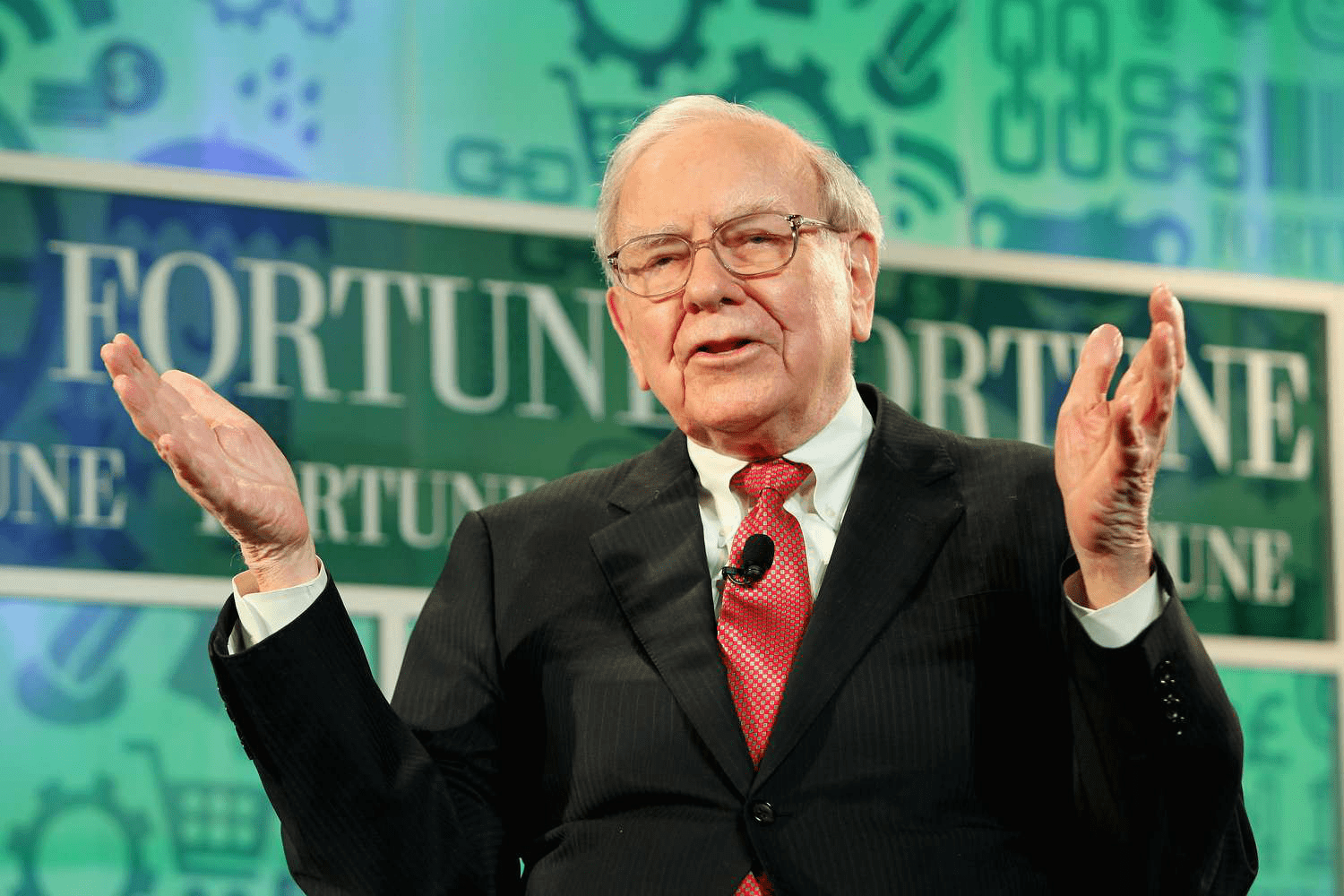

Warren Buffett's 2025 Move: Capital One Purchase at $954M & BNY Mellon Exit

In a strategic 2025 shift, Warren Buffett's Berkshire Hathaway invests nearly $1 billion in Capital One while divesting from BNY Mellon and US Bancorp amidst banking sector changes.

In the first quarter of 2024, Warren Buffett’s Berkshire Hathaway made significant adjustments to its banking portfolio, signaling confidence in Capital One by acquiring shares worth $954 million. This move comes amid ongoing turbulence in the banking industry.

Capital One, based in Virginia, responded positively with its stock climbing over 3% following the announcement. Meanwhile, Berkshire Hathaway exited its $1.14 billion stake in BNY Mellon and sold off its $290 million holding in US Bancorp, indicating a strategic reallocation of assets.

Highlights of Berkshire Hathaway’s Recent Transactions

- New substantial investment in Capital One and Diageo revealed in Berkshire’s 13F filing.

- Reduction of stakes in energy giant Chevron by 20% and automotive leader General Motors by 19%.

- Exit from Taiwan Semiconductor’s ADR shares, despite acknowledging its global significance.

Apple Inc. remains Berkshire Hathaway’s largest equity holding, praised by Buffett for its unparalleled business model and loyal customer base, particularly the iPhone's strong market presence.

Additionally, Berkshire expanded its portfolio by acquiring shares in UK-based beverage company Diageo, reflecting diversification beyond traditional sectors.

Buffett expressed caution regarding investments in Taiwan Semiconductor due to geopolitical tensions, favoring Japanese holdings for their stability. Other major investment firms, including Macquarie Group, Fidelity, and Tiger Global, capitalized on Berkshire’s exit by increasing their positions in the chipmaker.

These portfolio adjustments underscore Buffett’s adaptive investment strategy in 2024, balancing risk and opportunity amid a shifting global economic landscape.

Explore useful articles in Company News as of 21-05-2023. The article titled " Warren Buffett's 2025 Move: Capital One Purchase at $954M & BNY Mellon Exit " offers in-depth analysis and practical advice in the Company News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Warren Buffett's 2025 Move: Capital One Purchase at $954M & BNY Mellon Exit " article expands your knowledge in Company News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.