2025 30-Year Mortgage Rates Rise to 7.44%, Jumbo Loans Hit 3-Month High at 6.95%

Explore the latest trends in 30-year mortgage rates for 2025, including a slight increase to 7.44% and jumbo loan rates climbing to a three-month peak. Learn how rates vary by loan type and state, and get expert tips on securing the best mortgage deals today.

Updated Mortgage Rates & Trends – February 28, 2024

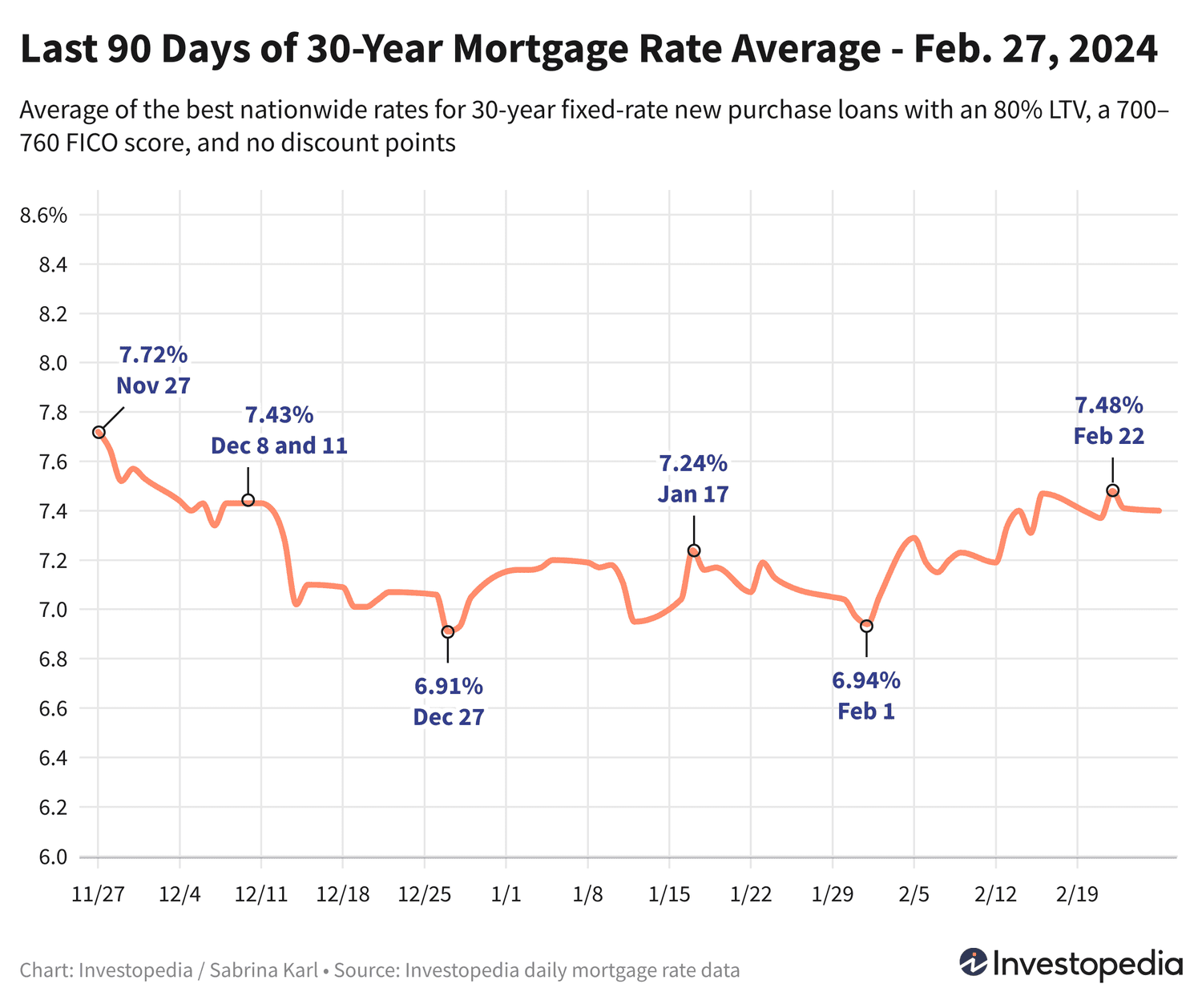

30-year fixed mortgage rates inched up slightly on Tuesday, averaging 7.44%, maintaining a level just below last week's nearly three-month high. Jumbo 30-year mortgage rates surged to 6.95%, marking their highest point in three months. Most other loan categories remained relatively stable.

Because mortgage rates can differ significantly among lenders, it’s crucial to compare offers regularly to find the best fit for your home financing needs.

Current 30-Year Mortgage Rates for New Home Purchases

After peaking at 7.48% last week—the highest since December 1—30-year mortgage rates for new purchases have fluctuated slightly below that level. While rates dipped on Friday and Monday, Tuesday saw a modest increase of 0.04%, settling at 7.44%.

Although rates briefly fell into the 6% range earlier this month, the current average remains elevated. However, it is still well below the historic 23-year peak of 8.45% recorded in October 2023.

15-Year Mortgage Rate Update

Rates for 15-year fixed loans inched up by 0.01% to an average of 6.76%. This is approximately two-thirds of a percentage point higher than the seven-month low of 6.10% seen just before the new year. Last October, 15-year rates peaked at 7.59%, the highest since 2000.

Jumbo 30-Year Mortgage Rates Reach New Heights

Jumbo 30-year mortgage rates jumped by 0.125% to 6.95%, the highest since November 15, 2023. While historical jumbo rate data before 2009 is limited, the 7.52% peak in October 2023 likely represents the highest jumbo 30-year average in over two decades.

Other loan categories mostly saw minimal changes, except VA 30-year loans, which decreased by 0.27%, and FHA 30-year rates, which increased by 0.16%.

Freddie Mac Weekly Mortgage Rate Averages

Freddie Mac's weekly average for 30-year mortgages rose by 0.13% last week, reaching 6.90%. This is down significantly from the 23-year high of 7.79% seen in late October 2023, and above the mid-January low of 6.60%.

Freddie Mac’s weekly averages differ from daily averages like ours because they include loans with discount points and calculate a five-day blended rate, whereas our data reflects zero-point loans daily.

Refinancing Rates Overview

Refinance rates were mostly stable on Tuesday. The 30-year refinance average dropped slightly by 0.02%, narrowing the gap between purchase and refinance rates to 0.41%. The 15-year refinance rate rose by 0.04%. Jumbo 30-year refinance rates climbed by 0.125%, mirroring the increase in purchase jumbo loans. FHA 30-year refinance rates saw the largest jump of 0.30%.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios.

Important Note

The mortgage rates presented here are averages and typically differ from advertised teaser rates, which may require upfront points or target borrowers with exceptional credit and smaller loan amounts. Your actual rate will depend on your credit profile, income, and other factors.

State-by-State Lowest Mortgage Rates

Mortgage rates vary by state due to differences in credit scores, loan types, sizes, and lender risk policies. The states offering the lowest 30-year purchase rates include Mississippi, Louisiana, Vermont, Hawaii, and Iowa. Conversely, Georgia, Minnesota, Tennessee, Alabama, and Oregon have the highest average rates.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are influenced by a complex mix of factors including:

- Movements in the bond market, especially 10-year Treasury yields

- The Federal Reserve's monetary policies, including bond purchases and mortgage funding

- Competition among lenders and loan products

Because multiple factors often act simultaneously, pinpointing a single cause for rate changes is challenging.

The Fed’s bond-buying during the pandemic helped keep rates low in 2021. However, starting in November 2021, tapering bond purchases and subsequent aggressive interest rate hikes—totaling a 5.25% increase over 16 months—have pushed mortgage rates higher.

The Fed has paused rate hikes since January 31, 2024, signaling a potential end to increases but cautioning that inflation remains elevated. Rate cuts are expected later in 2024, though timing remains uncertain.

How We Calculate Mortgage Rate Averages

Our national mortgage rate averages are derived from the lowest rates offered by over 200 top lenders, assuming an 80% loan-to-value ratio and a borrower credit score between 700 and 760. These averages represent realistic quotes borrowers can expect, distinct from promotional teaser rates.

State-level rate data reflects the lowest current offers under the same assumptions.

Explore useful articles in Personal Finance News as of 04-03-2024. The article titled " 2025 30-Year Mortgage Rates Rise to 7.44%, Jumbo Loans Hit 3-Month High at 6.95% " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " 2025 30-Year Mortgage Rates Rise to 7.44%, Jumbo Loans Hit 3-Month High at 6.95% " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.