Mortgage Rates Fall to Lowest Point in 5 Weeks - March 13, 2025 | Current Rates & Trends

Discover the latest mortgage rate updates as 30-year fixed rates drop to their lowest since early February 2025. Explore detailed insights on purchase and refinance rates, state-by-state comparisons, and factors influencing these changes.

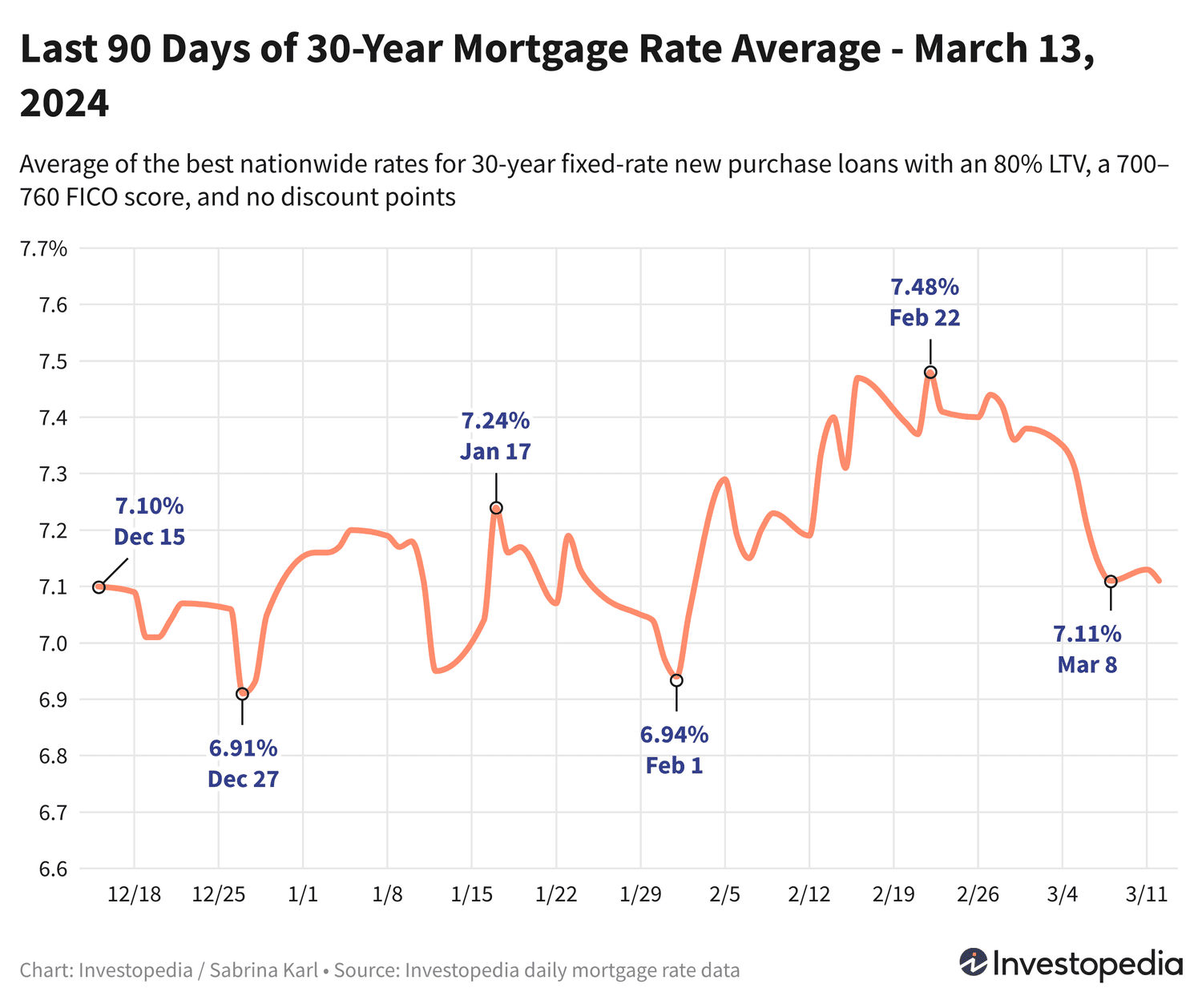

Latest Mortgage Rate Update – March 13, 2024

On Tuesday, 30-year fixed mortgage rates slightly declined, reversing the previous day's small increase and settling at an average of 7.11%. This marks the most affordable level seen since early February. Meanwhile, most other loan categories experienced a rise in rates.

Since mortgage rates vary significantly between lenders, it’s essential to shop around and compare offers regularly to secure the best home loan deal.

Current Average Rates for New Home Purchases

The 30-year fixed mortgage rate for new purchases has dropped substantially from its mid-February peak of 7.48%. Following five consecutive days of decline last week and stabilization this week, the average now stands at 7.11%, the lowest since February 2. Although rates dipped below 6% earlier in February, the current figures still remain slightly elevated but significantly lower than October’s historic 23-year high of 8.45%.

Rates for 15-year new purchase mortgages increased modestly by 6 basis points to 6.56%, higher than the seven-month low of 6.10% recorded just before the new year but well below last October’s peak of 7.59%, the highest since 2000.

Jumbo 30-year fixed rates rose by 0.125%, reaching 6.82% after holding steady near 6.70% recently. Although jumbo rate data before 2009 is limited, the October peak of 7.52% represents the highest in over two decades.

Other loan types mostly saw rate increases on Tuesday, including jumbo 5/6 and 7/6 adjustable-rate mortgages, which climbed 12 basis points. The only exception was jumbo 15-year loans, which decreased slightly by 2 basis points.

Weekly Freddie Mac 30-Year Mortgage Rate Average

Freddie Mac’s weekly average for 30-year fixed mortgages dropped by 6 basis points last week to 6.88%. This is a significant decrease from the late October 2023 record high of 7.79%, the most expensive level in 23 years. The average reached a recent low of 6.60% in mid-January.

Note that Freddie Mac’s weekly averages differ from daily averages because they incorporate rates from the previous five days and may include loans with discount points, whereas daily averages typically reflect zero-point loans.

Refinancing Rate Trends

After a 21-basis-point jump on Monday, the 30-year refinance average increased another 6 basis points on Tuesday, widening the spread between purchase and refinance rates to 60 basis points compared to 33 points last Friday.

Several jumbo refinance averages rose by 0.125%, while most other refinance rates remained stable. The 15-year refinance rate inched up by 3 basis points, and FHA 30-year refinance rates were the only category to decline, dropping 5 basis points.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios.

Important Considerations

The mortgage rates listed here are averages and may not match teaser rates advertised online, which often highlight the most attractive offers requiring upfront points or assume exceptional credit profiles and smaller loan amounts. Your actual rate depends on your credit score, income, and other personal factors.

Lowest Mortgage Rates by State

Mortgage rates differ by state due to variations in credit scores, loan types, and lender risk strategies. States offering the lowest 30-year fixed purchase rates include Mississippi, Hawaii, Louisiana, and Vermont. Conversely, Minnesota, Oregon, Montana, Nevada, and New York have some of the highest rates.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are shaped by multiple factors, including:

- Movements in the bond market, especially 10-year Treasury yields

- The Federal Reserve’s monetary policies, particularly bond purchases and mortgage funding

- Competition among lenders and across different loan products

Because these factors interact in complex ways, pinpointing a single cause for rate changes is challenging.

During much of 2021, mortgage rates remained relatively low due to the Federal Reserve’s large-scale bond-buying programs responding to pandemic economic challenges. Starting November 2021, the Fed tapered these purchases, ending net buys by March 2022.

From then until July 2023, the Fed raised the federal funds rate aggressively to combat inflation, increasing it by 5.25 percentage points over 16 months. Although the federal funds rate does not directly set mortgage rates, these hikes indirectly pushed mortgage rates higher.

The Fed has paused rate increases since January 31, 2024, signaling a likely end to hikes for now. However, Fed Chair Jerome Powell noted inflation remains elevated, suggesting cautious timing for any rate cuts, with no reductions expected before the March 19–20 meeting.

Quarterly Fed data indicates most members anticipate two to four rate cuts in 2024, with a median expectation of three cuts totaling 0.75%, though the timing and extent remain uncertain.

How We Monitor Mortgage Rates

The national averages presented are based on the lowest rates from over 200 leading lenders, assuming an 80% loan-to-value ratio and a borrower credit score between 700 and 760. These averages provide realistic expectations for qualified borrowers, differing from advertised teaser rates.

The state-specific rates reflect the lowest current lender offers within the same parameters, providing a clear view of regional mortgage cost differences.

Discover engaging topics and analytical content in Personal Finance News as of 18-03-2024. The article titled " Mortgage Rates Fall to Lowest Point in 5 Weeks - March 13, 2025 | Current Rates & Trends " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Mortgage Rates Fall to Lowest Point in 5 Weeks - March 13, 2025 | Current Rates & Trends " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.