Stock Market Crash in 2023: Debt Ceiling Deadlock Sparks Investor Panic

On May 24, 2023, U.S. stock markets plunged sharply as federal debt ceiling negotiations stalled, raising fears of a government default and global economic repercussions.

Bill McColl brings over 25 years of expertise as a senior producer and writer across TV, radio, and digital platforms, leading teams in delivering impactful news coverage on major global events.

Essential Highlights

- U.S. markets plunged on May 24, 2023, triggered by stalled federal debt ceiling talks.

- More than 50% of Dow Jones stocks dropped by at least 1%.

- Intuit shares fell after TurboTax revenue missed expectations during tax season.

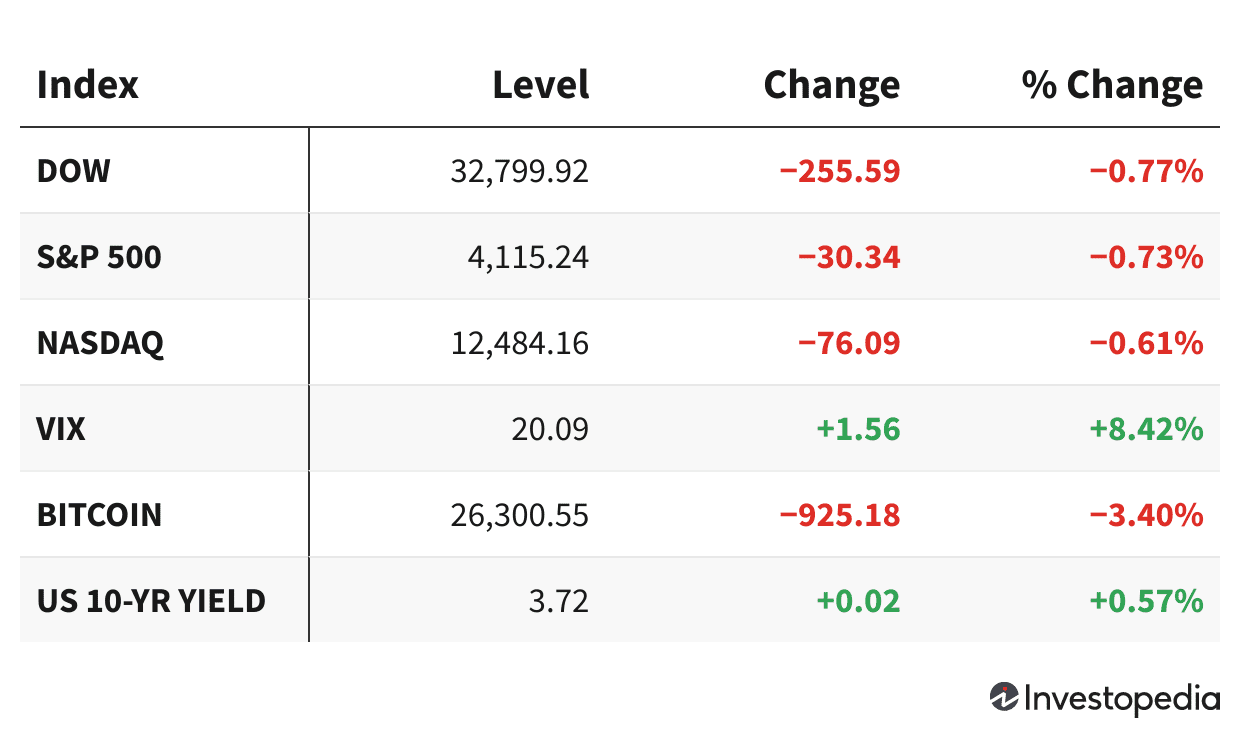

The U.S. equity markets experienced a sharp decline amid stalled negotiations to raise the federal debt ceiling, intensifying concerns about a possible government default next month and its ripple effects on both domestic and global economies. The Dow Jones Industrial Average declined for the fourth consecutive session.

Over half of Dow components saw declines exceeding 1%, with 3M (MMM) leading losses, falling 3.7%. Walgreens Boots Alliance (WBA) shares slipped 2.5%. Analog Devices (ADI) was the weakest performer in the S&P 500 after issuing a cautious sales forecast for the current quarter. Citigroup (C) shares declined following the announcement to abandon the sale of its Banamex unit in Mexico.

Intuit (INTU), the creator of TurboTax, saw its shares drop as tax-season revenues fell short of analyst estimates due to fewer tax filings. Agilent Technologies (A) shares declined after the company lowered its full-year outlook, prompting analyst downgrades and reduced price targets.

Netflix (NFLX) shares surged after Oppenheimer suggested that cracking down on password sharing could boost the stock price by up to 25%. Illumina (ILMN) shares jumped ahead of a critical shareholder meeting and proxy battle involving activist investor Carl Icahn.

Corning Incorporated (GLW) shares rose following a 20% price increase on glass used in TVs and displays. Energy stocks gained alongside rising oil prices amid speculation that OPEC+ may implement further production cuts.

Barclays upgraded Lennar (LEN), raising its price target and lifting shares of Lennar and other homebuilders. Abercrombie & Fitch (ANF) and Kohl’s (KSS) shares rallied after both companies reported unexpected quarterly profits.

Gold prices declined, while yields on 10-year U.S. Treasury notes rose. The U.S. dollar strengthened against the euro, pound, and yen. Major cryptocurrencies traded lower.

Explore useful articles in Markets News as of 29-05-2023. The article titled " Stock Market Crash in 2023: Debt Ceiling Deadlock Sparks Investor Panic " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Stock Market Crash in 2023: Debt Ceiling Deadlock Sparks Investor Panic " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.