June 2023 Market Update: Fed Chair Powell Hints at Possible Further Rate Hikes, Stocks Stay Flat

Explore the latest market trends as Fed Chair Jerome Powell signals potential additional interest rate increases to combat inflation, impacting U.S. equities and key sectors like cruise lines and semiconductors.

Highlights of June 28, 2023 Market Activity

- U.S. stock markets remained largely unchanged midday following Fed Chair Jerome Powell's remarks indicating that interest rate hikes may continue to address inflation concerns.

- Cruise line stocks surged, driven by strong travel demand and increasing bookings, marking them as top market performers.

- Semiconductor shares declined amid reports that the U.S. is considering export restrictions on AI chips to China.

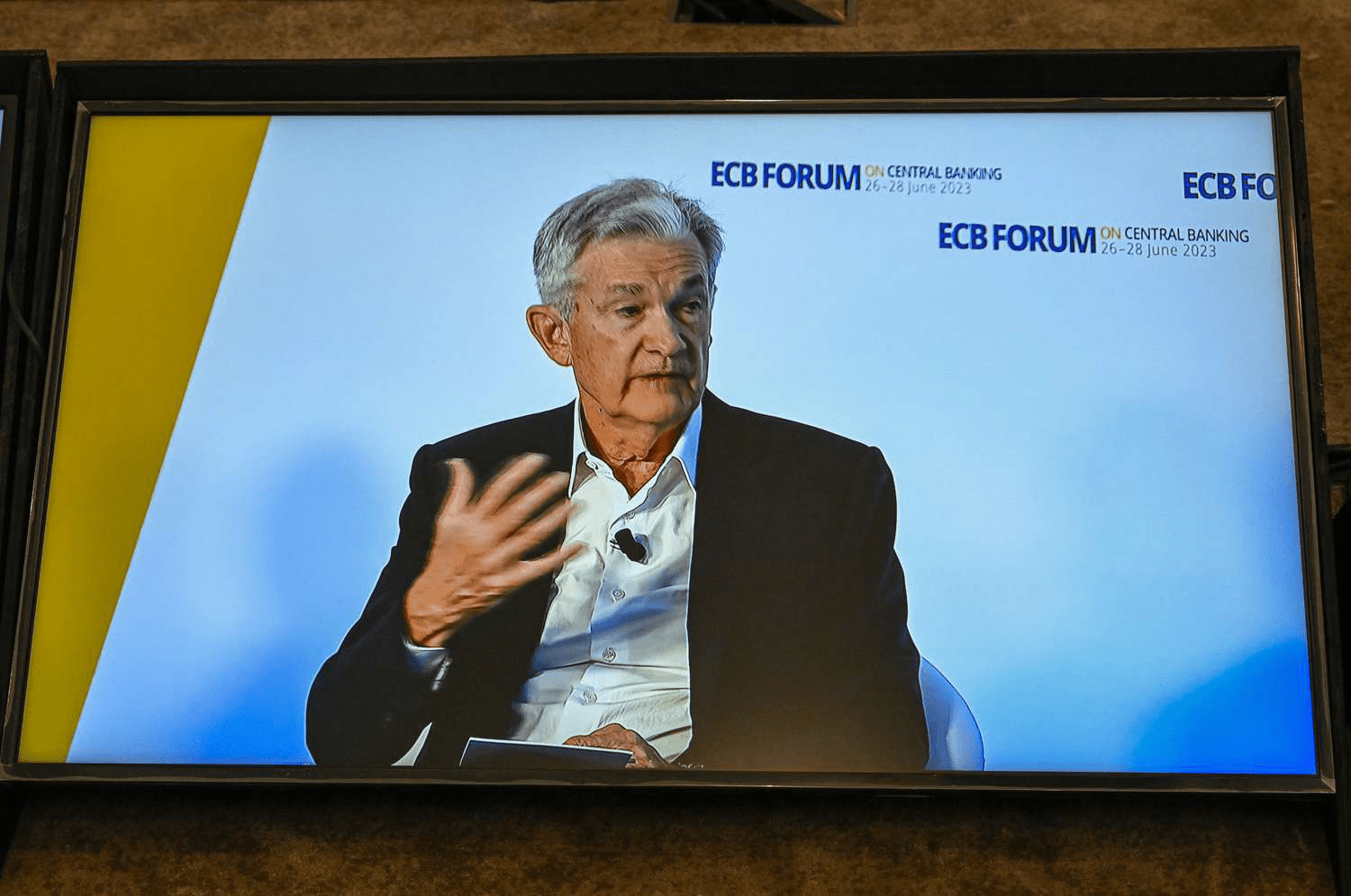

On June 28, 2023, U.S. equities showed little movement by midday after Fed Chair Jerome Powell's address at the ECB's Forum on Central Banking in Portugal. Powell emphasized that additional rate hikes might be necessary to control inflation, noting uncertainties surrounding the full impact of current policy measures.

Leading the market gains, cruise operators Carnival Corp. (CCL) and Norwegian Cruise Line (NCLH) rose by 7% and 6%, respectively. Carnival's shares climbed for the second consecutive session following strong quarterly earnings and have nearly doubled in value this year as travel rebounds post-pandemic.

Conversely, General Mills (GIS) experienced a decline after reporting lower-than-expected sales and profits in its fiscal fourth quarter, attributed to price increases and cautious consumer spending amid inflation. Semiconductor giants Nvidia (NVDA) and Advanced Micro Devices (AMD) also saw share drops after news surfaced about potential U.S. export controls on AI chips destined for China.

Electric vehicle manufacturers Tesla (TSLA) and Lucid Group (LCID) posted gains of 2% and 4%, respectively, with Tesla poised to announce record quarterly sales in China. Netflix (NFLX) shares increased over 3% following an analyst upgrade by Oppenheimer's Jason Helfstein, who raised the price target to $500 from $450, reflecting growing investor confidence.

Commodity and currency markets showed mixed movements: crude oil futures rebounded by 2% after earlier losses, 10-year Treasury yields declined, while the U.S. dollar strengthened against the euro, pound, and yen. Major cryptocurrencies, including Bitcoin, traded lower with Bitcoin down approximately 1%.

For news tips, contact Investopedia reporters at tips@investopedia.com.

Discover the latest news and current events in Markets News as of 03-07-2023. The article titled " June 2023 Market Update: Fed Chair Powell Hints at Possible Further Rate Hikes, Stocks Stay Flat " provides you with the most relevant and reliable information in the Markets News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " June 2023 Market Update: Fed Chair Powell Hints at Possible Further Rate Hikes, Stocks Stay Flat " helps you make better-informed decisions within the Markets News category. Our news articles are continuously updated and adhere to journalistic standards.