Why Warren Buffett Is Divesting His Newspaper Portfolio

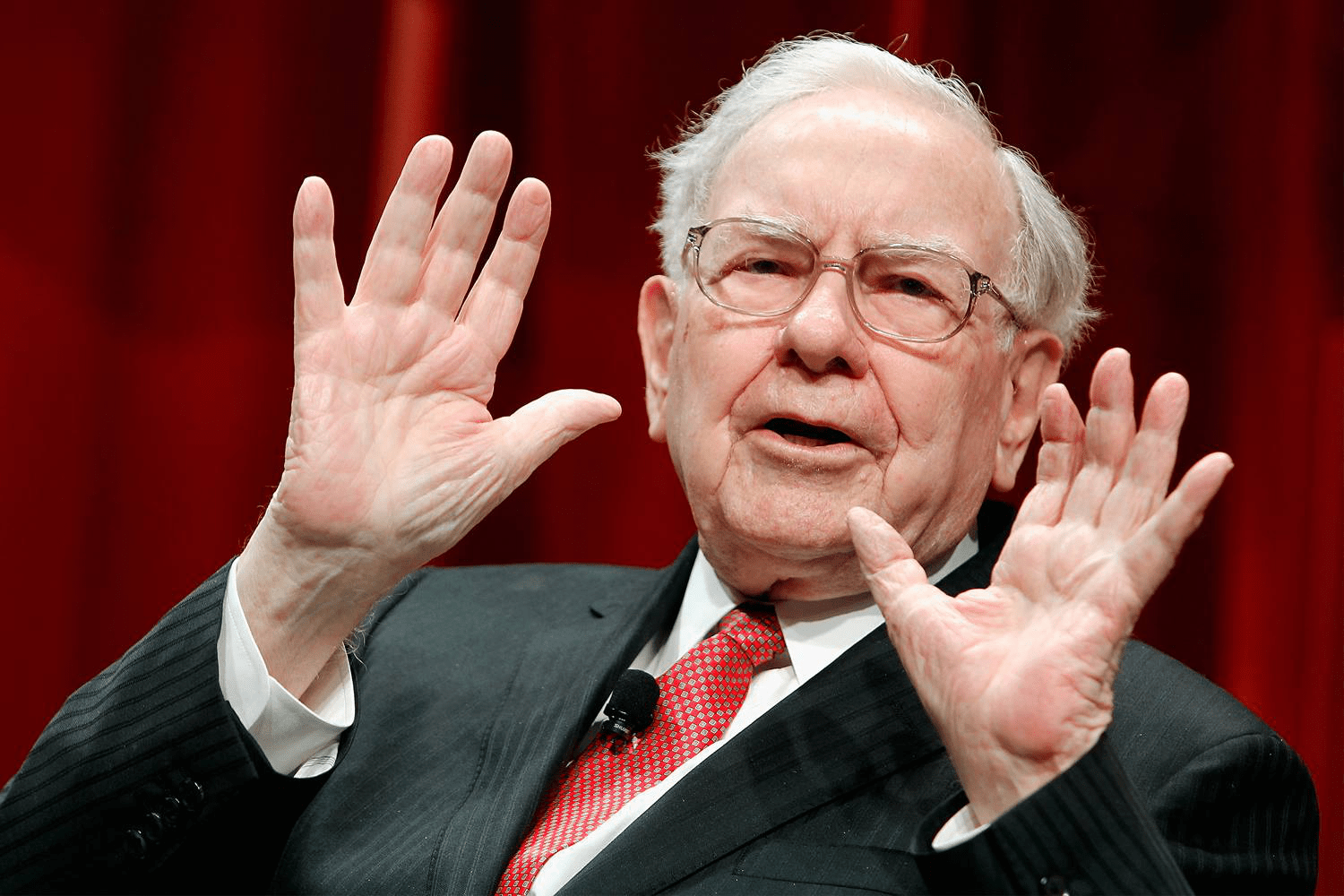

Berkshire Hathaway’s Chairman Warren Buffett, who once proudly highlighted his newspaper assets, is now making a strategic exit by selling them to Lee Enterprises.

Warren Buffett, famously known as the Oracle of Omaha and one of the most accomplished investors of our time, has long celebrated his extensive print newspaper holdings during annual shareholder meetings. Despite the broader industry's ongoing struggles with declining readership and profits, Buffett maintained confidence in his media investments. However, the landscape is shifting dramatically. Berkshire Hathaway Inc. (BRK.A) has agreed to transfer its newspaper assets to Lee Enterprises Inc. (LEE) for $140 million in cash, marking Buffett’s full withdrawal from the newspaper sector. This deal encompasses Berkshire’s media division, BH Media Group (BHMG), which manages 30 daily newspapers and their digital platforms, over 49 paid weekly publications with online presence, and 32 additional print products. Additionally, Lee will acquire The Buffalo News, a separately owned Berkshire title.

As part of the agreement, Berkshire is providing Lee Enterprises with approximately $576 million in long-term financing, maturing in 25 years, at an annual interest rate of 9%. This loan will fund the acquisition, refinance roughly $400 million of Lee’s existing debt, and position Berkshire as Lee’s exclusive lender.

Investor Impact

Buffett’s decision to divest aligns with mounting investor pressure on Berkshire to improve its stock performance, which has notably underperformed the broader market recently. Lee Enterprises’ shares have declined over the past year and five years, reflecting the ongoing challenges facing the newspaper industry.

Key Highlights

- Berkshire Hathaway is offloading its newspaper assets to Lee Enterprises.

- Lee has already been managing most of these publications on Berkshire’s behalf.

- Berkshire is financing the purchase and will serve as Lee’s sole creditor.

Details of the Lee-Berkshire Transaction

Since July 2018, Lee Enterprises has operated Berkshire’s newspaper properties through BHMG. In 2019, BHMG generated $373.4 million in revenue and an adjusted EBITDA of $47.4 million.

The sale excludes cash, real estate, and permanently affixed equipment owned by BHMG. Instead, Lee will enter a 10-year lease agreement for BHMG’s real estate assets, paying $8 million annually in monthly installments. Lee will also assume responsibility for all ongoing operational and maintenance expenses related to these properties. Lease payments may be reduced if any properties are sold during the lease term.

Lee Enterprises Doubles Down on Print Media

Upon closing, Lee Enterprises will increase its daily newspaper portfolio from 50 to 81 titles, nearly doubling its readership base. Lee also publishes over 200 weekly and specialty periodicals across 50 markets in 20 states. The combined daily print audience for Lee’s newspapers currently averages around 3 million readers.

Lee anticipates boosting revenue by 87% and adjusted EBITDA by 40%, while reducing leverage to 3.4 times pre-synergies. Management expects cost savings and revenue enhancements from synergies to eventually total between $20 million and $25 million annually. Additionally, Berkshire’s financing is projected to lower Lee’s annual interest expenses by approximately $5 million.

Although Buffett once described himself as a newspaper “addict” and expressed interest in expanding his holdings as recently as 2012, by 2019 he had grown pessimistic about the industry, stating that most newspapers are effectively “toast.”

Future Outlook

The Berkshire-Lee deal awaits regulatory approval. While concerns about media ownership concentration exist, the struggling state of the newspaper business makes consolidation an economic necessity.

For news tips, contact Investopedia reporters at tips@investopedia.comDiscover engaging topics and analytical content in Company News as of 04-02-2020. The article titled " Why Warren Buffett Is Divesting His Newspaper Portfolio " provides new insights and practical guidance in the Company News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Why Warren Buffett Is Divesting His Newspaper Portfolio " helps you make smarter decisions within the Company News category. All topics on our website are unique and offer valuable content for our audience.