Stock Market Update May 2023: Debt Ceiling Deal Sparks Mixed Reactions with Dow Down and Nasdaq Soaring

Explore how the uncertainty surrounding the U.S. debt ceiling deal in May 2023 led to a mixed market performance, with tech stocks rallying and oil prices dropping amid fears of a government default.

With over 25 years of experience, Bill McColl is a seasoned producer and writer in TV, radio, and digital media, leading teams to deliver impactful news coverage on major events.

Highlights from May 30, 2023

- Markets showed mixed signals as doubts lingered over the House passing the debt ceiling agreement.

- Artificial intelligence stocks continued their upward momentum.

- Oil prices sharply declined due to concerns about a potential U.S. default.

On May 30, 2023, U.S. stock markets reflected uncertainty tied to House Speaker Kevin McCarthy’s efforts to secure Congressional approval for the debt ceiling deal negotiated with President Joe Biden. The potential failure of this deal threatened a federal government default in the coming week. The Dow Jones Industrial Average dropped, the Nasdaq Composite climbed, and the S&P 500 remained relatively steady. Meanwhile, bond yields experienced a significant decline.

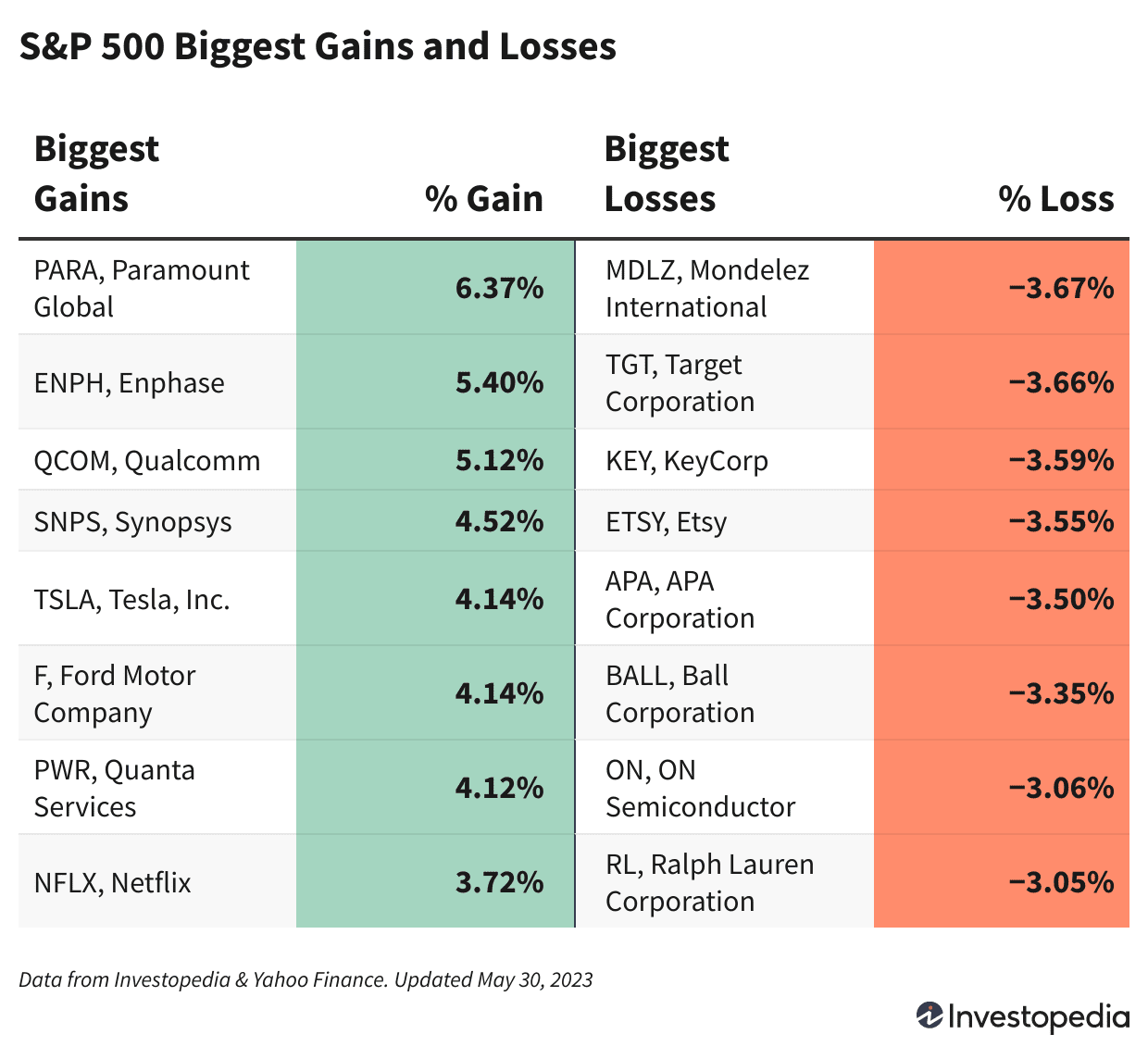

The artificial intelligence sector enjoyed another strong day. Qualcomm (QCOM) shares surged after announcing its semiconductor technology will expand AI capabilities on mobile devices. Nvidia (NVDA) hit a record high following the launch of new AI products, briefly pushing its market value over the $1 trillion threshold. Intel (INTC) led gains on the Dow with a 3% increase.

Paramount Global (PARA) topped the S&P 500 after receiving an upgrade from Wolfe Research. Netflix (NFLX) shares also rose. Tesla (TSLA) gained momentum as CEO Elon Musk visited China, with positive signals from the Chinese foreign minister about expanding Tesla’s presence. Ford (F) shares climbed following an analyst upgrade. Airline stocks increased as Memorial Day travel surpassed pre-pandemic numbers.

Fears of a U.S. default caused oil futures to plunge 4%, dragging down energy stocks. Comerica (CMA) shares fell sharply amid reports of contract violations with the U.S. Treasury. Target (TGT) shares declined for an eighth day amid controversy over its LGBTQ+ clothing marketing. Consumer staples stocks, including Mondelez International (MDLZ), Kroger (KR), and Procter & Gamble (PG), also saw declines.

Gold prices rose, while the U.S. dollar weakened against the euro, British pound, and Japanese yen. Cryptocurrency markets experienced a mixed session.

Explore useful articles in Markets News as of 04-06-2023. The article titled " Stock Market Update May 2023: Debt Ceiling Deal Sparks Mixed Reactions with Dow Down and Nasdaq Soaring " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Stock Market Update May 2023: Debt Ceiling Deal Sparks Mixed Reactions with Dow Down and Nasdaq Soaring " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.