Discover the Lowest 30-Year Mortgage Rates in 19 Months – Unlock Savings Now!

Explore the latest drop in 30-year mortgage rates to their most affordable point since early 2023, alongside new lows in 15-year mortgage rates. Get insights and tips to secure the best home loan rates today.

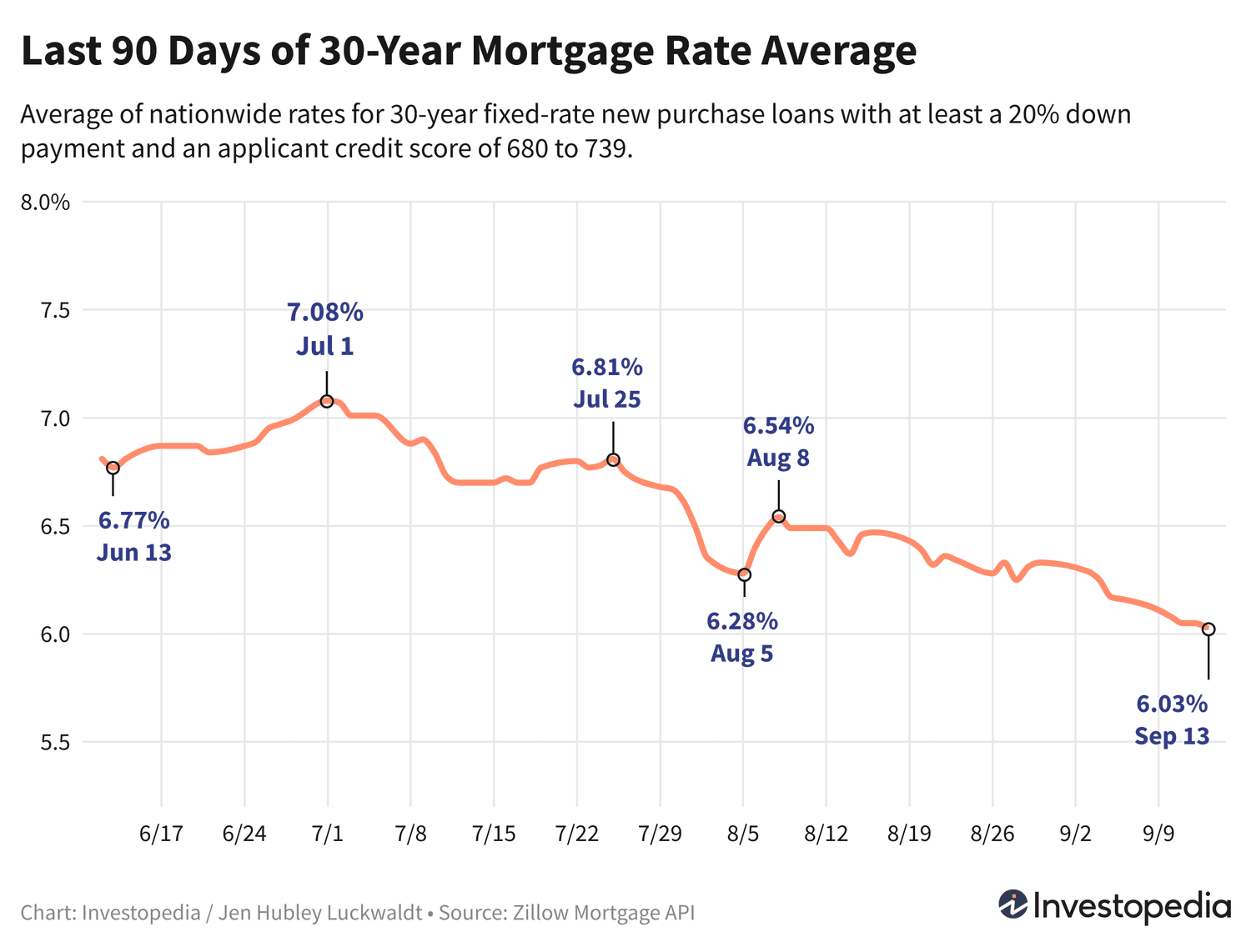

Mortgage rates for 30-year loans have recently declined to an average of 6.03%, marking the lowest point since early 2023. Similarly, 15-year mortgage rates have dropped to 5.07%, breaking previous 19-month records. While rates for other new purchase mortgages show varied trends, the overall movement signals a favorable borrowing environment for prospective homeowners.

Mortgage rates can differ significantly among lenders, so it’s essential to shop around and compare regularly to find the best possible deal, regardless of the loan type you’re considering.

Current Average Mortgage Rates for New Home Purchases

As of the most recent data, 30-year fixed-rate mortgages for new purchases average 6.03%, reflecting a 30 basis point drop since late August. This is the most affordable rate since February 2023 and represents a substantial decrease from July’s peak of 7.08%, and is nearly 2 percentage points below the historic high of 8.01% recorded in October 2023.

Meanwhile, 15-year mortgage rates have decreased by 3 basis points to 5.07%, setting a new 19-month low. This rate has declined by 22 basis points over the past week, significantly lower than last fall’s historic 7.08% peak, which was the highest since 2000.

Jumbo 30-year mortgage rates have seen a slight increase of 2 basis points, averaging 6.40%. Although detailed historical jumbo rates are limited before 2009, last fall’s peak of 8.14% is estimated to be the highest in over two decades.

Freddie Mac’s Weekly Mortgage Rate Insights

Freddie Mac, a government-backed mortgage purchaser, reports a weekly average for 30-year mortgage rates every Thursday. Last week’s average dropped by 15 basis points to 6.20%, the lowest weekly figure since February 2023. For comparison, last October’s average hit a 23-year high of 7.79%.

Note that Freddie Mac’s weekly averages blend rates over five days, differing slightly from daily averages reported elsewhere. Additionally, loan qualification criteria vary, affecting rate comparisons.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios and plan your finances effectively.

Important Considerations

Advertised teaser rates often don’t reflect the average rates presented here, as they may require upfront points or assume ideal borrower profiles with excellent credit scores and smaller loan amounts. Your actual mortgage rate will depend on your creditworthiness, income, and other personal factors.

Key Drivers Behind Mortgage Rate Fluctuations

Mortgage rates fluctuate due to a combination of factors, including:

- Movements in the bond market, especially 10-year Treasury yields

- The Federal Reserve’s monetary policies, particularly regarding bond purchases and government-backed mortgage funding

- Competition among lenders and across different loan types

Since these elements often interact simultaneously, pinpointing a single cause for rate changes is challenging.

In 2021, mortgage rates remained relatively low, influenced by the Federal Reserve’s bond-buying programs responding to pandemic-related economic challenges. However, starting November 2021, the Fed tapered these purchases, ending in March 2022, followed by a series of rate hikes to combat inflation.

Though the federal funds rate doesn’t directly set mortgage rates, its rapid increase over 16 months by 5.25 percentage points has indirectly pushed mortgage rates higher. Since July 2023, the Fed has held rates steady but signaled potential cuts as inflation eases, with reductions expected after the September 18 meeting.

How We Monitor Mortgage Rates

The mortgage rates cited here are sourced from the Zillow Mortgage API, based on an 80% loan-to-value ratio and credit scores between 680 and 739. These averages provide realistic expectations for borrowers but can differ from promotional rates advertised elsewhere. © Zillow, Inc., 2024. Use is subject to Zillow Terms of Use.

Discover engaging topics and analytical content in Personal Finance News as of 05-05-2024. The article titled " Discover the Lowest 30-Year Mortgage Rates in 19 Months – Unlock Savings Now! " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Discover the Lowest 30-Year Mortgage Rates in 19 Months – Unlock Savings Now! " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.