JPMorgan's Dimon Predicts 10-Year Treasury Yields Could Hit 5%

Jamie Dimon remains bullish on the U.S. economy, forecasting a rise in 10-year Treasury yields to 5% or beyond.

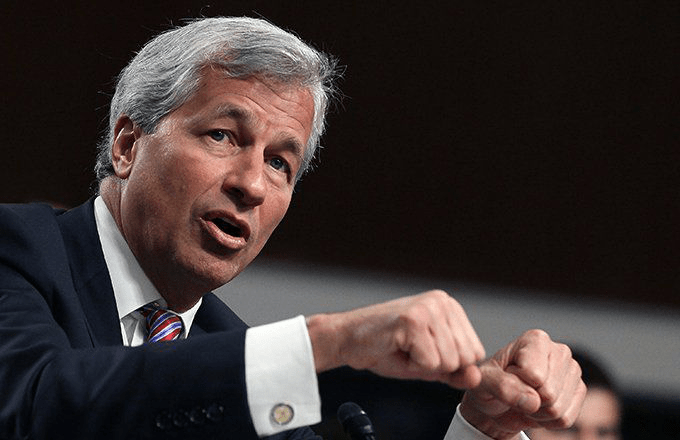

One influential voice in the financial world anticipates a significant increase in U.S. Treasury yields soon. Jamie Dimon, CEO of J.P. Morgan Chase (JPM), cautioned investors over the weekend to brace for the 10-year U.S. Treasury yield climbing to 5% or possibly higher. (Related: Jamie Dimon Warns Fed QE Tactics Could Trigger Market Turmoil)

Dimon's outlook, shared during the Aspen Institute’s 25th Annual Summer Celebration Gala, builds upon his earlier forecast predicting the benchmark yield would reach 4% in 2018.

“I believe rates should be at 4% today,” Dimon told Bloomberg on Saturday. “Prepare for rates hitting 5% or more – the likelihood is greater than many anticipate.”

Yields Hover Around 3%

Meanwhile, the 10-year Treasury note yield has intermittently surpassed the psychologically important 3% mark multiple times this year. However, these surges have been fleeting as economic uncertainties linger despite strong indicators of U.S. growth, employment gains, and inflation trends. The last brief spike above 3% occurred late last week, followed by a recent pullback in yields this week.

Source: TradingView. Daily chart tracking the U.S. 10-Year Treasury Note yield since early 2018.

Strong Economic Confidence

Dimon’s latest forecast is largely fueled by his optimistic view of the U.S. economy. With unemployment at a historic low of 3.9%, GDP growth robust at an annualized 4.1%, inflation steady near the Federal Reserve’s 2% target, and continued fiscal stimulus efforts, Dimon sees compelling reasons to believe Treasury yields have room to climb further.

Earlier this year, rising inflation fears and climbing interest rates, as reflected by surging Treasury yields, sparked increased market volatility. However, these worries have eased as major stock indexes have rebounded toward record highs. On Saturday, Dimon also expressed confidence in the market’s future, projecting the current bull market could persist for another 2 to 3 years thanks to the U.S. economy’s strength.

If you have news tips for Investopedia reporters, please contact us at tips@investopedia.com.

Discover the latest news and current events in Company News as of 11-08-2018. The article titled " JPMorgan's Dimon Predicts 10-Year Treasury Yields Could Hit 5% " provides you with the most relevant and reliable information in the Company News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " JPMorgan's Dimon Predicts 10-Year Treasury Yields Could Hit 5% " helps you make better-informed decisions within the Company News category. Our news articles are continuously updated and adhere to journalistic standards.