Federal Reserve Interest Rate Cuts in 2025: One or Two? Latest Dot Plot Analysis

Discover the Federal Reserve's forecast on interest rate cuts for 2025, highlighting the close debate between one or two reductions and their potential impact on borrowing costs and the economy.

Diccon Hyatt, a seasoned financial and economic journalist, has extensively covered the pandemic-era economy in numerous reports over the past two years. He specializes in breaking down complex financial topics into clear, relatable language, focusing on how economic trends affect personal finances and market dynamics. His experience includes roles at U.S. 1, Community News Service, and the Middletown Transcript.

Key Insights

- The Federal Open Market Committee (FOMC) remains divided on the number of rate cuts in 2024, with a slim majority favoring just one cut, while several members anticipate two.

- Since March, policymakers have adjusted their outlook due to stronger-than-expected inflation data, reducing expectations for multiple cuts.

- Even a single rate cut by the Fed can significantly lower borrowing costs across various loan types, influencing economic activity.

The Federal Reserve's policy committee currently leans towards implementing a single key interest rate reduction this year. However, the recent "dot plot"—a critical chart monitored by financial markets—reveals this decision is finely balanced, with some officials favoring two cuts.

The dot plot, unveiled Wednesday afternoon, illustrates the projections of 19 Federal Open Market Committee members concerning where interest rates will stand by year-end.

The median forecast suggests a quarter-point reduction, placing the target range between 5% and 5.25%.

Nevertheless, the vote split is narrow: four members expect rates to remain steady, seven predict one cut, and eight anticipate two.

The Importance of the Initial Rate Cut

The timing and number of rate cuts are crucial, as lowering the federal funds rate often encourages financial institutions to offer loans more freely, stimulating economic growth.

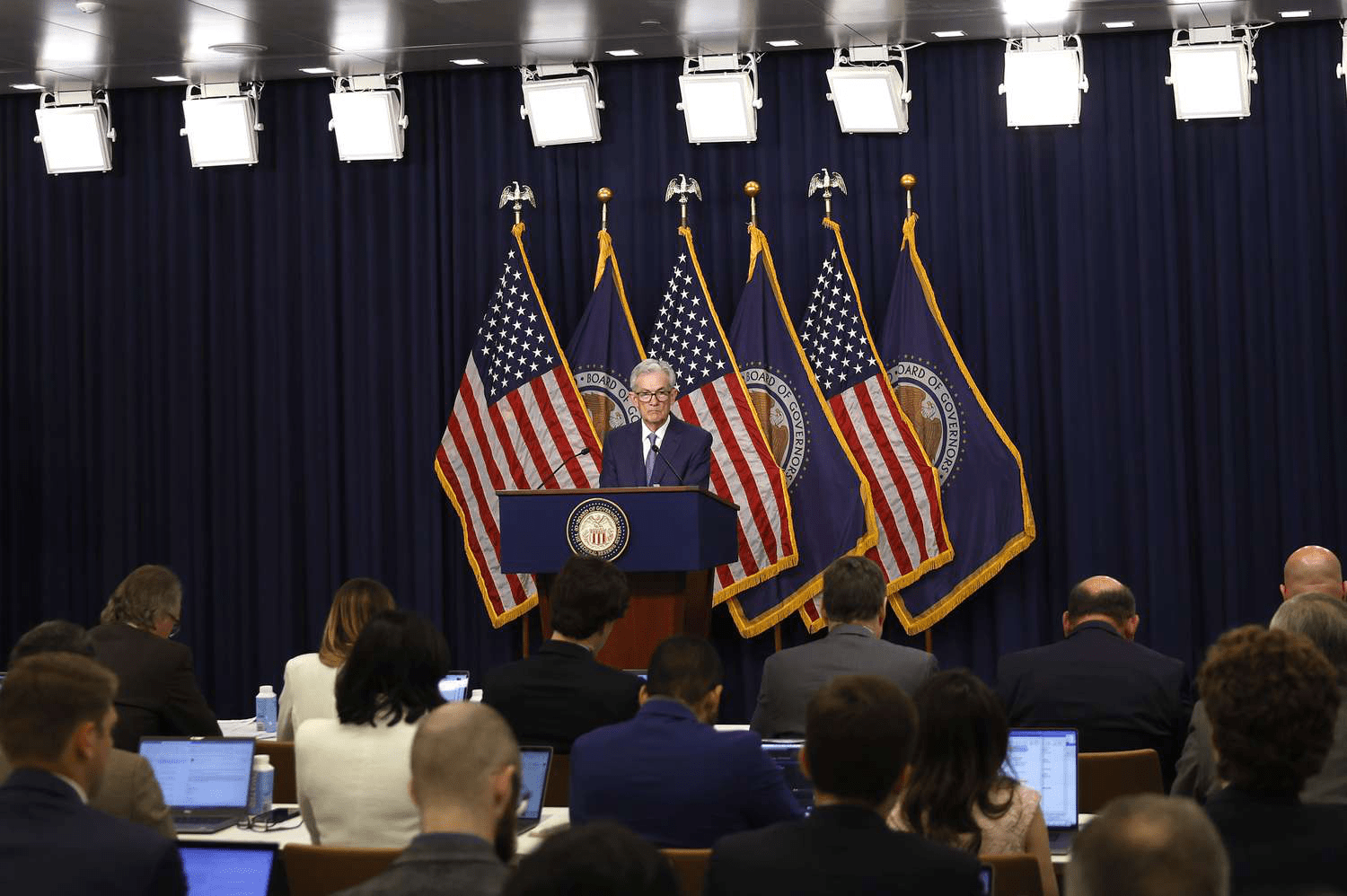

“When we begin to ease policy, it typically results in a meaningful loosening of financial market conditions,” Federal Reserve Chair Jerome Powell stated during Wednesday’s press conference. “This decision carries significant weight for the economy, so precision is essential.”

The June dot plot marks a notable shift from March’s projections, where most policymakers foresaw three cuts. Elevated inflation early in the year led to tempered expectations for rate reductions.

Though inflation reports have shown moderation recently, including data released in May, these updates have yet to significantly influence policymakers’ forecasts, as Powell noted that most members maintained their positions after reviewing new data.

If you have news tips for ZAMONA reporters, please contact us at tips@ZAMONA.

Discover the latest news and current events in Economic News as of 16-05-2024. The article titled " Federal Reserve Interest Rate Cuts in 2025: One or Two? Latest Dot Plot Analysis " provides you with the most relevant and reliable information in the Economic News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Federal Reserve Interest Rate Cuts in 2025: One or Two? Latest Dot Plot Analysis " helps you make better-informed decisions within the Economic News category. Our news articles are continuously updated and adhere to journalistic standards.