June 2023 Market Insights: Debt Ceiling Update & Key Stock Movements to Watch

Stay informed with the latest market developments including the debt ceiling bill progress, May payroll report forecasts, and significant stock shifts in Salesforce, CrowdStrike, and C3.ai.

Market Highlights for June 1, 2023

The House has passed the debt ceiling bill, sending it to the Senate just days before the critical June 5 deadline. Meanwhile, the ADP report anticipates a slowdown in private job growth for May. Here’s a detailed look at what investors should focus on today.

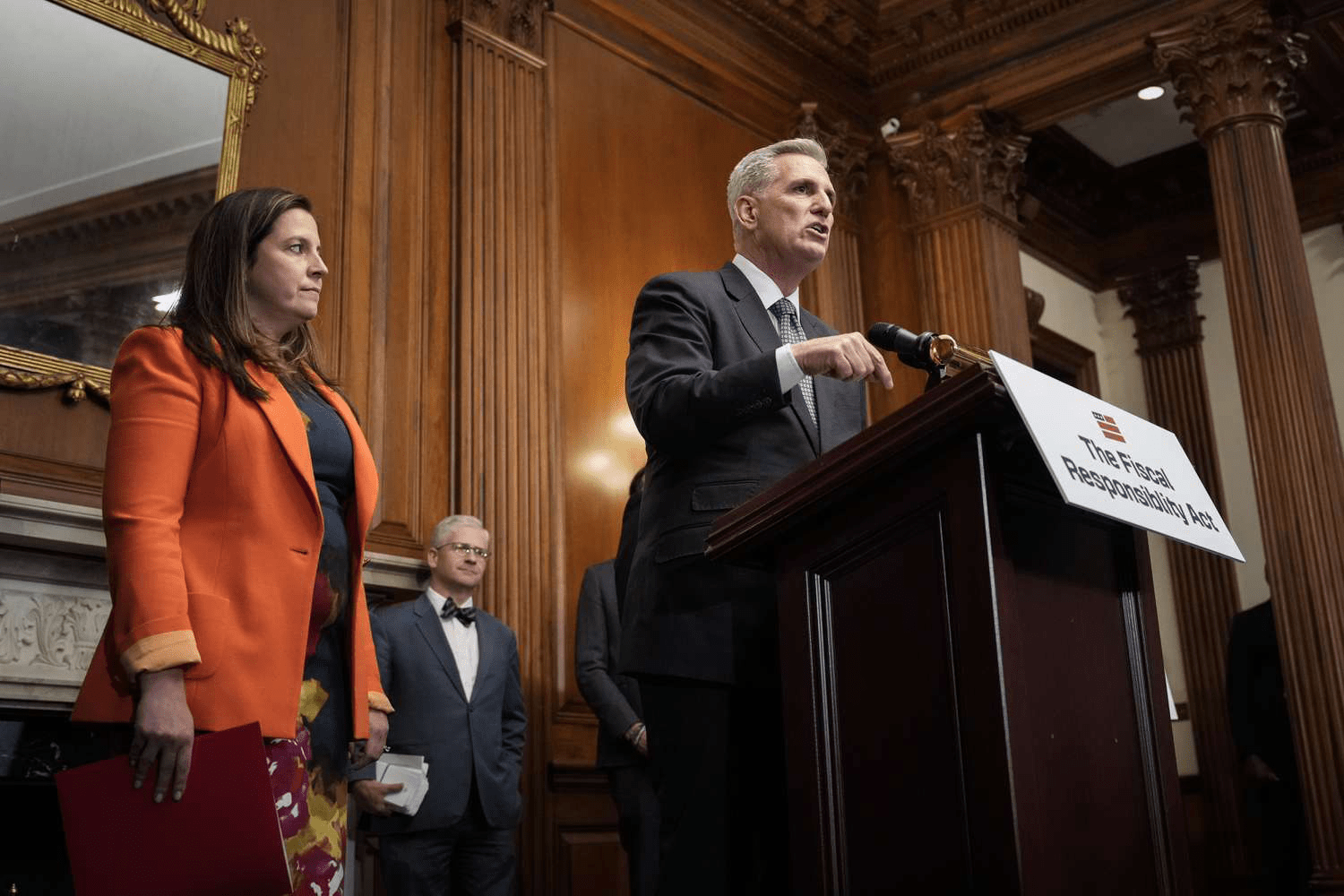

1. Debt Ceiling Legislation Advances to Senate Ahead of Crucial Deadline

The House approved the debt ceiling increase with a 314-117 vote, extending the limit for two years. The bill now moves to the Senate with limited time to avoid a potential U.S. default by June 5. It maintains flat spending for 2024, sets new spending caps for 2025 excluding Social Security and Medicare, and includes a 3% military budget increase.

2. May’s Private Payroll Growth Expected to Slow Down

The ADP National Employment Report, scheduled for release at 8:30 a.m. ET, is expected to reveal a deceleration in private sector job additions, projecting 180,000 new jobs in May compared to 296,000 in April. Additionally, the manufacturing Purchasing Managers' Index (PMI), due at 10 a.m. ET, is forecasted to slightly dip to 47% from April’s 47.1%.

3. Salesforce Shares Drop Over Rising Capital Expenditure Concerns

Salesforce (CRM) stock declined over 5% in pre-market trading after the company reported earnings and revenue that beat expectations but revealed capital expenditures of $234 million—36% above estimates. This higher spending overshadowed an 11% revenue increase, raising investor concerns.

4. CrowdStrike Stock Falls Despite Earnings Beat Amid Slower Revenue Growth

Cybersecurity firm CrowdStrike (CRWD) saw its shares fall 11% pre-market after reporting Q1 earnings that surpassed profit and revenue estimates but showed revenue growth of 42% year-over-year, below the anticipated 61% growth rate. Earnings per share stood at 57 cents, beating the forecasted 51 cents.

5. C3.ai Shares Tumble as Revenue Forecast Misses Analyst Expectations

C3.ai (AI) shares dropped approximately 20% in pre-market trading despite exceeding profit and revenue estimates. The company’s 2024 fiscal year revenue forecast ranges between $295 million and $320 million, falling short of the $321 million analysts had projected.

Have a news tip for our team? Email us at tips@investopedia.com

Discover the latest news and current events in Markets News as of 06-06-2023. The article titled " June 2023 Market Insights: Debt Ceiling Update & Key Stock Movements to Watch " provides you with the most relevant and reliable information in the Markets News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " June 2023 Market Insights: Debt Ceiling Update & Key Stock Movements to Watch " helps you make better-informed decisions within the Markets News category. Our news articles are continuously updated and adhere to journalistic standards.