UK rate cut to 3.75% as further reductions hinge on growth

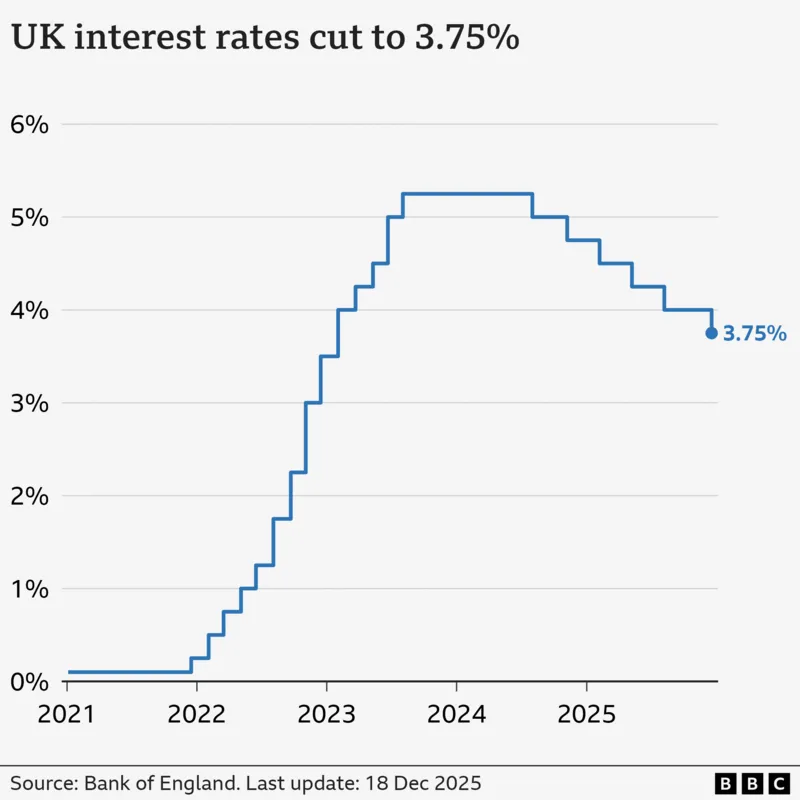

Britain's central bank trims the base rate to 3.75%, the lowest in years, as inflation cools; policymakers warn that any future cuts will be a closer call tied to growth and price trends.

Britain's borrowing costs were lowered to 3.75% today as inflation cools, potentially easing repayments for households. The move comes with a clear warning: any additional reductions will be a closer call, depending on how the economy performs in the months ahead.

What happened

The Bank of England reduced the benchmark rate from 4.0% to 3.75% in a narrowly split vote of 5 to 4. Officials signaled rates are likely to move downward gradually, but a further cut next year will require careful judgement.

Bank's outlook

Inflation is forecast to approach the 2% target within the next year, earlier than previously expected. The Bank also expects the economy to stagnate in the final months of this year, underscoring the delicate balancing act between inflation and growth.

Impact on households

Millions of borrowers with tracker loans will see smaller payments; about 500,000 homeowners on products tied to the Bank's rate could save around £29 a month on average. Those on standard variable rates are also likely to pay less, though most borrowers are now in fixed-rate deals and not immediately affected.

Personal voice

Kayleigh Taylor, who lives in Essex, said her mortgage costs rose sharply after remortgaging and is weighing options for next year, including potentially moving to a more affordable area if rates fall further.

Budget and economy

The Budget measures aimed at easing living costs, including a £150 cut to household energy bills, were cited by the Bank as supporting the inflation outlook. Still, November growth data pointed to a weak economy, with consumer spending cautious and retailers trying to preserve value during the holiday period.

Expert view

Ruth Gregory of Capital Economics suggested a rate move could come in February, with a path down to 3% in 2026 if inflation continues to slow more quickly than expected.

Conclusion

The Bank reiterates its independence and a gradual approach to policy, balancing price stability with the risk of weaker growth. The 3.75% cut reflects a cautious path that could tighten or ease further depending on the data ahead.

The chancellor welcomed the move as swift relief for families and businesses, while opposition critics argued it underscored concerns about the economy's fragility.

The Bank, independent of the government, sets rates to keep price rises in check. Higher rates can cool demand but risk slowing growth and investment.

Earlier data showed food price inflation easing, a factor the Bank cited as helping the inflation outlook.

With inflation cooling faster than some forecasts, analysts say a February cut could be on the cards, with some expecting rates as low as 3% in 2026.

Summary: The Bank's 3.75% decision signals cautious easing in policy as inflation falls and growth remains tepid. Borrowers may see relief in payments, while savers face smaller returns; the path ahead will depend on the next inflation readings and activity data.

Key takeaway: Rate cuts ease borrowing costs but weigh on savers and growth prospects; the balance now depends on inflation momentum. BBC News

Discover the latest news and current events in Economics as of 19-12-2025. The article titled " UK rate cut to 3.75% as further reductions hinge on growth " provides you with the most relevant and reliable information in the Economics field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " UK rate cut to 3.75% as further reductions hinge on growth " helps you make better-informed decisions within the Economics category. Our news articles are continuously updated and adhere to journalistic standards.