Understanding the Fed's Dot Plot: Anticipated Interest Rate Cuts in 2025 and Beyond

Explore the Federal Reserve's latest projections indicating further interest rate reductions in 2025 and 2025, and what this means for the economy and unemployment trends.

Essential Insights

- The Federal Reserve’s updated "dot plot" forecasts an additional 0.5% cut in interest rates during 2024 following the recent half-point reduction.

- Economic projections signal a further 1% decrease in rates in 2025, with long-term rates expected to stabilize near 2.9%.

- Fed officials anticipate a rise in the unemployment rate by year-end, with elevated levels persisting into 2025 before improving in the longer term.

Market analysts carefully examined the Federal Reserve's outlook on upcoming rate adjustments revealed alongside the first interest rate cut since 2020.

The widely observed "dot plot" suggests ongoing reductions in the federal funds rate, potentially occurring in upcoming meetings and continuing into the next year. The projections indicate a possible half-percentage point cut this year and a full percentage point cut in 2025.

These expectations are slightly more conservative than futures market predictions, where tools like CME FedWatch imply investors foresee a 0.75% cut in 2024.

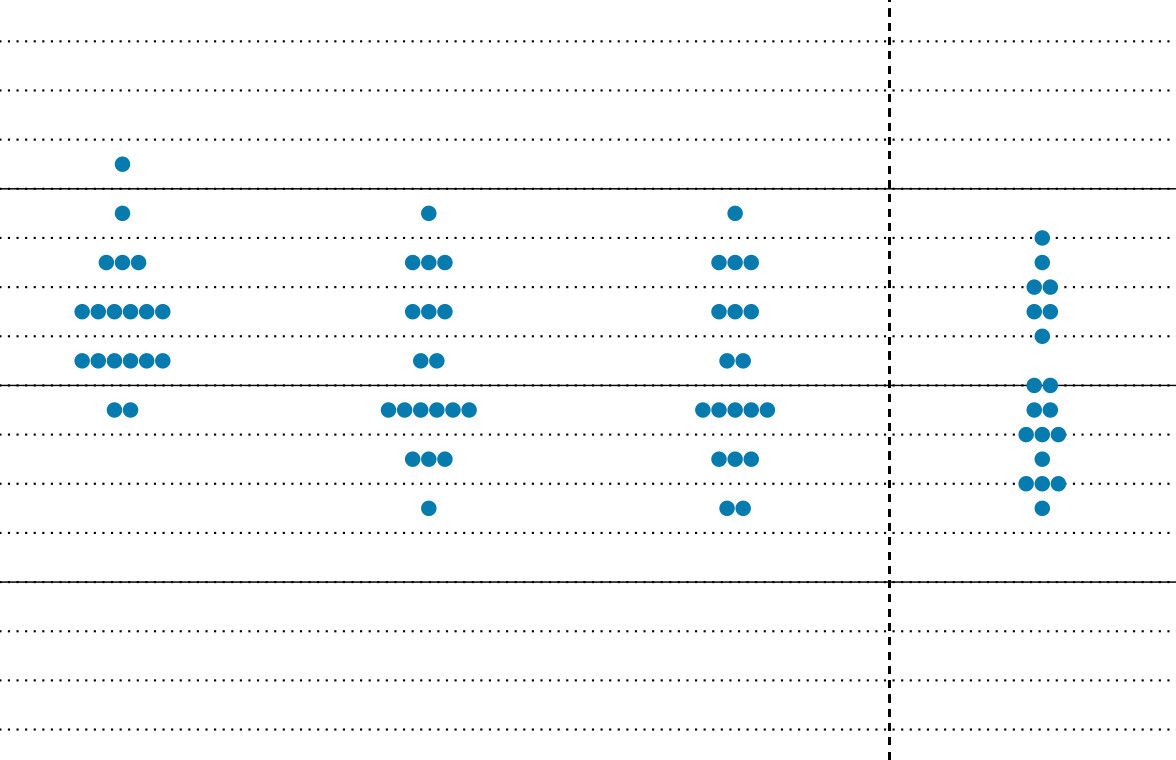

Decoding the Dot Plot's Interest Rate Trajectory

The Federal Reserve releases its economic projections, including the dot plot, quarterly during alternate Federal Open Market Committee (FOMC) meetings. The chart displays individual committee members’ predictions for future interest rates anonymously.

Investors often interpret the median of these dots as the Fed’s consensus forecast, although individual opinions vary. Some market participants find the dot plot’s signals ambiguous regarding future policy.

The previous dot plot from June indicated expectations of only one 0.25% rate cut in 2024, with some members anticipating two cuts.

Since then, signs of a softening labor market and declining inflation have led investors to price in more significant rate reductions ahead of Fed actions.

Projected Fed Funds Rate for the Remainder of 2024

Analysis shows nine members expect at least a 0.5% cut by year-end, seven anticipate a single 0.25% reduction, and two prefer rates to remain steady between 4.75% and 5%. One member advocates for more substantial cuts.

This suggests the Fed may implement either two quarter-point cuts in November and December or a single half-point cut, potentially bringing rates to 4.25%–4.5% entering 2025.

Ryan Sweet, chief economist at Oxford Economics, notes it would be unusual for the Fed to cut aggressively in September and pause subsequently, especially given current restrictive rate levels.

Federal Reserve Chair Jerome Powell emphasized during his press conference that the committee is proceeding cautiously with rate reductions.

"Our policy stance is being recalibrated gradually from last year’s environment of high inflation and low unemployment to a setting that reflects current and expected conditions," Powell explained.

Interest Rate Outlook for 2025 and Beyond

Eight members foresee rates between 2.75% and 3.25%, while nine anticipate rates above 3.75%, with the median rate approximately 1% lower than 2024’s forecast, settling at 3.4%. Long-term projections suggest rates will average around 2.9%.

Economists believe reduced borrowing costs can stimulate economic growth and support continued stock market gains.

"Provided the economy remains stable and inflation stays controlled, lower rates combined with strong earnings growth may drive stock prices higher over time," said Bret Kenwell, eToro US investment analyst.

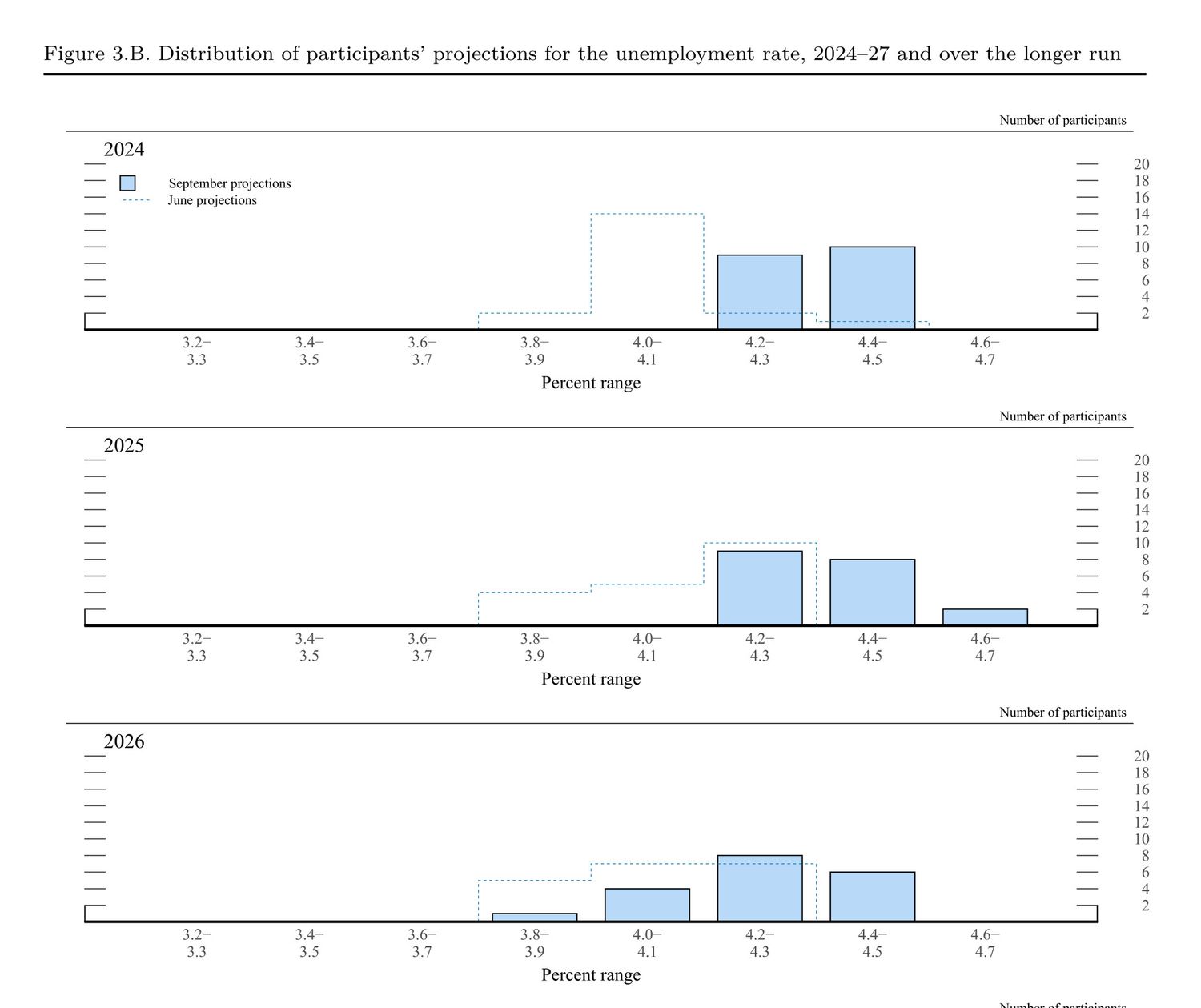

Unemployment Rate Projections

Committee members are divided on unemployment trends: ten expect rates rising to 4.4%–4.5%, while others predict it will hold near the current 4.2% level through the year.

The Fed anticipates a temporary rise in unemployment before improvement, with labor market concerns influencing the decision for a larger-than-usual rate cut.

While immediate cuts may not prevent short-term unemployment increases, projections for 2025 and beyond suggest a healthy job market is likely to persist.

Have a news tip for our reporters? Reach out to us at tips@investopedia.com.

Explore useful articles in Economic News as of 23-09-2024. The article titled " Understanding the Fed's Dot Plot: Anticipated Interest Rate Cuts in 2025 and Beyond " offers in-depth analysis and practical advice in the Economic News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Understanding the Fed's Dot Plot: Anticipated Interest Rate Cuts in 2025 and Beyond " article expands your knowledge in Economic News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.