S&P 500 Surges 1.1% as Green Energy Stocks Rally Post-Presidential Debate

On September 11, the S&P 500 climbed 1.1% driven by strong performances in green energy stocks following the latest CPI report and a pivotal presidential debate.

Michael Bromberg is a seasoned finance editor with over ten years of expertise in simplifying complex financial concepts. He holds a Bachelor of Arts in Literature from the University of Wisconsin-Madison and a Master’s degree in Linguistics from Universidad de Antioquia, Medellin, Colombia.

Highlights

- The S&P 500 rose 1.1% on September 11 as investors digested recent CPI data and the presidential debate’s impact.

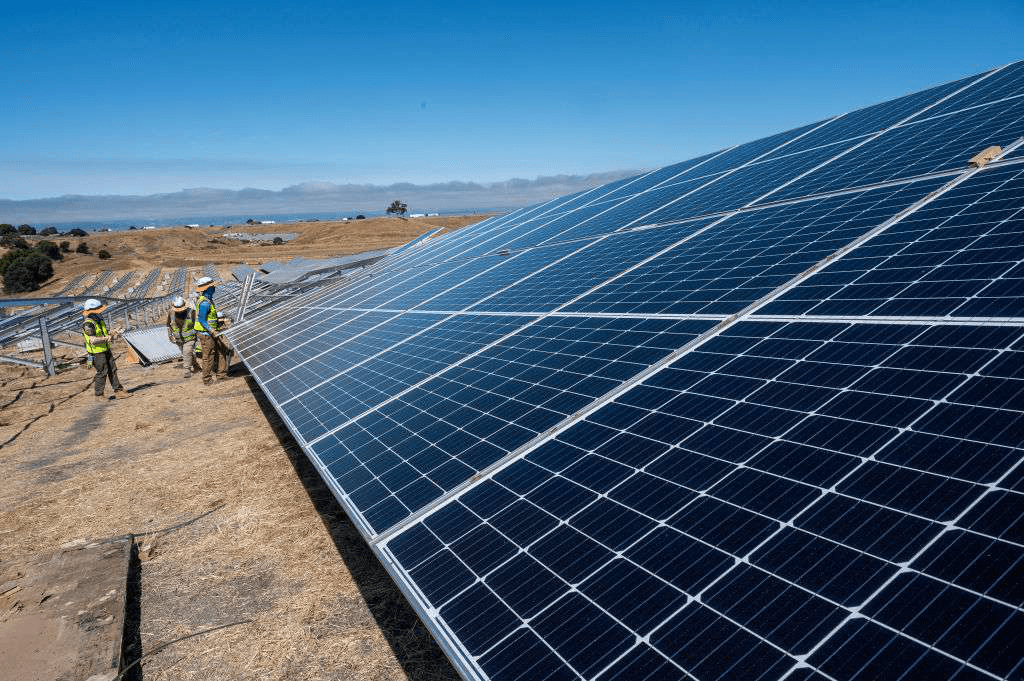

- Green energy stocks, including First Solar, soared due to energy policy discussions during the debate.

- Health insurer Humana shares declined amid concerns about Medicare policy changes under a potential Democratic administration.

Major U.S. stock indices rebounded from early setbacks to close higher on Wednesday.

The day’s volatility was influenced by the release of August’s Consumer Price Index, indicating easing inflation and supporting expectations for a modest Federal Reserve rate cut. Additionally, market participants evaluated the financial implications of Tuesday night’s presidential debate.

The S&P 500 gained 1.1%, the Dow Jones Industrial Average increased 0.3%, and the Nasdaq surged 2.2%, buoyed by tech giants like Nvidia and other AI-focused companies.

Vice President Kamala Harris’s strong debate performance boosted investor confidence in green energy firms. If elected, Harris is expected to uphold and expand Biden-era clean energy initiatives. First Solar’s stock led the rally with a remarkable 15.2% jump.

Shares of Albemarle, the world’s top lithium producer, climbed 13.6% following news that a major Chinese battery manufacturer plans to reduce lithium output. This move may help stabilize lithium prices, which have pressured Albemarle’s stock earlier this year.

Virginia-based AES Corporation, specializing in clean energy utilities, saw its shares rise 8.6%. Jefferies initiated coverage on AES with a 'buy' rating and a $20 target, praising its diversified global energy assets and shift toward renewables.

Conversely, Humana’s stock dropped 5.3%, marking the steepest decline in the S&P 500. Concerns about potential Medicare policy changes under a Democratic administration and recent negative Star rating reports weighed on healthcare stocks.

Conagra Brands shares fell 4.0%, retreating from a recent 52-week high despite expanding its snack portfolio with the Sweetwood Smoke & Co. acquisition. Lower-than-expected guidance amid challenging consumer conditions contributed to the decline.

After 155 years, Campbell Soup rebranded as 'The Campbell's Company,' reflecting its broader snack and food brand portfolio. Shares declined 3.8% following the announcement.

Discover the latest news and current events in Markets News as of 21-05-2024. The article titled " S&P 500 Surges 1.1% as Green Energy Stocks Rally Post-Presidential Debate " provides you with the most relevant and reliable information in the Markets News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " S&P 500 Surges 1.1% as Green Energy Stocks Rally Post-Presidential Debate " helps you make better-informed decisions within the Markets News category. Our news articles are continuously updated and adhere to journalistic standards.