2023 Mortgage Rates Hit 20-Year High: 30-Year at 7.92%, 15-Year at 7.21%

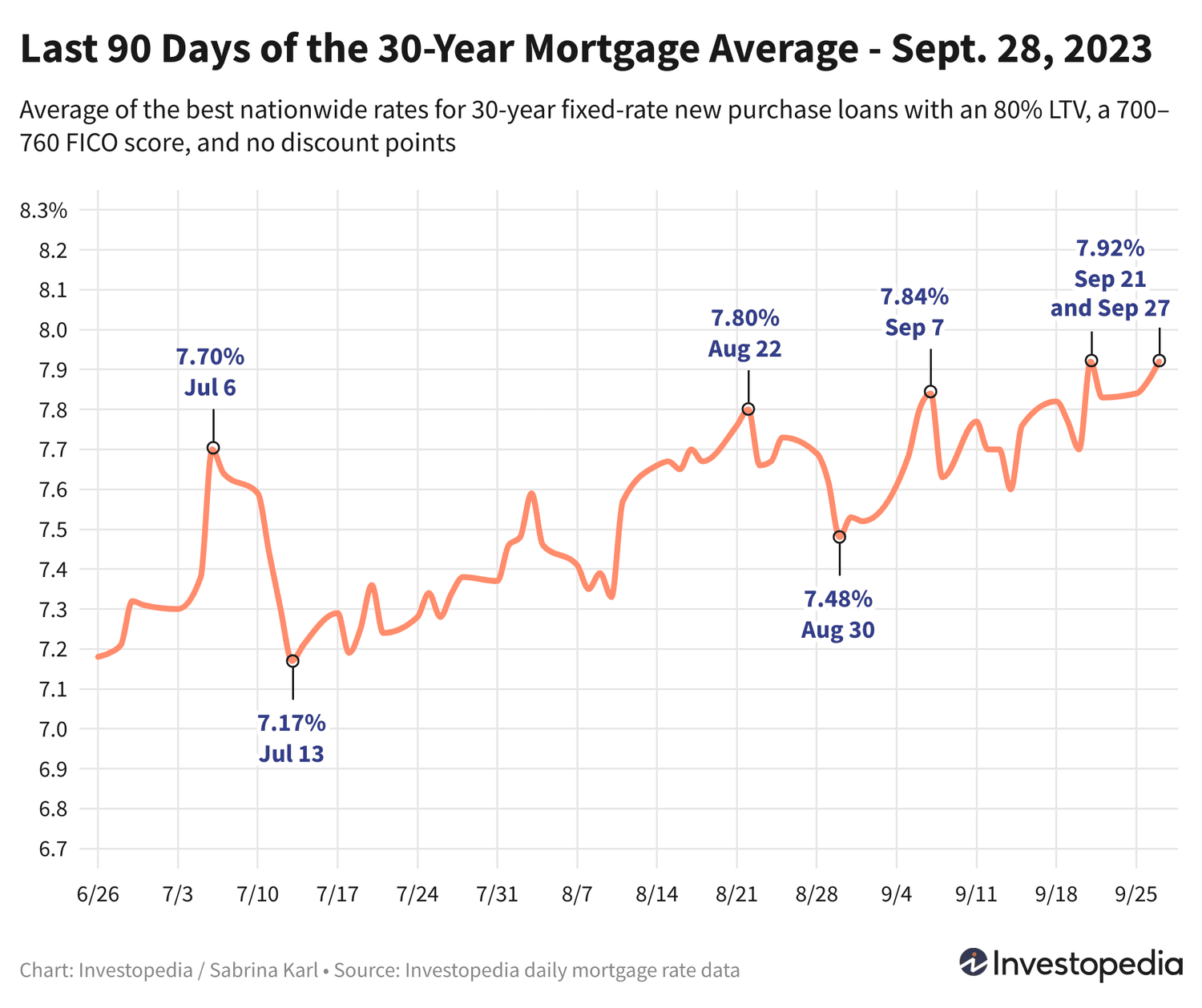

Mortgage rates for 30-year and 15-year loans have surged to their highest levels in over two decades, with 30-year fixed rates reaching 7.92% and 15-year fixed rates climbing to 7.21%. Explore the latest trends, state-by-state rate variations, and factors driving these historic highs.

Mortgage Rate Update – September 28, 2023

The average mortgage rates for 30-year fixed loans climbed again, reaching 7.92%, matching the highest point seen in over 22 years. Similarly, 15-year fixed mortgage rates rose to a new 21-year peak at 7.21%. Most other loan types remained steady, with minor fluctuations.

The 30-year fixed-rate average at 7.92% signals a challenging market for homebuyers and refinancers alike. Given the wide variance among lenders, it is crucial to shop around and compare rates regularly to secure the most favorable mortgage terms.

Current Mortgage Rate Averages for New Home Purchases

On Wednesday, 30-year new purchase mortgage rates increased by 5 basis points, reinforcing the 7.92% average—the highest since 2001. Meanwhile, FHA and VA 30-year rates experienced slight declines, with FHA rates pulling back from their recent 20-year peak.

Additional Insights

Freddie Mac’s latest weekly report confirms a 23-year high for 30-year fixed rates at 7.31%, slightly below the daily averages reported here due to methodological differences. Freddie Mac’s averages include loans with discount points and blend rates over five days, whereas these figures reflect daily zero-point loans.

Jumbo 30-year mortgage rates remain at historic highs around 7.15%, marking the priciest levels in two decades. Adjustable-rate mortgages (ARMs), particularly jumbo 7/6 ARMs, saw notable declines, dropping 12 basis points.

Refinancing Rate Trends

Refinancing rates showed mixed movement. The 30-year refinance average jumped 16 basis points, expanding the gap to 36 basis points above new purchase rates. The 15-year refinance average rose by 14 basis points, while jumbo 30-year refinance rates held steady. Adjustable-rate refinance mortgages decreased, with jumbo 7/6 ARMs dropping by 13 basis points.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios and plan your finances effectively.

Important Considerations

Displayed mortgage rates represent averages and generally do not match advertised teaser rates, which are often tailored to borrowers with exceptional credit or involve upfront points. Your actual mortgage rate will depend on factors such as credit score, income, loan size, and lender policies.

Lowest Mortgage Rates by State

Mortgage rates vary significantly by state due to differences in credit profiles, loan types, and lender risk strategies. The states with the lowest 30-year new purchase mortgage rates include Delaware, Vermont, Mississippi, North Dakota, South Dakota, Wisconsin, and Wyoming. Conversely, Arizona, Georgia, Nevada, Idaho, Minnesota, and Oregon report the highest averages.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are shaped by a complex mix of economic and industry factors including:

- Bond market trends, particularly 10-year Treasury yields

- Federal Reserve monetary policies, including bond purchases and interest rate decisions

- Competitive dynamics among lenders and loan products

Since late 2021, the Fed’s tapering of bond purchases and aggressive interest rate hikes to combat inflation have indirectly driven mortgage rates upward. The Fed’s benchmark rate has increased by 5.25% over 18 months, contributing to the rising cost of borrowing.

With two more Federal Reserve meetings scheduled before the end of 2023, further rate adjustments remain possible, potentially impacting future mortgage rates.

Methodology

The mortgage rate averages are calculated from quotes by over 200 leading lenders nationwide, based on an 80% loan-to-value ratio and borrowers with FICO scores between 700 and 760. These averages reflect realistic expectations for qualified borrowers and differ from promotional teaser rates.

State-level rate data represents the lowest current rates offered by lenders in each state under similar assumptions.

Discover the latest news and current events in Personal Finance News as of 03-10-2023. The article titled " 2023 Mortgage Rates Hit 20-Year High: 30-Year at 7.92%, 15-Year at 7.21% " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " 2023 Mortgage Rates Hit 20-Year High: 30-Year at 7.92%, 15-Year at 7.21% " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.