Mortgage Rates Drop to Lowest Point in Four Months

Discover how 30-year and 15-year mortgage rates have fallen to their lowest levels in months, offering new opportunities for homebuyers. Learn about the factors influencing these changes and how to find the best rates today.

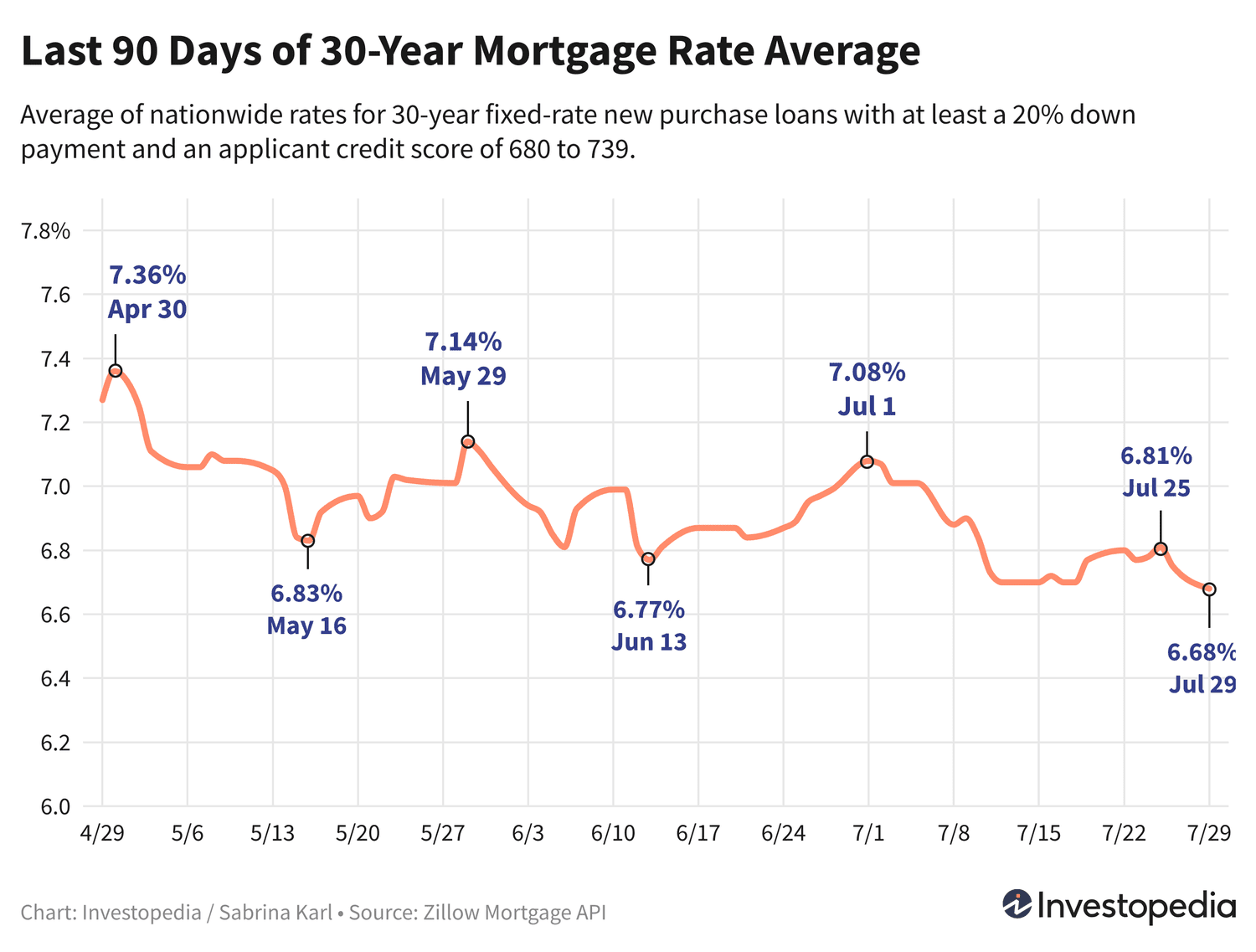

The 30-year mortgage rate average has declined to its most affordable level since late March, signaling a positive shift for prospective homeowners.

On Monday, rates for new 30-year purchase mortgages decreased by 7 basis points, bringing the average down to 6.68%, marking the lowest point in over four months. Nearly all other mortgage categories also saw rate reductions on the same day.

Since mortgage rates can vary significantly among lenders, it's essential to shop around and compare options regularly, regardless of the loan type you are considering.

Current New Purchase Mortgage Rate Averages

The 30-year mortgage average dropped for the second consecutive day on Monday, falling an additional 7 basis points after a 6-point decline on Friday. This brings the average to 6.68%, the most affordable since March 27. Since July 1, rates have decreased by 40 basis points from 7.08%.

Although current 30-year mortgage rates are higher than February's low of 6.36%, they remain significantly below the historic 23-year peak of 8.01% reached in October.

Rates for 15-year mortgages also decreased by 6 basis points on Monday, reaching a new average of 5.81%. This marks the lowest point for 15-year rates in nearly six months, and they remain well below last fall's peak of 7.08%, the highest since 2000.

Jumbo 30-year mortgage rates fell by 7 basis points, lowering the average to 6.92% on Monday. This is the lowest level since early June and is notably below the May high of 7.30%. While historical jumbo rates before 2009 are unavailable, last fall's peak of 8.14% is believed to be the highest in over two decades.

Weekly Freddie Mac Mortgage Rate Averages

Freddie Mac, a government-sponsored entity that purchases mortgage loans, publishes weekly 30-year mortgage rate averages every Thursday. Last week, the average inched up by 1 basis point to 6.78%. Freddie Mac’s average reached a historic 23-year high of 7.79% last October and later dropped to a low of 6.60% in mid-January.

The difference between Freddie Mac’s weekly averages and our daily Investopedia averages arises because Freddie Mac blends rates over five days, providing a broader view, while our daily average offers more immediate insight. Additionally, criteria such as down payment amounts, credit scores, and discount points differ between methodologies.

Use our Mortgage Calculator to estimate monthly payments across various loan scenarios.

Important Note

Published rates here differ from promotional teaser rates often advertised online. Those teaser rates may require upfront points or assume an ideal borrower profile with excellent credit and smaller loan amounts. Your actual mortgage rate will depend on your creditworthiness, income, and other personal factors, so it may differ from average rates shown.

What Influences Mortgage Rate Fluctuations?

Mortgage rates fluctuate based on a complex mix of economic and industry factors, including:

- Movements in the bond market, particularly 10-year Treasury yields

- Federal Reserve monetary policies, especially bond purchasing and support for government-backed mortgages

- Competition among lenders and across different loan products

Because multiple factors often act simultaneously, it’s challenging to attribute rate changes to a single cause.

Throughout much of 2021, macroeconomic conditions kept mortgage rates relatively low, largely due to the Federal Reserve’s extensive bond-buying programs responding to pandemic-related economic challenges.

However, starting in November 2021, the Fed gradually reduced bond purchases, ending them by March 2022.

Between then and July 2023, the Fed raised the federal funds rate aggressively to combat high inflation. While this benchmark rate influences mortgage rates indirectly, they can sometimes move independently.

The rapid and substantial increase of 5.25 percentage points in the federal funds rate over 16 months has significantly contributed to the rise in mortgage rates during the past two years.

Since last July, the Fed has held the federal funds rate steady, with the most recent rate hold announced last month. Inflation has decreased but remains above the Fed’s 2% target. The central bank has indicated it will wait for sustained inflation declines before reducing rates.

Four more Fed meetings are scheduled this year, with the next concluding on July 31.

How We Monitor Mortgage Rates

The national and state mortgage averages provided are sourced via the Zillow Mortgage API, assuming an 80% loan-to-value ratio (20% down payment) and a credit score between 680 and 739. These rates reflect what borrowers might expect based on their qualifications and may differ from promotional rates. © Zillow, Inc., 2024. Use is subject to Zillow Terms of Use.

Discover the latest news and current events in Personal Finance News as of 06-03-2024. The article titled " Mortgage Rates Drop to Lowest Point in Four Months " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Mortgage Rates Drop to Lowest Point in Four Months " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.