Warren Buffett and Jamie Dimon’s Strong Case for Stock Buybacks

Explore why Warren Buffett and Jamie Dimon defend stock buybacks against rising criticism, highlighting their impact on shareholder value and corporate growth.

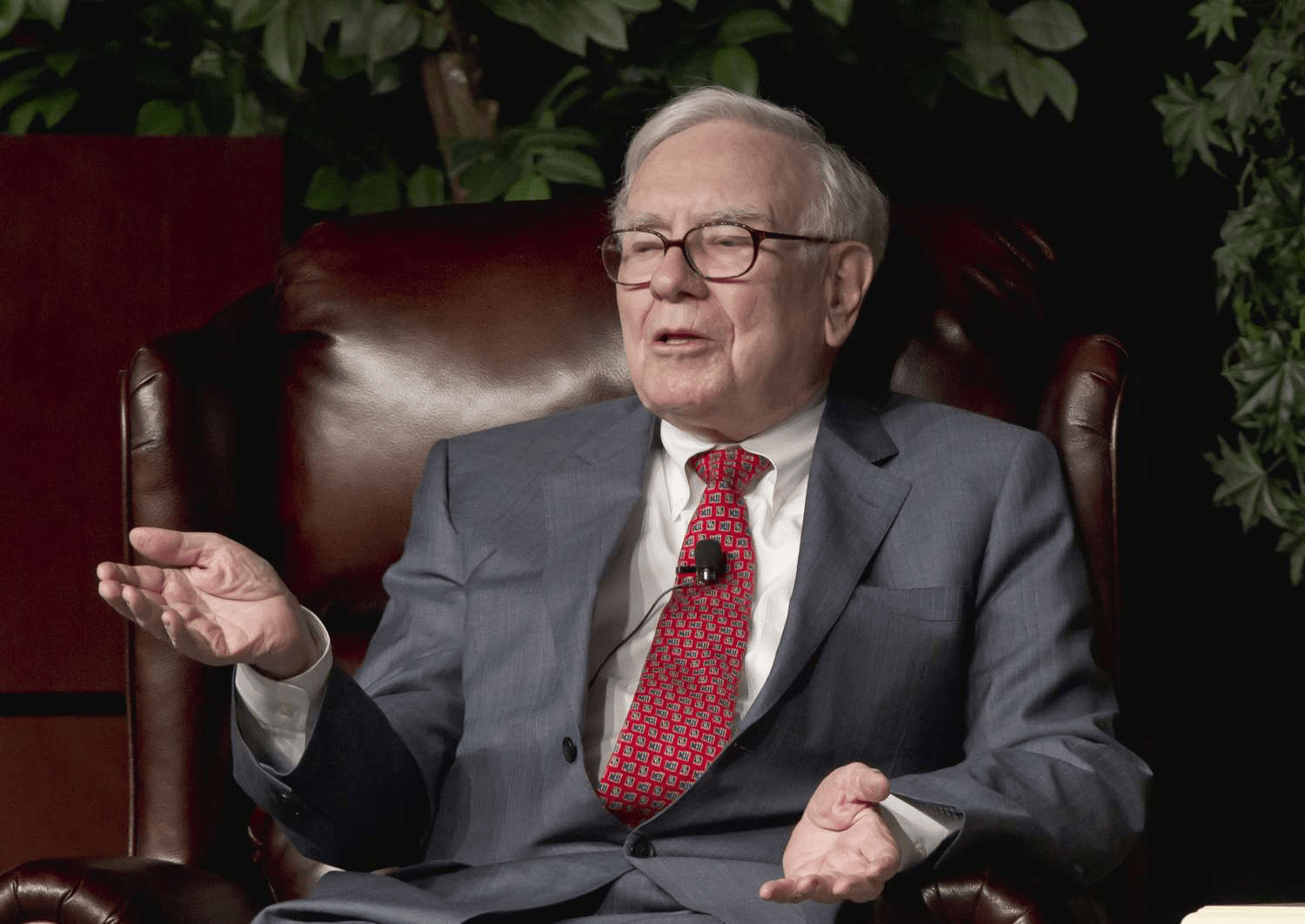

Two of the most influential figures in American business—Warren Buffett, the legendary investor and CEO of Berkshire Hathaway Inc. (BRK.A), and Jamie Dimon, CEO of JPMorgan Chase & Co. (JPM), the largest U.S. bank—are actively defending the practice of corporate share repurchases, commonly known as stock buybacks. Both leaders have overseen significant buyback programs at their respective companies in recent years.

Their defense comes amid growing criticism from several 2020 Democratic presidential candidates and Senate Minority Leader Chuck Schumer, who argue that stock buybacks primarily benefit wealthy shareholders and executives at the expense of the broader economy and workers. Notably, Buffett and Dimon have historically supported Democratic candidates, making their stance particularly noteworthy.

Warren Buffett’s Perspective

Warren Buffett, renowned globally as a master stock picker and the architect behind Berkshire Hathaway’s rise to a market value near $500 billion, offers a nuanced view on buybacks. In Q4 2018 alone, Berkshire invested $418 million in repurchasing its shares. Buffett believes buybacks can create value for both departing and remaining shareholders when executed prudently.

Buffett’s Key Insights on Buybacks:

- "Repurchases benefit shareholders who exit as well as those who remain invested."

- "Buying stock below its intrinsic business value is often the best use of cash."

- "Berkshire repurchases shares at prices above book value but below intrinsic value, which increases per-share intrinsic value despite lowering book value per share."

- "Many of our top holdings use retained earnings to repurchase shares, which we appreciate because it increases Berkshire’s ownership when we believe the stock is undervalued."

These insights were shared in Buffett’s February 23, 2019 letter to Berkshire Hathaway shareholders.

Jamie Dimon’s Perspective

JPMorgan Chase has repurchased approximately 20% of its shares over the past five years, investing $55 billion as detailed in its 2018 annual report. With a current market value around $345 billion, Dimon emphasizes that buybacks are a critical tool for effective capital allocation.

Dimon’s Views on Buybacks Include:

- "Stock buybacks are essential for proper capital allocation."

- "They provide companies with a way to redeploy excess capital efficiently."

- "Buybacks must not compromise necessary investments in the company’s future."

Dimon describes buybacks as a "no-brainer" that have significantly enhanced JPMorgan’s value. He cites an example from seven years ago where repurchasing stock at tangible book value led to substantially higher earnings and tangible book value per share within four years. Looking forward, Dimon projects that a large buyback today could boost earnings per share by 2%–3% over five years.

Stock repurchases have been a major driver of demand in the current bull market, with total buyback spending expected to reach $940 billion in 2019, according to The Wall Street Journal.

Future Outlook

Senators Chuck Schumer and Bernie Sanders, who is also a presidential candidate, have proposed legislation requiring companies to raise employee pay before conducting buybacks. However, given Republican control of the Senate and a likely presidential veto, such measures face significant hurdles. Meaningful restrictions on buybacks would probably require Democratic control of both Congress and the White House.

Discover engaging topics and analytical content in Company News as of 30-06-2019. The article titled " Warren Buffett and Jamie Dimon’s Strong Case for Stock Buybacks " provides new insights and practical guidance in the Company News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Warren Buffett and Jamie Dimon’s Strong Case for Stock Buybacks " helps you make smarter decisions within the Company News category. All topics on our website are unique and offer valuable content for our audience.