Mortgage Rates 2023: 15-Year, FHA 30-Year & Jumbo 30-Year Hit 20-Year Highs

Explore the latest mortgage rate trends in 2023 as 15-year, FHA 30-year, and jumbo 30-year loans reach record highs not seen in over two decades. Learn how these rates impact your home financing options and what to expect moving forward.

Mortgage Rate Update - September 27, 2023

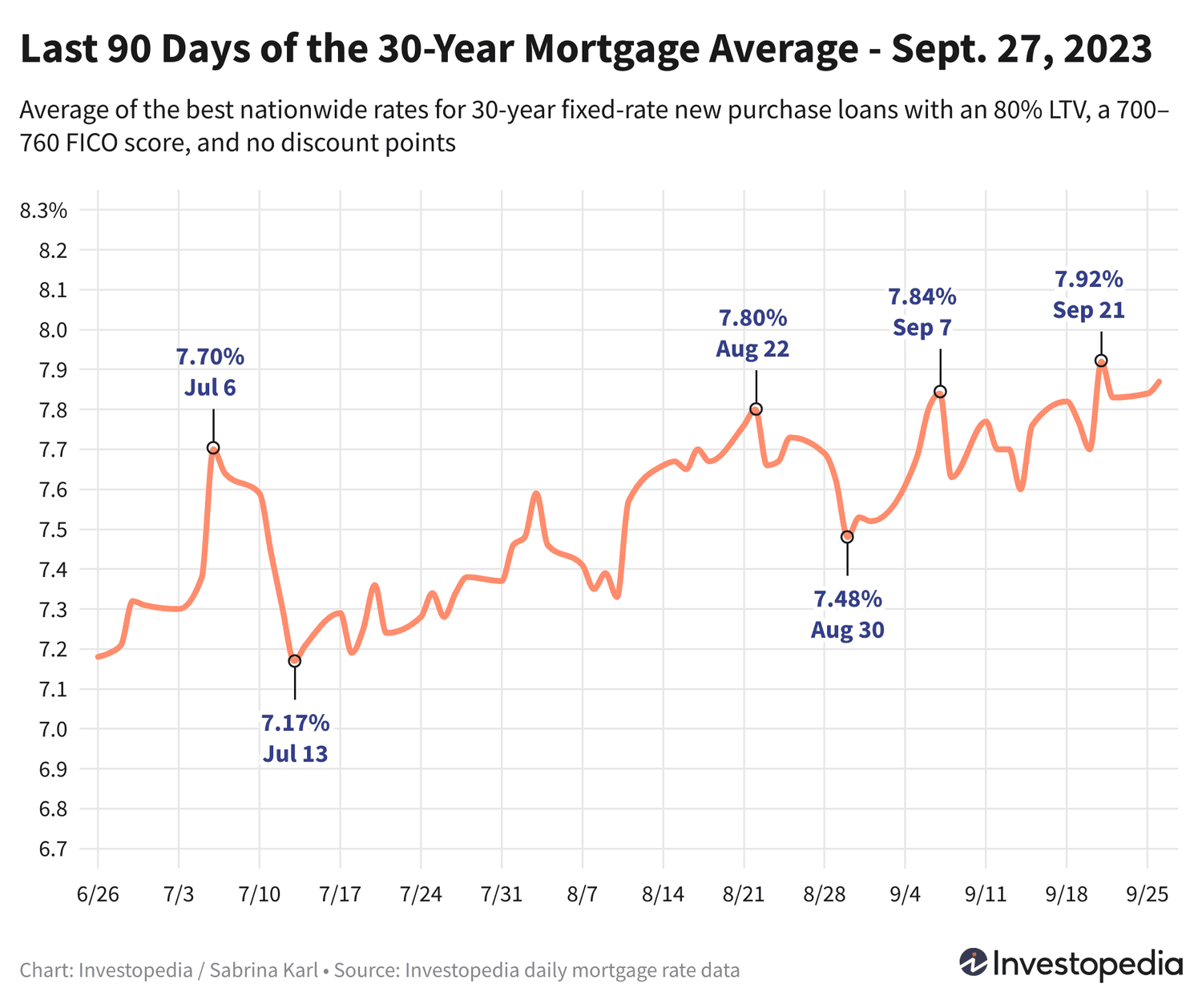

Mortgage averages for 15-year, FHA 30-year, and jumbo 30-year loans have surged to their highest levels in over 20 years, signaling a significant shift in the home financing landscape. The FHA 30-year mortgage rate notably spiked on Tuesday, joining the 15-year and jumbo 30-year rates that reached their peaks earlier in the week. Meanwhile, the 30-year conventional fixed-rate loan remains just below its highest point in 22 years.

The current average for a 30-year fixed-rate mortgage stands at 7.87%. Given the wide variation in rates offered by different lenders, it’s crucial for borrowers to shop around frequently to secure the most favorable mortgage terms.

Current Mortgage Rate Averages for New Purchases

On Tuesday, rates for 30-year new purchase loans increased by 3 basis points, reaching 7.87%. This figure is just 5 basis points shy of the historic peak of 7.92% recorded last Thursday, marking the highest rate since 2001.

The FHA 30-year mortgage rate saw a significant jump of 19 basis points to 7.88%, hitting a two-decade high. This sharp rise reflects ongoing market volatility and lender adjustments.

Important Notes

Freddie Mac’s weekly mortgage averages reported a 22-year high for 30-year rates at 7.23% in late August 2023; however, their methodology differs as they calculate weekly averages including loans with discount points. In contrast, the daily averages presented here reflect zero-point loans, providing a more immediate snapshot of rate movement.

Meanwhile, 15-year mortgage rates remain steady at 7.18%, the highest in 21 years. Jumbo 30-year loan rates also continue to hover at historic peaks, currently estimated at 7.15%, marking the highest levels in two decades or more.

Some mortgage categories saw slight declines on Tuesday: the 7/6 adjustable-rate mortgage (ARM) dropped by 10 basis points, while the 10/6 ARM and FHA 15-year loans decreased by 5 and 4 basis points respectively.

Refinancing Rate Trends

Refinancing rates moved differently compared to new purchase rates on Tuesday. The 30-year refinance average dipped slightly, narrowing the spread between refinance and new purchase rates to 25 basis points. The 15-year refinance rate also declined by 2 basis points, while jumbo 30-year refinance rates held steady.

However, refinancing rates for FHA 30-year, 5/6 ARM, and jumbo 7/6 ARM loans surged by 13 to 15 basis points, indicating increased market volatility in these segments.

Use our Mortgage Calculator to estimate monthly payments across various loan scenarios and better plan your finances.

What You Should Know

Displayed mortgage rates represent averages and may differ from promotional teaser rates advertised online, which often apply to borrowers with excellent credit or require upfront points. Your actual mortgage rate will depend on personal factors like credit score, income, and loan size.

State-by-State Lowest Mortgage Rates

Mortgage rates vary by state due to differences in borrower credit profiles, loan types, and lender risk strategies. Currently, Vermont, Delaware, Mississippi, and North Dakota offer the lowest 30-year purchase mortgage rates, while Arizona, Georgia, Minnesota, and Nevada report the highest.

Factors Influencing Mortgage Rate Changes

Mortgage rates are shaped by a complex mix of economic and industry dynamics, including:

- Movements in the bond market, especially 10-year Treasury yields

- The Federal Reserve’s monetary policies, including bond purchases and interest rate adjustments

- Competitive pressures among lenders and loan products

Due to the interplay of these factors, pinpointing a single cause for rate fluctuations is challenging.

In 2021, aggressive Federal Reserve bond-buying programs helped keep mortgage rates relatively low. However, starting in November 2021, the Fed began tapering these purchases, ending them by March 2022. Subsequently, the Fed raised benchmark interest rates multiple times to combat inflation, indirectly pushing mortgage rates higher.

Looking ahead to the remaining 2023 Fed meetings on November 1 and December 13, further rate hikes remain possible, potentially impacting mortgage rates again.

Methodology

The mortgage rate averages presented are based on the lowest rates offered by over 200 leading lenders nationwide, assuming an 80% loan-to-value ratio and a borrower credit score between 700 and 760. These averages reflect realistic quotes borrowers can expect, rather than promotional teaser rates.

State-specific lowest rates are similarly derived under these parameters, providing localized insights into mortgage cost variations.

Discover engaging topics and analytical content in Personal Finance News as of 02-10-2023. The article titled " Mortgage Rates 2023: 15-Year, FHA 30-Year & Jumbo 30-Year Hit 20-Year Highs " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Mortgage Rates 2023: 15-Year, FHA 30-Year & Jumbo 30-Year Hit 20-Year Highs " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.