S&P 500 Climbs as Rate-Sensitive Stocks Surge Following Powell’s Rate Cut Signals

On August 23, 2025, the S&P 500 rose 1.2% after Federal Reserve Chair Jerome Powell hinted at potential interest rate reductions, boosting sectors sensitive to rate changes.

Michael Bromberg is a seasoned finance editor with over ten years of experience, known for simplifying complex financial concepts into clear, accessible language. He holds a Bachelor of Arts in Literature from the University of Wisconsin-Madison and a Master’s degree in Linguistics from Universidad de Antioquia in Medellin, Colombia.

Key Highlights

- The S&P 500 increased by 1.2% on Friday, August 23, 2024, following Federal Reserve Chair Jerome Powell’s indication of upcoming interest rate cuts.

- Rate-sensitive sectors such as construction materials, cruise lines, and solar energy experienced notable gains.

- Shares of financial software company Intuit dropped sharply after reporting an unexpected quarterly loss.

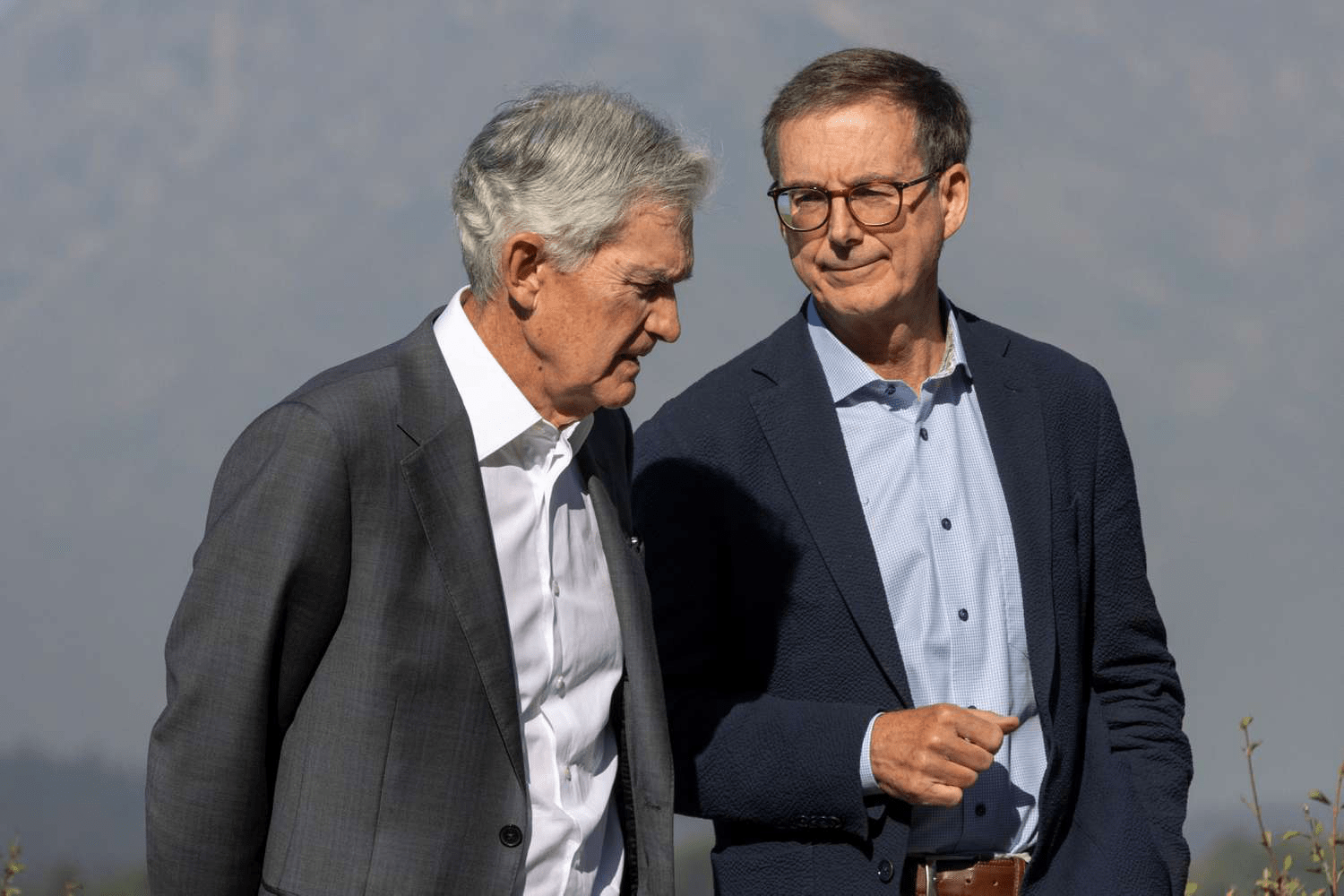

Major U.S. stock indices advanced during the last trading session of the week as Jerome Powell reinforced expectations for imminent interest rate reductions. Speaking at the Jackson Hole Economic Symposium, Powell signaled that conditions are favorable for a rate cut as soon as September, but emphasized that the timing and scale will depend on evolving economic data.

The S&P 500 climbed 1.2%, the Nasdaq surged 1.5%, and the Dow Jones Industrial Average rose 1.1% on the day.

Leading the S&P 500 gains was Builders FirstSource (BLDR), a construction materials supplier, which soared 8.7%. The company benefits from anticipated lower mortgage rates and has strengthened its position through aggressive stock buybacks and acquisitions, effectively reducing net debt despite market uncertainties, according to a recent Wall Street Journal report.

Cruise line stocks also rallied strongly as lower interest rates improve their debt servicing outlook and consumer discretionary spending prospects. Norwegian Cruise Line Holdings (NCLH) shares jumped 7.7%, while Carnival Corporation (CCL) rose 7.4%.

Warner Bros. Discovery (WBD) shares gained 7.3% after news surfaced about the company’s strategy to revamp its cable network programming, focusing on high-intensity dramas aimed at male viewers on TNT, marking a strategic pivot away from streaming following the loss of NBA broadcasting rights.

Solar energy stocks enjoyed a boost as reduced financing costs enhance project viability. Enphase Energy (ENPH), a solar micro-inverter maker, increased 6.5%, supported by Truist analysts’ reaffirmed buy rating citing growth potential. First Solar (FSLR) shares rose 5.9%.

Conversely, Intuit (INTU) shares fell 6.8%, the largest decline in the S&P 500, after the company reported an unexpected quarterly loss and provided cautious full-year profit guidance. Despite announcing a 10% workforce reduction last month, Intuit plans to refocus talent recruitment towards artificial intelligence capabilities.

Synopsys (SNPS), a design automation software firm, saw shares drop 1.6% following earnings that beat EPS expectations but met revenue forecasts. The company’s planned $35 billion acquisition of engineering software provider Ansys (ANSS) faces scrutiny from U.K. regulators concerned about competitive impacts.

Shares of Micron Technology (MU), a memory and data storage provider, declined 1.4% after Susquehanna lowered its price target. Although the firm expects flat DRAM and NAND shipments quarter-over-quarter, it remains optimistic about supply-demand dynamics fueling an industry upcycle.

Have a news tip for our reporters? Email us at tips@investopedia.com.

Discover the latest news and current events in Markets News as of 19-05-2024. The article titled " S&P 500 Climbs as Rate-Sensitive Stocks Surge Following Powell’s Rate Cut Signals " provides you with the most relevant and reliable information in the Markets News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " S&P 500 Climbs as Rate-Sensitive Stocks Surge Following Powell’s Rate Cut Signals " helps you make better-informed decisions within the Markets News category. Our news articles are continuously updated and adhere to journalistic standards.