2023 Mortgage Rates Surge to $7.92% - Highest 30-Year Average in Over Two Decades

Mortgage rates have sharply increased, reaching a new 22-year peak for 30-year fixed loans at 7.92%. Discover how this impacts homebuyers and refinancers in 2023.

Mortgage Rate Update - September 22, 2023

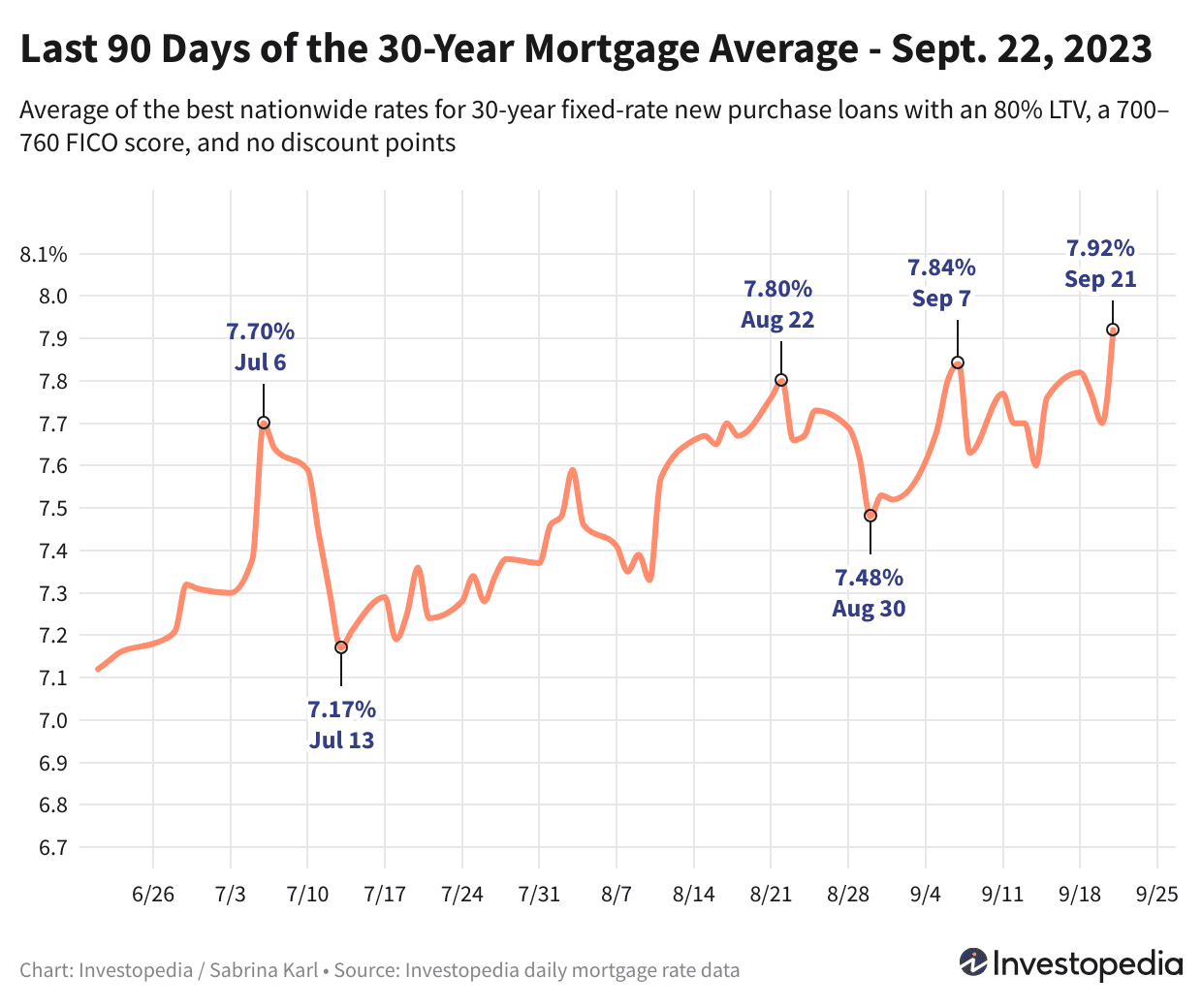

After a brief decline earlier this week, 30-year mortgage rates have rebounded dramatically, climbing nearly 0.25% to establish a new historic high. All mortgage categories saw increases, with most rising by double-digit basis points.

The current 30-year fixed mortgage rate average stands at 7.92%. Since lender rates vary widely, it’s essential for borrowers to shop around and compare offers regularly to secure the best deal.

Latest 30-Year Fixed Mortgage Rates for New Home Purchases

New purchase mortgage rates for 30-year loans jumped 22 basis points on Thursday, surpassing the previous 22-year record of 7.84% set on September 7. This 7.92% rate marks the highest level since at least 2001.

Important Note

Freddie Mac’s weekly mortgage averages, which include loans priced with discount points and blend five days of data, showed a 22-year high of 7.23% on August 24. Our daily averages focus on zero-point loans, explaining slight differences.

15-year mortgage rates also rose by 8 basis points, reaching a 21-year peak of 7.17% last seen on August 22. Jumbo 30-year mortgages climbed to 7.15%, setting a new historic high beyond the previous 7.02% peak.

Adjustable-rate mortgages (5/6 and 7/6 ARMs) saw minor increases, while other new purchase loan averages increased between 10 and 26 basis points.

Refinancing Mortgage Rate Trends

Refinance rates for 30-year loans surged by 30 basis points, widening the gap between refinance and new purchase rates to 38 basis points. Jumbo 30-year refinance rates increased by 13 basis points.

Refinance rates for 15-year loans rose modestly by 5 basis points, while most other refinance averages saw double-digit increases. The only exception was the 5/6 ARM refinance rate, which declined slightly by 2 basis points.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios.

Key Consideration

Displayed rates represent averages and generally differ from advertised teaser rates, which may require upfront points or assume ideal borrower profiles. Actual mortgage rates depend on individual credit scores, income, and loan specifics.

States with the Lowest Mortgage Rates

Mortgage rates vary by state due to differences in average credit scores, loan types, and lender risk strategies. On Thursday, Vermont, Delaware, Mississippi, North Dakota, and Rhode Island offered the lowest 30-year new purchase rates, while Arizona, Minnesota, Nevada, Georgia, Idaho, Oregon, and Washington reported the highest.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are shaped by a complex mix of economic and industry factors, including:

- Movements in the bond market, particularly 10-year Treasury yields

- The Federal Reserve’s monetary policies, including bond purchases and government-backed mortgage funding

- Competition among lenders and loan products

Multiple factors often interact, making it challenging to pinpoint a single cause for rate changes.

In 2021, the Fed's bond-buying program helped keep rates low amid pandemic pressures. However, starting November 2021, the Fed tapered these purchases, ending them by March 2022.

Since then, the Fed has aggressively raised the federal funds rate by 5.25% over 18 months to combat inflation. Although the fed funds rate doesn’t directly set mortgage rates, its rapid hike has indirectly pushed mortgage rates higher.

The Fed has two remaining rate decisions in 2023, on November 1 and December 13, with another increase possible.

How We Calculate These Averages

Our national averages derive from the lowest rates offered by over 200 top lenders, assuming an 80% loan-to-value ratio and a FICO score between 700 and 760. These figures reflect realistic quotes borrowers can expect, differing from promotional teaser rates.

State-level rates reflect the lowest currently available lender rates under the same assumptions.

Explore useful articles in Personal Finance News as of 27-09-2023. The article titled " 2023 Mortgage Rates Surge to $7.92% - Highest 30-Year Average in Over Two Decades " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " 2023 Mortgage Rates Surge to $7.92% - Highest 30-Year Average in Over Two Decades " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.