Top CD Rates in 2025: Best 3-Month CD Drops to 5.42%, 6-Month CDs Yield Up to 5.75%

Explore the latest nationwide CD rates for 2025, featuring top yields up to 5.75% APY on 6-month terms and competitive rates across 1 to 5-year CDs. Secure your savings with high-yield certificates today.

Essential Highlights

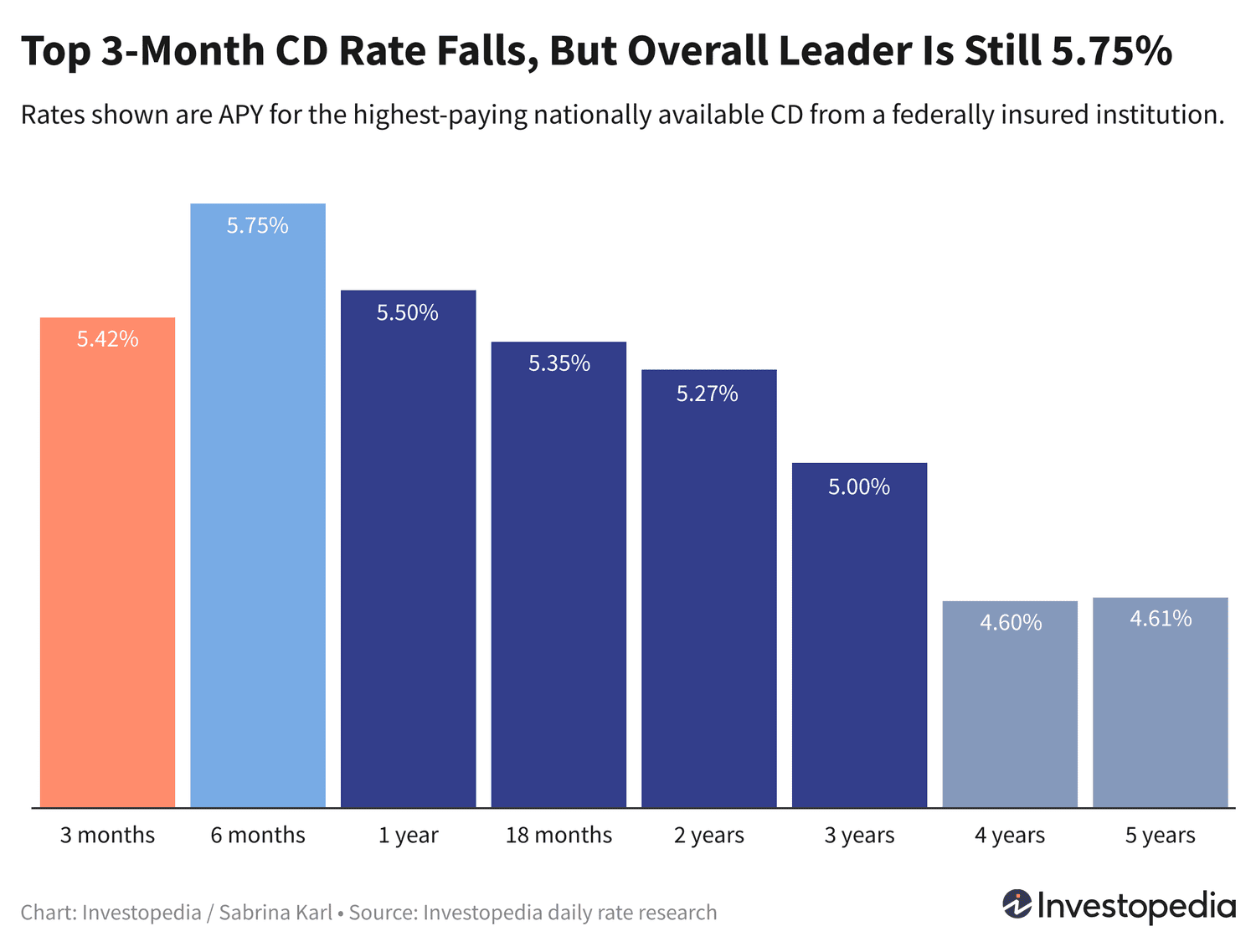

- The leading 3-month CD rate decreased to 5.42% APY, with TotalDirectBank remaining the term leader.

- Andrews Federal Credit Union continues as the overall rate champion, offering 5.75% APY on 6-month CDs.

- For jumbo deposits, Hughes Federal Credit Union provides a strong 5.65% APY on a 17-month term.

- CDs with multi-year rate guarantees of 5% or higher are still accessible for terms up to 3 years.

- While CD rates have softened recently, they remain historically high and may decline faster if the Federal Reserve signals rate cuts.

Discover today’s top CD rates nationwide, along with exclusive offers from our trusted partners.

High CD Rates Remain Attractive in 2024

After peaking at 6.50% in October, certificate of deposit (CD) rates have experienced a slight pullback. The premier 3-month CD rate dropped from 5.51% to 5.42% APY, yet other term rates held steady. Andrews Federal Credit Union leads with an impressive 5.75% APY on 6-month CDs.

For longer commitments, rates remain competitive: up to 5.50% APY for 1-year CDs, 5.35% for 18 months, and 5.27% APY for 2-year terms. CDs spanning 30 to 36 months offer 5.00% APY, while 4- and 5-year terms maintain solid mid-4% rates.

Although rates have gradually declined since November, the current offerings still surpass averages from the past two decades. Locking in a rate for a year or more can be a strategic move amid potential rate cuts in 2024.

Leading Bank, Credit Union, and Jumbo CD Rates

Hughes Federal Credit Union’s jumbo CD tops the chart with 5.65% APY on a 17-month term. Some jumbo rates have slightly decreased, such as the 2-year jumbo CD dropping from 5.11% to 5.10% APY.

Note that jumbo CDs don’t always yield more than standard CDs. Currently, standard CDs offer better returns in several terms, so comparing both options is advisable before deciding.

Outlook for CD Rates in 2024

The Federal Reserve has held interest rates steady since January 2024, following aggressive hikes from March 2022 through July 2023 to combat high inflation. This environment led to historically favorable CD rates and high yields on savings and money market accounts.

With inflation easing, the Fed is now considering the timing of its first rate cut, though Chair Jerome Powell emphasizes inflation remains above target. Recent economic data show mixed signals, causing markets to delay expectations for a rate cut until mid-2024 or later.

Consequently, CD rates are expected to remain stable or decline slightly until the Fed signals a rate reduction, at which point financial institutions may lower their rates more noticeably.

Current Best Rates for May 2025 Maturities

- High-Yield Savings Accounts: Up to 5.00%

- CDs: Up to 4.50%

- Money Market Accounts: Up to 4.40%

Important Information

The "top rates" highlighted represent the highest nationally available APYs identified through daily research across hundreds of banks and credit unions. These rates significantly exceed national averages, which include many institutions offering minimal interest.

How We Identify the Best CD Rates

Our team monitors rate data daily from over 200 federally insured banks and credit unions nationwide. To qualify, institutions must be FDIC or NCUA insured, offer CDs with minimum deposits not exceeding $25,000, and be accessible in at least 40 states. Credit unions requiring donations over $40 for membership are excluded. For complete details, please review our methodology.

Discover the latest news and current events in Personal Finance News as of 11-03-2024. The article titled " Top CD Rates in 2025: Best 3-Month CD Drops to 5.42%, 6-Month CDs Yield Up to 5.75% " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Top CD Rates in 2025: Best 3-Month CD Drops to 5.42%, 6-Month CDs Yield Up to 5.75% " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.