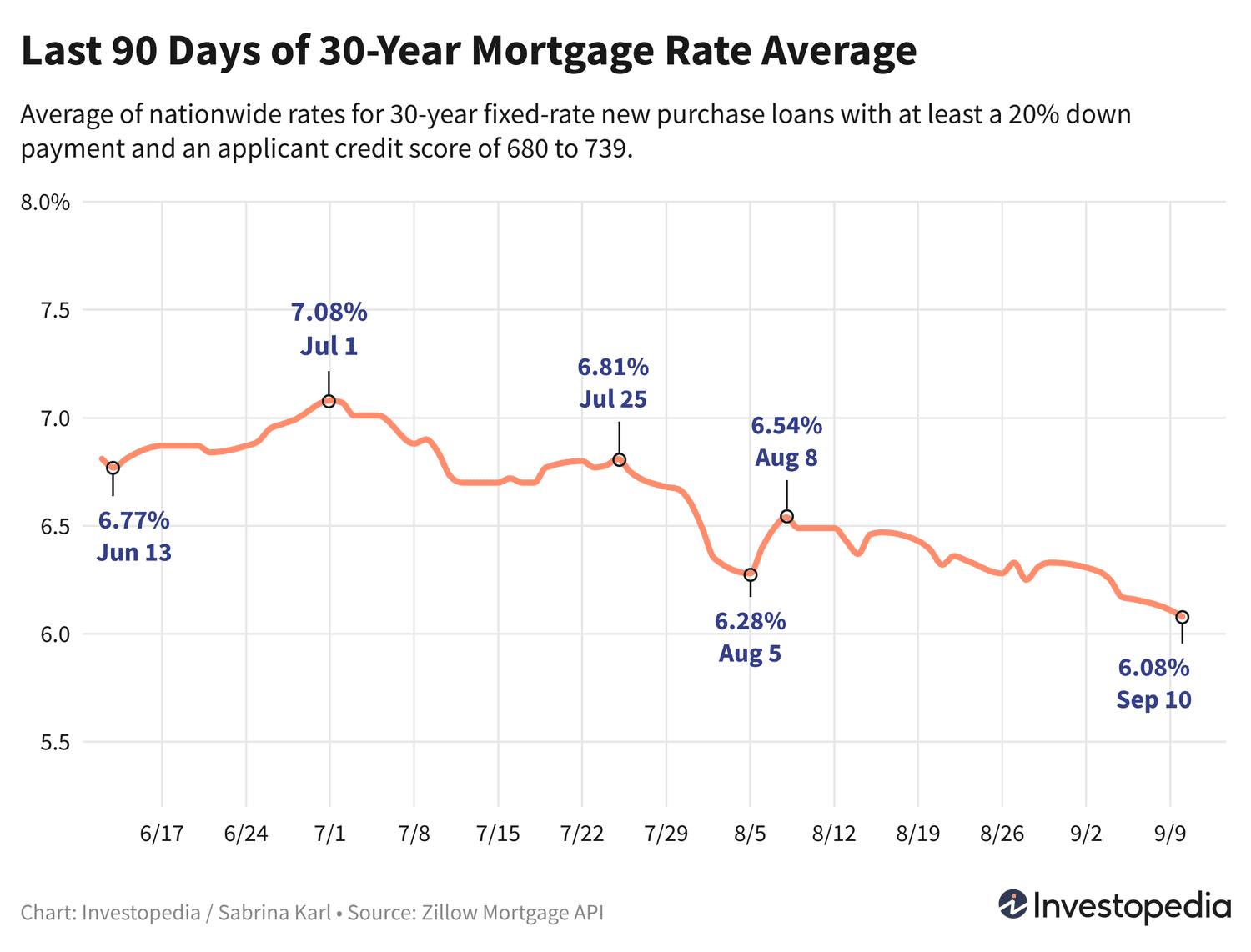

Mortgage rates have continued their downward trend, with the average 30-year fixed-rate mortgage falling to 6.08%, marking the lowest point since February 2023. Similarly, 15-year mortgage rates have dropped to an average of 5.13%, also reaching a 19-month low. This decline extends across various loan types, providing favorable conditions for prospective homebuyers.

Since mortgage rates vary significantly among lenders, it’s essential to compare offers regularly to secure the best possible rate for your home loan.

Current 2025 Mortgage Rate Averages

The 30-year fixed mortgage rate has declined by 25 basis points over six consecutive market days, now averaging 6.08%. This represents a full percentage point drop from July's peak of 7.08% and nearly a 2-point decrease from the historic high of 8.01% recorded in October 2023.

15-year mortgage rates have also fallen by 28 basis points over the last six market days, averaging 5.13%, a level not seen since early 2023 and significantly below last fall's 7.08% peak.

Jumbo 30-year mortgage rates decreased to 6.39%, the lowest since December, following a peak of 8.14% last fall, the highest in over two decades.

Freddie Mac Weekly Mortgage Rate Update

Freddie Mac reported a stable 30-year mortgage average of 6.35% last week, maintaining the lowest weekly average since May 2023. Their weekly average differs slightly from daily averages due to calculation methods and loan criteria.

For accurate monthly payment estimates, utilize our Mortgage Calculator tailored to various loan scenarios.

Important Note

Published averages differ from advertised teaser rates, which often reflect ideal borrower profiles and may require upfront points. Actual rates depend on individual credit scores, income, and loan specifics.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are influenced by multiple macroeconomic and industry dynamics, including:

- Movements in the bond market, particularly 10-year Treasury yields

- The Federal Reserve's monetary policies related to bond purchases and mortgage funding

- Competitive pressures among lenders and loan products

Since 2021, the Federal Reserve’s bond-buying and rate adjustments have significantly impacted rates, with recent signals indicating potential rate cuts as inflation moderates.

How We Monitor Mortgage Rates

Our data, sourced from the Zillow Mortgage API, reflects national and state averages based on an 80% loan-to-value ratio and credit scores between 680–739. These figures provide realistic expectations for borrowers, distinct from promotional rates. © Zillow, Inc., 2024. Use subject to Zillow Terms of Use.

Discover the latest news and current events in Personal Finance News as of 25-01-2024. The article titled " 2025 Mortgage Rates: 30-Year at 6.08% & 15-Year at 5.13% Hit Lowest in 19 Months " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " 2025 Mortgage Rates: 30-Year at 6.08% & 15-Year at 5.13% Hit Lowest in 19 Months " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.