2023 Mortgage Rates: 30-Year Loans Steady Below Peak, 15-Year Rates Reach Record High

Explore the latest mortgage rate trends for 2023, with 30-year fixed rates holding steady under recent peaks and 15-year averages hitting new highs. Discover state-by-state variations and factors influencing these rates.

Mortgage Rate Update - September 26, 2023

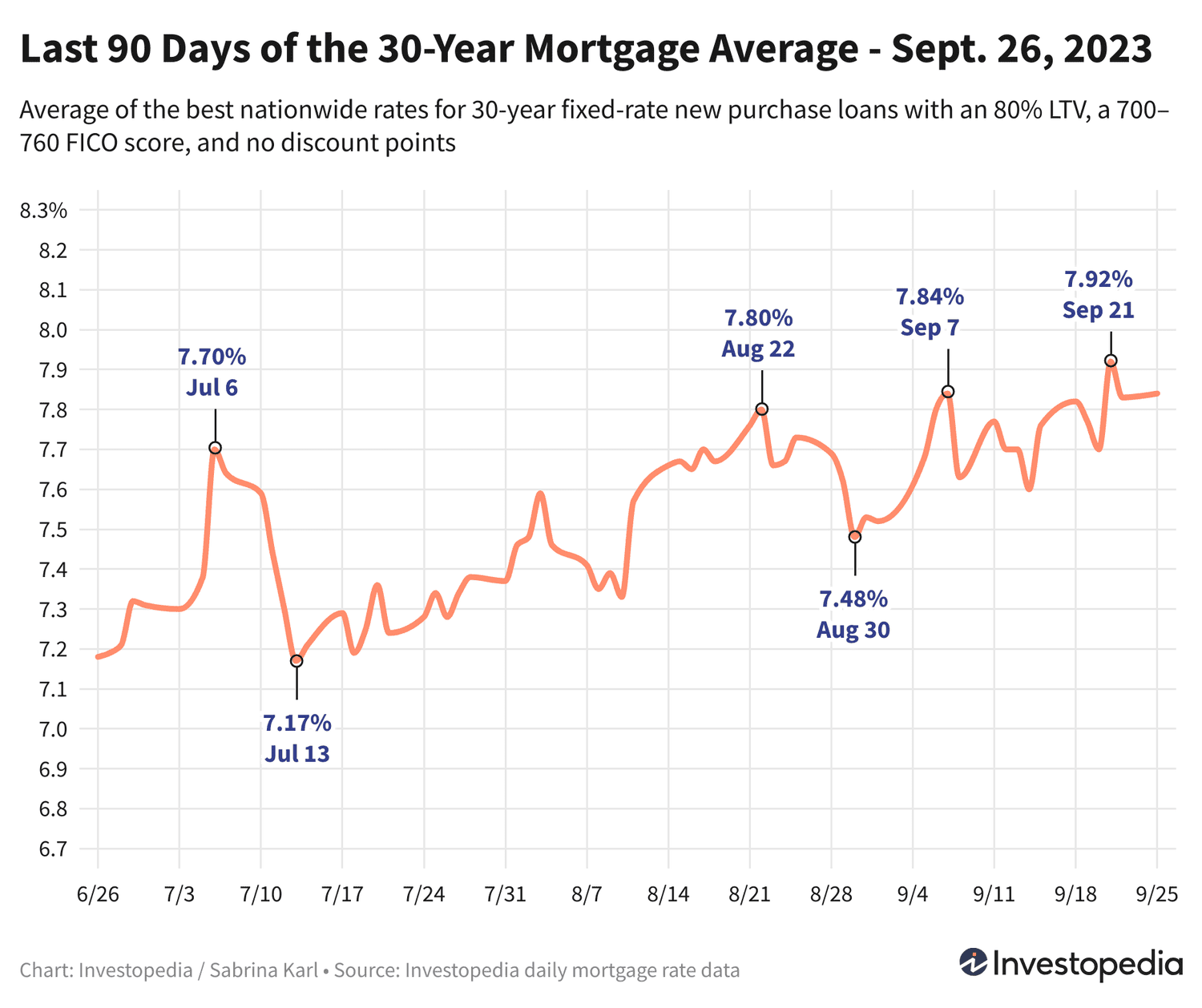

Following a slight decrease of nearly 0.10% last Friday from a historic 22-year peak, the 30-year fixed mortgage rate has stabilized at the start of the week. While most mortgage averages remained consistent on Monday, the 15-year fixed rate climbed to a new 21-year high.

The current average for 30-year fixed-rate mortgages stands at 7.84%. Since rates vary significantly among lenders, it's essential to shop around and compare offers regularly to secure the best mortgage terms regardless of loan type.

Current Mortgage Rate Averages for New Purchases

On Monday, 30-year new purchase mortgage rates inched up by 0.01%, reaching an average of 7.84%. This remains 0.08% below Thursday's record high of 7.92%, marking the highest rate since at least 2001.

Key Insight

Freddie Mac reported a 22-year high mortgage average of 7.23% on August 24, 2023, the highest since June 2001. Our daily averages differ slightly due to methodology variations, including Freddie Mac's weekly blend of rates and inclusion of loans with discount points, whereas our data reflects daily zero-point loan averages.

The 15-year fixed mortgage rate also increased by 0.01% on Monday, setting a new 21-year record at 7.18%.

Jumbo 30-year mortgage rates rebounded by 0.13% on Monday, returning to Thursday’s record high of 7.15%. Although daily jumbo rate data is limited before 2009, this is likely the highest level in over two decades.

Additional changes include an 0.08% rise in 20-year mortgage rates and a 0.12% increase for jumbo 5/6 adjustable-rate mortgages (ARMs). Conversely, VA 30-year and 5/6 ARM rates decreased by 0.06%.

Refinancing Rate Trends

Refinancing rates mirrored the new purchase trends on Monday. The 30-year refinance average rose by 0.01%, maintaining a 0.32% spread compared to new purchase rates. The 15-year refinance rate remained relatively unchanged, while jumbo 30-year refinance rates increased by 0.13%.

The most notable change was an 0.18% jump in 20-year refinance rates, contrasted by a 0.13% decline in 5/6 ARM refinance rates.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios.

Important Considerations

The mortgage rates presented are averages and typically differ from advertised teaser rates, which often feature selective criteria such as upfront points or borrowers with exceptional credit scores. Your actual mortgage rate depends on personal factors including creditworthiness and income.

State-by-State Lowest Mortgage Rates

Mortgage rates vary by state due to differences in credit profiles, loan types, and lender risk strategies. As of Thursday, Vermont, Delaware, Mississippi, and Wisconsin offered the lowest 30-year new purchase rates, while Arizona, Georgia, Minnesota, Nevada, and Oregon reported the highest.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are shaped by multiple interconnected factors, including:

- Movements in the bond market, especially 10-year Treasury yields

- The Federal Reserve's monetary policies, particularly bond purchases affecting government-backed loans

- Competitive dynamics among lenders and loan products

These elements often interact simultaneously, making it challenging to attribute rate changes to a single cause.

Throughout much of 2021, mortgage rates remained relatively low due to the Federal Reserve's extensive bond-buying program responding to pandemic-induced economic challenges. However, from November 2021, the Fed began tapering these purchases, ceasing them entirely by March 2022.

Since then, the Fed has aggressively increased the federal funds rate to combat high inflation, cumulatively raising it by 5.25% over 18 months. While the federal funds rate indirectly influences mortgage rates, their movements can occasionally diverge.

Two additional Fed rate-setting meetings are scheduled for November 1 and December 13, 2023. Though outcomes remain uncertain, Fed Chair Jerome Powell has indicated a possible rate hike at either meeting.

Methodology

The national mortgage rate averages are based on the lowest rates offered by over 200 top lenders nationwide, assuming an 80% loan-to-value (LTV) ratio and a borrower credit score between 700 and 760. These averages reflect realistic rate quotes rather than promotional teaser rates.

State-level lowest rates are similarly derived from surveyed lenders under the same assumptions.

Discover engaging topics and analytical content in Personal Finance News as of 01-10-2023. The article titled " 2023 Mortgage Rates: 30-Year Loans Steady Below Peak, 15-Year Rates Reach Record High " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 2023 Mortgage Rates: 30-Year Loans Steady Below Peak, 15-Year Rates Reach Record High " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.