2025 Mortgage Rates Drop: 30-Year Fixed Hits 6.11%, Lowest Since February 2023

Explore the latest 2025 mortgage rate trends as 30-year fixed-rate loans reach a 19-month low at 6.11%, offering homebuyers more affordable financing options.

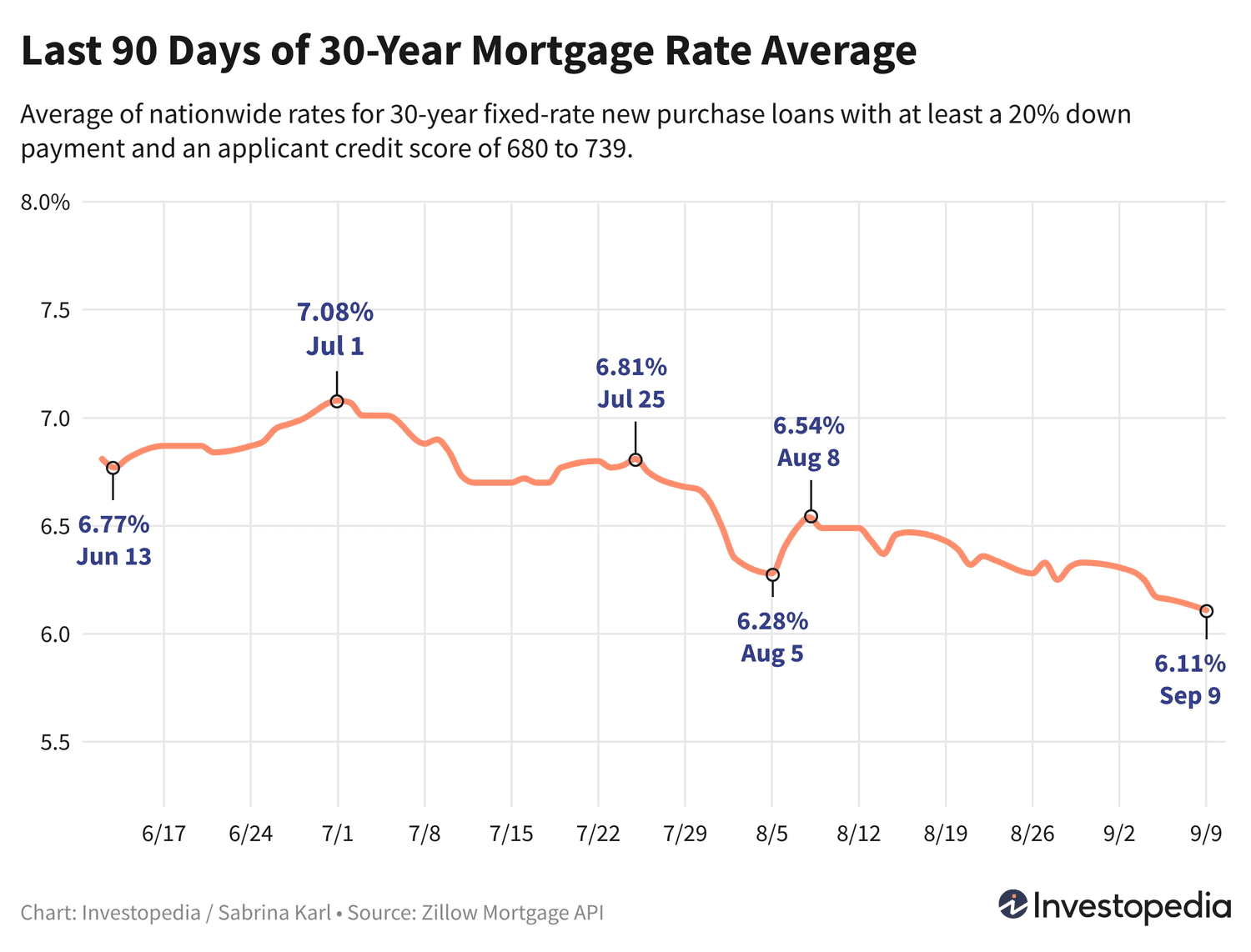

Mortgage rates continue their downward trend, with the flagship 30-year fixed-rate mortgage average falling to 6.11%, marking the lowest point since February 2023.

On Monday, rates for new 30-year purchase mortgages decreased further, settling at an average of 6.11%. This represents the most affordable average in over 19 months. Rates for other mortgage types showed mixed results on the same day.

Since mortgage rates vary significantly among lenders, it’s crucial to shop around and regularly compare offers to secure the best possible rate regardless of your loan type.

Current Mortgage Rate Averages as of May 9, 2025

The 30-year fixed-rate mortgage average dropped by 5 basis points on Monday alone, culminating in a week-long decline of 22 basis points to 6.11%. This is the lowest average since early February 2023.

Today's 30-year rates are nearly a full percentage point lower than July 2024's peak of 7.08%, and approximately 2 percentage points below the historic 23-year high of 8.01% recorded in October 2023.

Additionally, 15-year fixed mortgage rates also declined, dropping 4 basis points to a new average of 5.15%. This reflects a 26 basis point decrease over the past week and the lowest level since February 2023. These rates are significantly below last fall’s historic peak of 7.08%, the highest since 2000.

Jumbo 30-year mortgage rates experienced a slight increase of 1 basis point, reaching an average of 6.42% on Monday. This level is near the lowest since December 2024. Although detailed jumbo rate data prior to 2009 is limited, the 8.14% peak last fall was the highest in over two decades.

Weekly Average According to Freddie Mac

Freddie Mac publishes a weekly average of 30-year mortgage rates every Thursday. Last week’s rate held steady at 6.35%, the lowest weekly average since May 2023. Freddie Mac’s average hit a historic 23-year high of 7.79% in October 2024.

Note that Freddie Mac’s weekly average differs from daily averages reported elsewhere because it blends rates from the previous five days. Our daily averages provide a more immediate reflection of rate changes. Additionally, differences in loan criteria, such as down payment size and credit score requirements, affect these averages.

Use our Mortgage Calculator to estimate monthly payments under various loan scenarios.

Important Considerations

Published mortgage rates differ from advertised teaser rates, which are often the most attractive offers and may require upfront points or assume ideal borrower profiles with excellent credit scores and smaller loan amounts. Actual rates depend on personal factors like creditworthiness and income, so your rate may vary from published averages.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are influenced by several macroeconomic and industry factors, including:

- Movements in the bond market, particularly 10-year Treasury yields

- The Federal Reserve's monetary policies, especially regarding bond purchases and support for government-backed mortgages

- Competition among mortgage lenders and across different loan products

Due to the interplay of these factors, pinpointing a single cause for rate changes is challenging.

In 2021, mortgage rates remained relatively low, supported by the Federal Reserve’s bond-buying programs designed to mitigate pandemic-related economic challenges. However, starting in November 2021, the Fed began tapering bond purchases, completing the process by March 2022.

From then until July 2023, the Fed raised the federal funds rate aggressively to combat inflation, increasing it by 5.25 percentage points over 16 months. While the federal funds rate indirectly affects mortgage rates, the two can move independently.

Since July 2023, the Fed has held rates steady but has signaled potential cuts as inflation eases, with a rate reduction widely anticipated following the September 18, 2025 meeting.

How We Monitor Mortgage Rates

The mortgage rate averages presented here are sourced from the Zillow Mortgage API, assuming an 80% loan-to-value ratio (20% down payment) and a credit score between 680 and 739. These averages reflect typical borrower experiences but may differ from advertised teaser rates. © Zillow, Inc., 2024. Use subject to Zillow Terms of Use.

Discover engaging topics and analytical content in Personal Finance News as of 16-05-2024. The article titled " 2025 Mortgage Rates Drop: 30-Year Fixed Hits 6.11%, Lowest Since February 2023 " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 2025 Mortgage Rates Drop: 30-Year Fixed Hits 6.11%, Lowest Since February 2023 " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.