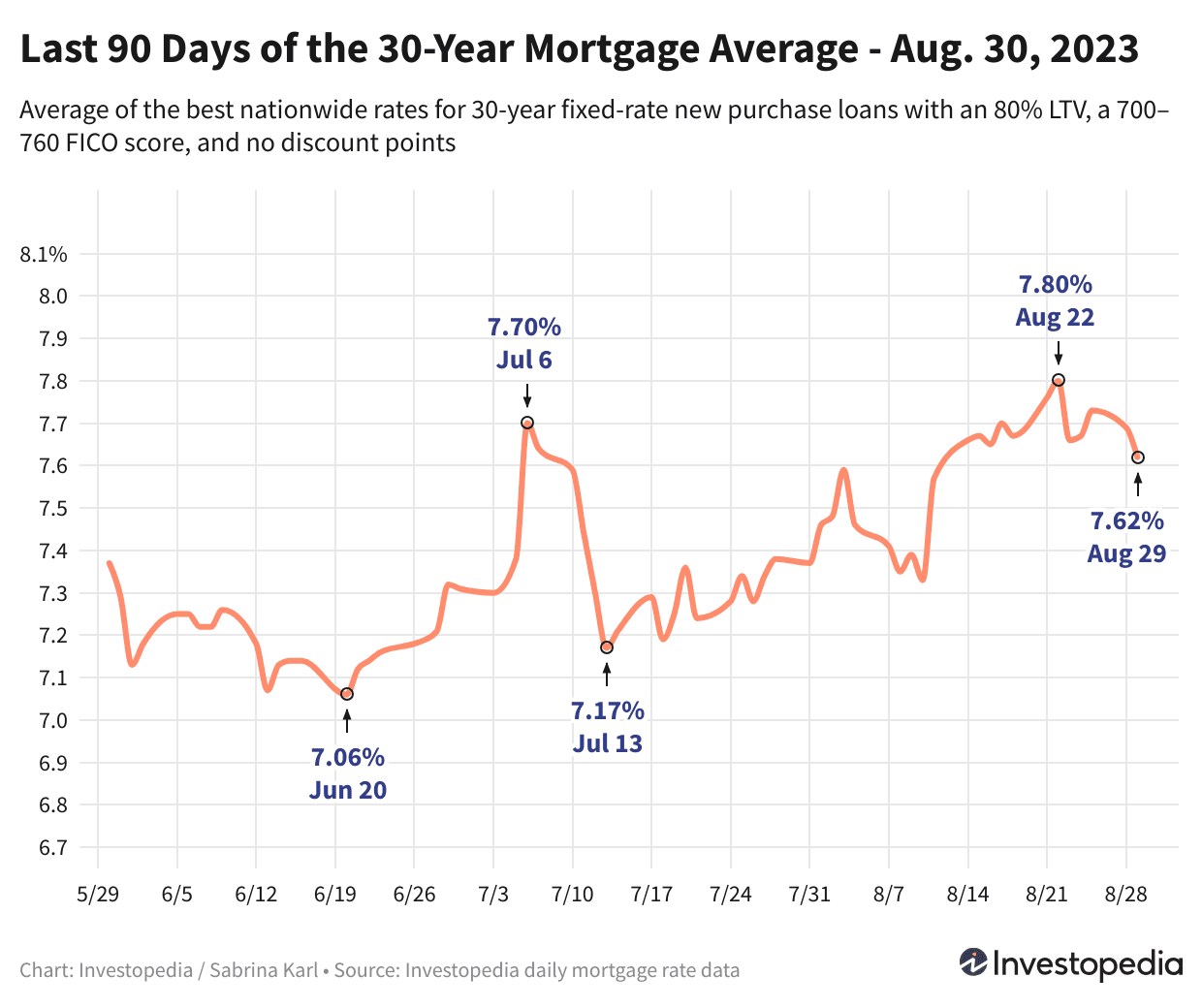

2023 Mortgage Rates Fall to Lowest in Two Weeks – Current Average at 7.62%

Mortgage rates on 30-year fixed loans have declined to their lowest point in over two weeks, easing from last week's 22-year high. Discover today's updated rates, state-by-state variations, and key factors influencing mortgage trends.

Mortgage Rate Update – August 30, 2023

Mortgage rates for 30-year fixed loans have decreased for the second consecutive day, dropping to their lowest average in more than two and a half weeks. This decline moves rates further away from the 22-year peak recorded just last week.

The current national average for 30-year fixed mortgages stands at 7.62%. Since rates can vary significantly among lenders, it’s essential for prospective borrowers to compare options regularly to secure the best possible terms for their loan type.

Recent Market Highlights

Last Thursday, Freddie Mac reported a new 22-year high for 30-year mortgage rates, with their weekly average climbing 14 basis points to 7.23%, the highest since June 2001. It’s important to note that Freddie Mac’s weekly averages differ from daily snapshots as they incorporate rates over five days and may include mortgage discount points. Our data reflects daily averages without points for a clearer daily market view.

Current National Mortgage Rate Averages

As of Tuesday, 30-year fixed-rate mortgages fell by 7 basis points to an average of 7.62%, down nearly 0.2% from last Tuesday’s historic 7.80% high. This peak marked the highest national average in over two decades.

Rates for 15-year fixed mortgages remained steady, averaging 7.14%, just under the 21-year peak of 7.17% recorded last week. Jumbo 30-year loan rates dropped 13 basis points to 6.77%, after holding steady for several days. Though jumbo loan data before 2009 is limited, last week’s 7.02% peak likely represents a 20+ year high.

The FHA 15-year fixed-rate average was the only category to increase slightly, rising 2 basis points.

Refinance rates mirrored new purchase trends, with 30-year refinance rates dropping 3 basis points, creating a 35 basis point gap between new purchase and refinance rates. The 15-year refinance rate remained flat, while jumbo 30-year refinance rates declined 13 basis points. The 7/6 ARM refinance rate was the sole exception, increasing by 8 basis points.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios.

Key Considerations

Displayed mortgage rates represent averages and generally differ from advertised teaser rates, which often highlight the most attractive offers with specific conditions such as upfront points or ideal borrower profiles. Your actual mortgage rate will depend on personal factors including credit score, income, and loan specifics, potentially resulting in rates higher or lower than these averages.

Lowest Mortgage Rates by State

Mortgage rates vary across states due to differences in credit profiles, loan types, and lender risk strategies. Below is a state-by-state overview of the lowest currently available mortgage rates, assuming an 80% loan-to-value ratio and a credit score between 700 and 760.

What Influences Mortgage Rate Fluctuations?

Mortgage rates are shaped by a complex mix of economic and industry factors, including bond market trends—especially 10-year Treasury yields—the Federal Reserve’s monetary policies, and lender competition across loan types. Because multiple elements interact simultaneously, pinpointing a single cause for rate changes is challenging.

During much of 2021, mortgage rates remained relatively low due to the Federal Reserve’s aggressive bond-buying program responding to pandemic-related economic challenges. This policy significantly suppressed rates.

Starting in November 2021, the Fed began tapering its bond purchases monthly, reaching zero by March 2022.

The federal funds rate, set periodically by the Federal Open Market Committee (FOMC), also impacts mortgage rates indirectly. Notably, mortgage rates and the fed funds rate can sometimes move in opposite directions.

At its July 26, 2023 meeting, the Fed raised rates by 25 basis points to a range of 5.25%–5.50%. Fed Chair Jerome Powell indicated that future rate decisions depend on inflation trends, with the possibility of either another hike or a pause at the September 20 meeting.

Methodology

National averages are calculated using the lowest rates offered by over 200 top lenders, assuming an 80% loan-to-value ratio and a FICO score between 700 and 760. These averages reflect typical borrower experiences rather than promotional teaser rates.

State-level lowest rates follow the same assumptions.

Have news tips for Investopedia? Email us at tips@investopedia.com.

Discover engaging topics and analytical content in Personal Finance News as of 05-09-2023. The article titled " 2023 Mortgage Rates Fall to Lowest in Two Weeks – Current Average at 7.62% " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 2023 Mortgage Rates Fall to Lowest in Two Weeks – Current Average at 7.62% " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.