Arm Holdings Stock Soars: AI Chip Launch Planned for 2025 – Price Targets & Market Outlook

Arm Holdings is set to revolutionize the AI chip market with a 2025 launch. Discover key price levels, market strategy, and what investors should watch in this evolving tech space.

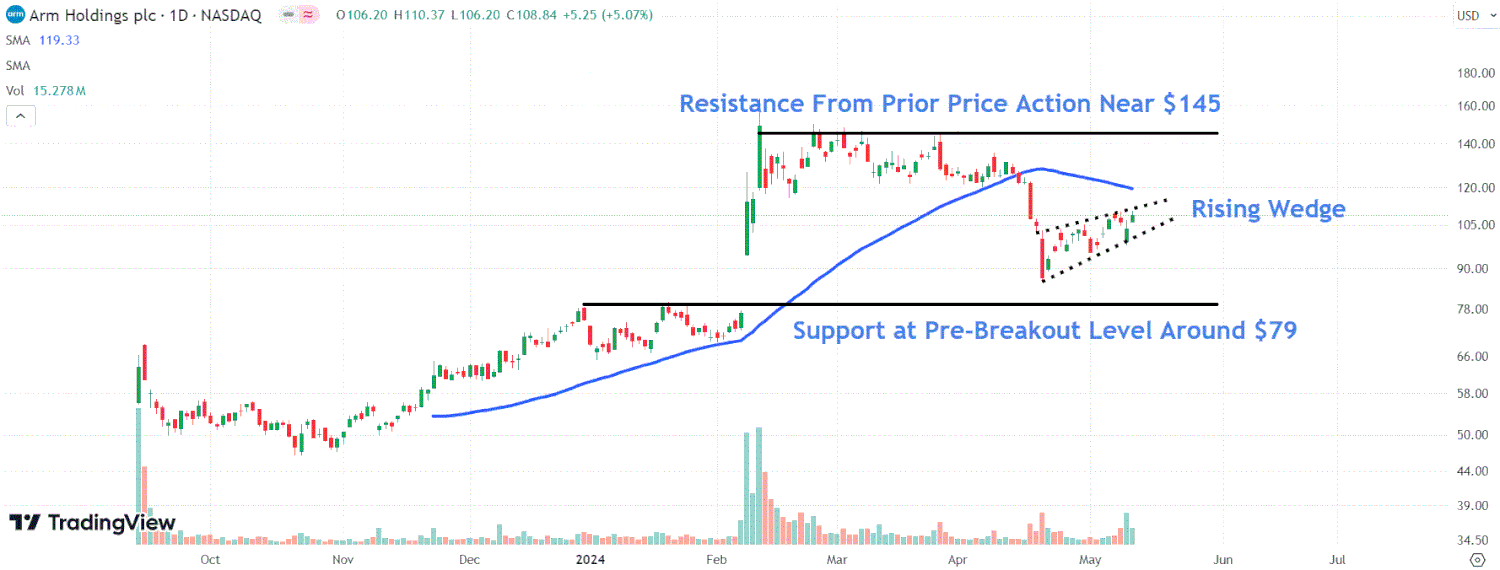

Watch These Crucial Price Points

Key Highlights

- Arm Holdings (ARM) stock is attracting attention following reports that the UK-based chip designer aims to launch AI chips by 2025.

- The company is creating a dedicated AI chip division with plans to develop a prototype by spring 2025 and begin mass production by fall 2025 through contract manufacturers.

- Currently, Arm’s shares are trading within a rising wedge pattern; a breakdown could test support near $79, while a breakout might push prices toward resistance around $145.

Shares of Arm Holdings, a leading British chip design firm, are in the spotlight after Nikkei Asia revealed the company’s ambitious plan to enter the artificial intelligence (AI) chip market with a prototype expected in early 2025.

Arm, primarily owned (90%) by Japan's SoftBank (SFTBY), is establishing a new AI chip business unit. The plan includes prototype development by spring 2025, followed by large-scale manufacturing arrangements slated for fall 2025.

The initial development phase is projected to incur costs running into billions of yen, primarily funded by Arm with additional investment from SoftBank. Post-launch, the AI chip segment might be spun off as a separate entity under SoftBank's umbrella.

In preparation for production, Arm has already begun talks with Taiwan Semiconductor Manufacturing Company (TSMC) and other manufacturers to secure capacity, according to Nikkei Asia.

Arm’s Strategic Move Into the Expanding AI Datacenter Market

Arm generates revenue by licensing its chip designs and is aggressively targeting the growing AI datacenter sector. Major technology players—including Microsoft (MSFT), Meta (META), Alphabet (GOOGL), and Amazon (AMZN)—are developing their own AI chips to reduce reliance on Nvidia (NVDA), the current market leader.

Since its IPO in September last year at $51, Arm’s shares have more than doubled as investors anticipate a significant share capture in the AI infrastructure market. Market research firm Precedence Research projects the AI chip market to expand from $30 billion in 2024 to $200 billion by 2032.

Technical Outlook: Rising Wedge Pattern Signals Key Price Zones

Arm’s stock price has been confined within a rising wedge formation since mid-April, which often signals weakening buying momentum and a potential downside move. Short-term fluctuations are expected until the 50-day moving average converges with the wedge’s upper trendline, setting the stage for a decisive breakout or breakdown.

Should the price decline, investors should watch the $79 level, a critical support zone near February’s pre-breakout price. Conversely, a breakout above the wedge could propel the stock toward resistance near $145, reflecting previous price action highs.

Arm closed last week at $108.84, marking a 5.1% gain on Friday’s trading session.

Disclaimer: The insights and opinions presented here are for informational purposes only and do not constitute financial advice. Please consult our warranty and liability disclaimer for further information.

Author’s Note: As of this article’s publication, the author holds no positions in the securities mentioned.

Explore useful articles in Company News as of 18-05-2024. The article titled " Arm Holdings Stock Soars: AI Chip Launch Planned for 2025 – Price Targets & Market Outlook " offers in-depth analysis and practical advice in the Company News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Arm Holdings Stock Soars: AI Chip Launch Planned for 2025 – Price Targets & Market Outlook " article expands your knowledge in Company News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.