Arm Holdings Stock Price Analysis 2025: Key Support and Resistance Levels Amid Downgrade and Selloff

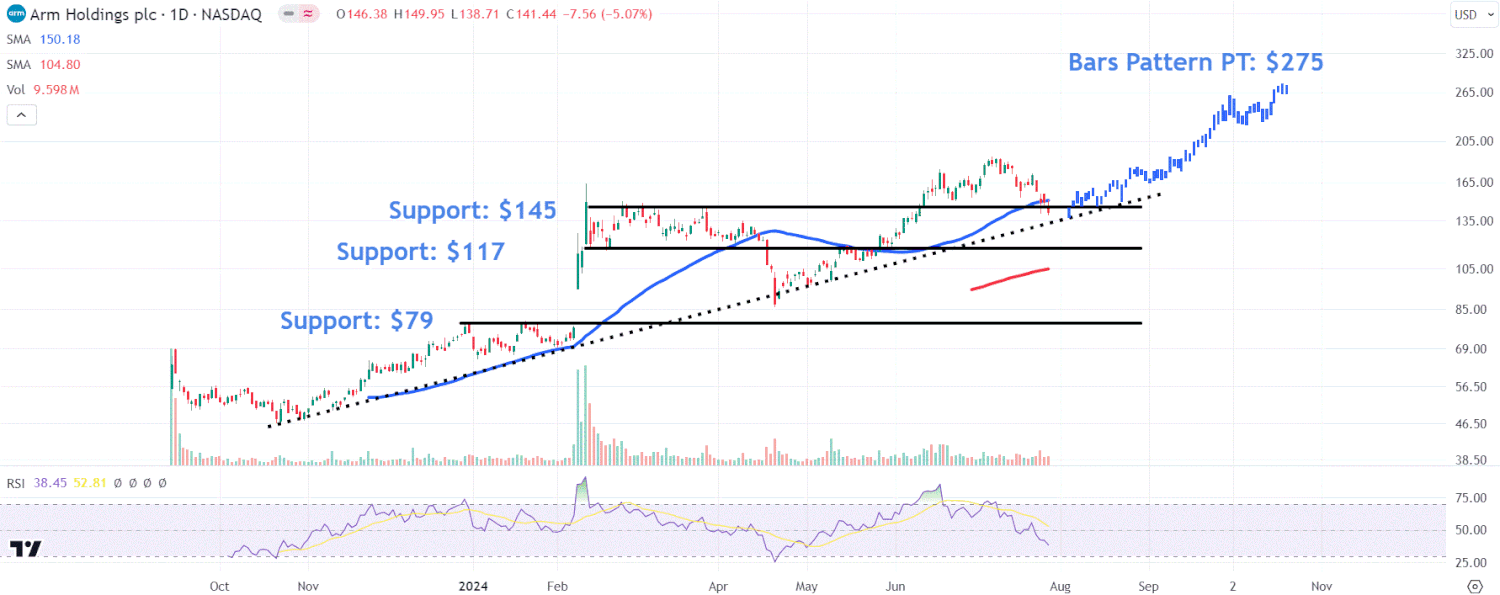

Explore the latest Arm Holdings (ARM) stock price movements in 2025 as shares drop over 5% following an HSBC downgrade. Discover critical support levels at $145, $117, and $79, and potential upside targets amid market volatility.

Arm Holdings Shares Have Declined Approximately 24% from This Month's Record Close

Important Highlights

- Arm Holdings shares plunged more than 5% on Monday after HSBC downgraded the stock, accelerating the pullback from its record high earlier in 2024.

- The stock has retraced around 24% from its peak, with relatively light trading volume suggesting a temporary correction rather than a full trend reversal.

- Key technical support levels to monitor include $145, $117, and $79, where buyers may step in.

- A bar chart pattern projecting from late April to early July indicates a potential price target near $275 if the uptrend resumes.

After reporting quarterly earnings following Wednesday’s close, Arm Holdings (ARM) experienced a sharp decline, shedding more than 5% on Monday after HSBC issued a downgrade. This move hastened the stock’s pullback from its recent record highs set earlier this month.

HSBC cited short-term earnings risks due to a possible slowdown in Android smartphone demand and a cooling artificial intelligence (AI) enthusiasm—both critical markets for the UK-based chip design leader. Additionally, the bank highlighted valuation concerns, noting Arm trades at a significant premium compared to its large-cap semiconductor peers after doubling in value over the past year.

During regular trading on Monday, Arm shares dropped 5.1%, followed by a further 0.8% decline in after-hours trading, closing near $140.25.

Light Volume Retracement Signals Potential Pullback

Since bottoming out roughly five weeks after its September 2023 IPO, Arm’s stock has predominantly trended upward. The recent 24% retracement from its all-time high is occurring on light volume, implying a corrective pullback rather than a sustained downtrend.

Critical Support Levels to Watch During Weakness

Investors should closely monitor three key price points that could provide support amid ongoing weakness:

- $145: The stock closed below this level on Monday. If buyers reclaim it alongside the 50-day moving average in coming sessions, it could signal a bear trap and pave the way for recovery, especially if the price holds above the uptrend line originating from late October 2023.

- $117: A break below $145 might lead to a test of $117, an area supported by historical horizontal resistance between February and May 2024.

- $79: A deeper correction could target this level, where bargain hunters may enter, attracted by previous price peaks before the early February breakout gap.

Monitoring the Relative Strength Index (RSI) alongside these levels is crucial, as oversold conditions could indicate a rebound or continuation of the uptrend.

Potential Upside Target if Momentum Returns

Should Arm shares regain upward momentum, a bar pattern analysis based on the stock’s movement from late April to early July projects a potential price target near $275.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Please consult a financial professional before making investment decisions.

As of this article's publication, the author holds no position in Arm Holdings.

For news tips, contact us at tips@investopedia.com.

Discover engaging topics and analytical content in Markets News as of 31-07-2024. The article titled " Arm Holdings Stock Price Analysis 2025: Key Support and Resistance Levels Amid Downgrade and Selloff " provides new insights and practical guidance in the Markets News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Arm Holdings Stock Price Analysis 2025: Key Support and Resistance Levels Amid Downgrade and Selloff " helps you make smarter decisions within the Markets News category. All topics on our website are unique and offer valuable content for our audience.