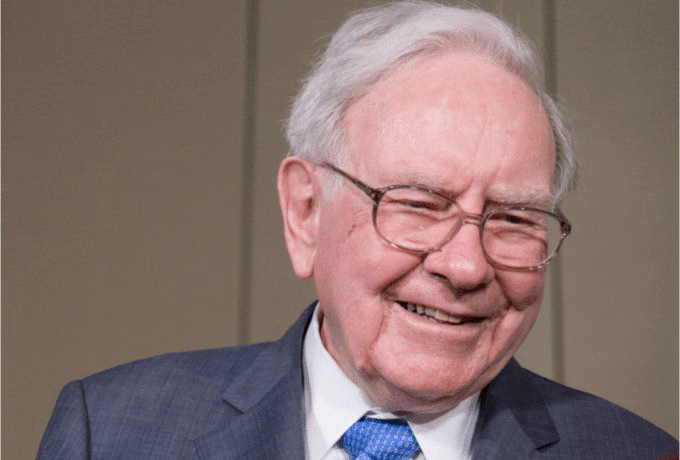

Warren Buffett’s Top 3 Stock Investing Rules in 2025: Insights & Portfolio Value

Discover Warren Buffett’s timeless investing principles that powered Berkshire Hathaway’s 19.8% annual growth from 1965 to 2022. Learn how his strategies can help you achieve profitable stock investments today.

Thomas J Catalano, a Certified Financial Planner and Registered Investment Adviser in South Carolina, founded his financial advisory firm in 2018. His expertise spans investments, retirement planning, insurance, and comprehensive financial strategies.

In 2018, CNBC analyzed decades of Warren Buffett’s public statements to decode the secrets behind his extraordinary investing success. They identified three fundamental rules Buffett follows when selecting stocks.

These core principles are:

- Invest only within your circle of competence.

- Approach stock purchases as if buying an entire business.

- Acquire stocks at undervalued prices to maintain a margin of safety.

From 1965 to 2017, Berkshire Hathaway’s shares produced an average annual compound return of 20.9%, more than twice the 9.9% return of the S&P 500 Index. This translated into Berkshire’s cumulative gains being 155 times greater than the S&P 500 over that period.

Keep reading to explore Buffett’s three best investment rules in detail.

Key Highlights

- Warren Buffett’s insights offer invaluable guidance for investors.

- His three essential stock buying rules have driven Berkshire Hathaway’s stellar returns.

- Investing within your expertise ensures better understanding and decision-making.

- Focus on the business fundamentals rather than short-term market fluctuations.

- Buffett champions value investing, seeking bargains with intrinsic worth.

1. Invest Within Your Circle of Competence

Buffett emphasizes investing only in businesses you thoroughly understand. Before buying, ensure you grasp how the company operates, generates profits, and sustains its business model long-term. He described this as staying within your "circle of competence" during Berkshire’s 1999 annual meeting.

While Buffett avoided many tech stocks due to unfamiliarity, he made an exception for Apple Inc., gradually increasing Berkshire’s stake to 5.8% of outstanding shares by June 2023, with Apple representing half of the portfolio.

2. Buy Stocks as If Buying a Business

Inspired by Benjamin Graham’s "The Intelligent Investor," Buffett views stock purchases as buying ownership in a business, not just trading volatile price movements. As he stated in the 2002 annual meeting, investors should ignore short-term market noise and focus on the company’s long-term performance.

This mindset helps investors remain patient and avoid reacting emotionally to market fluctuations.

3. Maintain a Margin of Safety

Buffett learned from Graham the importance of buying stocks at prices significantly below their intrinsic value. This margin of safety helps protect investors from downside risk if their valuations are off or unexpected problems arise.

Estimating intrinsic value requires rigorous fundamental analysis of company data, industry trends, and economic conditions. Buffett’s exceptional skill lies in consistently making accurate value assessments.

Impressive Returns

Between 1964 and 2022, Berkshire Hathaway’s total return soared an astounding 3,787,464%, compared to 24,708% for the S&P 500 with dividends reinvested.

Additional Buffett Wisdom

Avoid Headlines

For most investors without Buffett’s analytical edge, the safest strategy is to invest in the long-term growth of the U.S. economy and stock market. Buffett advises ignoring daily headlines and market noise, likening a stock index fund investment to owning a farm.

A $10,000 investment in an index fund in 1942 would have grown to over $51 million by 2018 with dividends reinvested.

Seize Opportunities Fully

Buffett famously said, "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble." Investors should capitalize on strong opportunities by investing as much as possible since such chances are rare.

Temperament Over Intelligence

Successful investing requires a calm mindset amidst market frenzy. Avoid herd mentality and emotional decisions. Focus on objective analysis of company fundamentals to make informed choices.

Tip

Explore Investopedia's "10 Rules of Investing" for more expert guidance by checking out their special print edition.

Buffett’s Biggest Winners (As of March 2023)

Top performers in Berkshire Hathaway’s portfolio include:

- Coca-Cola (KO): Cost $1.3B, Market Value $24.8B

- American Express (AXP): Cost $1.3B, Market Value $24.0B

- Moody's (MCO): Cost $248M, Market Value $7.5B

- Apple (AAPL): Cost $30-35B, Market Value $151B

Buffett’s Notable Losers (Year-to-Date 2022)

- Snowflake (SNOW): -58.4%, Unrealized Loss $1.21B

- Nu Holdings (NU): -55%, Unrealized Loss $553M

- RH (RH): -48.7%, Unrealized Loss $616M

- Floor & Decor Holdings (FND): -45.5%, Unrealized Loss $282M

What Does Buffett Look for When Choosing Stocks?

He evaluates company performance, return on equity, debt levels relative to equity, profit margins, product uniqueness, and competitive advantages.

Does Buffett Own All of Berkshire Hathaway?

Warren Buffett owns 15.6% of Berkshire Hathaway’s shares and controls 31.5% of voting rights, making him the largest shareholder.

When Did Buffett Start Investing?

Buffett bought his first stock at age 11 in March 1942.

Final Thoughts

Warren Buffett’s decades of shared wisdom and proven track record highlight the power of disciplined investing. His key rules—staying within your expertise, thinking like a business owner, and buying with a margin of safety—have generated extraordinary wealth for Berkshire Hathaway shareholders.

As of September 22, 2023, Berkshire Hathaway’s stock price stood at $550,341 per share, a testament to Buffett’s investment mastery and the strength of the companies he backs.

Discover the latest news and current events in Business Leaders as of 27-09-2023. The article titled " Warren Buffett’s Top 3 Stock Investing Rules in 2025: Insights & Portfolio Value " provides you with the most relevant and reliable information in the Business Leaders field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Warren Buffett’s Top 3 Stock Investing Rules in 2025: Insights & Portfolio Value " helps you make better-informed decisions within the Business Leaders category. Our news articles are continuously updated and adhere to journalistic standards.