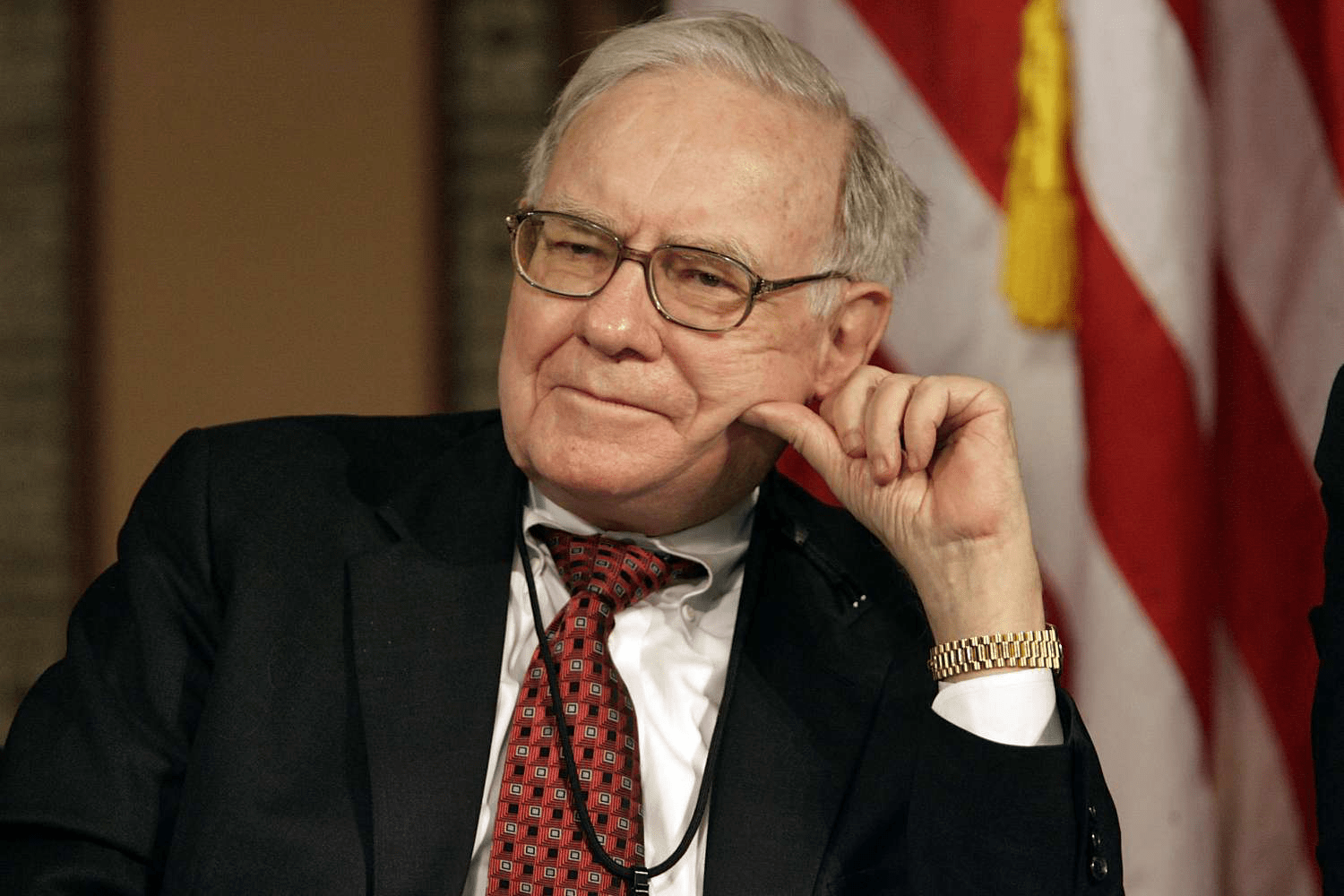

Berkshire Hathaway 2025: How Warren Buffett Turned $835M into a $900B Empire

Discover how Warren Buffett transformed Berkshire Hathaway from a struggling textile firm into a $900 billion powerhouse with shares soaring above $650,000 in 2025. Learn the secrets behind Buffett’s value investing, dividend strategy, and the company’s massive insurance float.

From a faltering textile business in 1965 to a global conglomerate dominating multiple sectors today, Berkshire Hathaway stands as a testament to Warren Buffett’s legendary investment acumen.

Headquartered in Omaha, Nebraska, Berkshire Hathaway (BRK.A, BRK.B) has evolved into one of the most sought-after stocks worldwide. Buffett’s strategic acquisition in the mid-1960s laid the groundwork for this transformation.

Through acquiring and revitalizing distressed companies, Buffett expanded Berkshire’s portfolio to include household names such as GEICO, Duracell, and Fruit of the Loom. As of mid-2024, Berkshire boasts a staggering market cap exceeding $900 billion, with Class A shares trading above $650,000 each.

This article delves into Buffett's methods that propelled Berkshire Hathaway to its current status.

Key Highlights

- Warren Buffett took control of Berkshire Hathaway in 1965, growing it into the world’s largest holding company.

- Buffett’s value investing focuses on acquiring undervalued, struggling companies and turning them profitable.

- Berkshire favors investments in firms with a strong track record of consistent dividend payments.

- Dividends are reinvested rather than distributed to Berkshire shareholders, fueling growth.

- The company’s insurance float, premiums collected before claims are paid, provides a major source of investment capital.

Berkshire Hathaway: A Historical Snapshot

Berkshire’s origins trace back to the 19th century with two Massachusetts-based cotton mills: Berkshire Fine Spinning Associates and Hathaway Manufacturing. These merged in 1955 to form Berkshire Hathaway.

In 1965, Buffett's investment firm acquired a controlling stake during the company’s decline. His first major move was buying National Indemnity, marking the start of Berkshire’s expansion into insurance. He then exited the textile sector entirely.

Today, Berkshire Hathaway’s portfolio spans industries including finance, apparel, entertainment, food and beverages, utilities, furniture, household products, media, and construction.

Notable subsidiaries include:

- Benjamin Moore

- Dairy Queen

- Duracell

- Fruit of the Loom

- GEICO

- Kraft Heinz

- See's Candies

The Power of Berkshire’s Insurance Float

A cornerstone of Berkshire Hathaway’s financial strength is its insurance float — premiums collected upfront that have yet to be paid out as claims. This “available reserve” was $168.9 billion in 2023, providing a vast pool for investment.

As Berkshire’s 2023 annual report states, "Our unparalleled capital reserves, abundant cash flow, and diverse income streams grant us exceptional investment flexibility, enabling us to seize major opportunities when they arise."

This float enables Berkshire to swiftly acquire and revive struggling companies, exemplified by the 2002 $835 million purchase of Fruit of the Loom after its stock plummeted 97%.

Buffett’s mentor, Benjamin Graham, emphasized dividends, and many Berkshire holdings like Apple, Coca-Cola, and American Express boast long histories of dividend growth. Coca-Cola, for instance, has raised its dividend annually since 1980.

Despite dividends being a key vitality indicator, Berkshire itself opts not to distribute dividends to shareholders, preferring to reinvest earnings for compounded growth.

Leadership Transition

Warren Buffett’s successor is expected to be Greg Abel, CEO of Berkshire Hathaway Energy and vice chair overseeing noninsurance operations, as unofficially announced in May 2021. No official transition date has been set.

Why Berkshire Hathaway Avoids Paying Dividends

While Buffett favors dividends in companies he invests in, Berkshire Hathaway has only ever paid a dividend once—in 1967, at 10 cents per share. Buffett humorously claimed he must have missed the decision.

Shareholders benefit more from reinvested profits, as evidenced by the extraordinary rise in Class A shares—from $275 in 1980 to over $630,000 by July 2024.

Class B shares have also shown impressive growth, climbing from $20.66 in 1996 to $418.60 in 2024.

Berkshire’s philosophy is clear: investors are better served by Buffett’s proven reinvestment strategy than by dividends.

Due to their high value, Class A shares trade infrequently, increasing from around 400 daily trades in 1980 to over 400,000 in 2024. Buffett has resisted splitting Class A shares to avoid speculative trading.

In contrast, Class B shares were introduced in 1996 to offer a more affordable investment option, later splitting 50-for-1 in 2010, and are included in the S&P 500 for better market representation.

The Purpose of Class A and Class B Shares

Buffett created Class B shares to counter unit trusts that mimicked Berkshire Hathaway but charged high fees, targeting small investors. These shares provided an affordable way to invest directly in Berkshire.

Understanding Berkshire Hathaway’s Float

The float consists of insurance premiums received but not yet paid out as claims, which Berkshire invests to generate returns before liabilities arise.

What Are Dividends?

Dividends are portions of a company's profits paid to shareholders, typically in cash or shares, approved by the board to reward investors without selling stock.

Conclusion

Berkshire Hathaway exemplifies a unique value investing approach—acquiring entire companies rather than just shares. Decades of disciplined investment and reinvestment have built this colossal conglomerate, making it a beacon of financial prowess in 2024.

Discover the latest news and current events in Business Leaders as of 15-05-2024. The article titled " Berkshire Hathaway 2025: How Warren Buffett Turned $835M into a $900B Empire " provides you with the most relevant and reliable information in the Business Leaders field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Berkshire Hathaway 2025: How Warren Buffett Turned $835M into a $900B Empire " helps you make better-informed decisions within the Business Leaders category. Our news articles are continuously updated and adhere to journalistic standards.