2023 Stock Market Update: Inflation and Interest Rate Fears Stall Rally - February Insights

Explore the latest shifts in the 2023 U.S. stock market as inflation worries and Federal Reserve rate decisions impact major indices. Key sector performances and company highlights detailed.

Bill McColl brings over 25 years of expertise as a senior producer and writer across TV, radio, and digital platforms, leading teams to cover pivotal news events with accuracy and depth.

Market Highlights

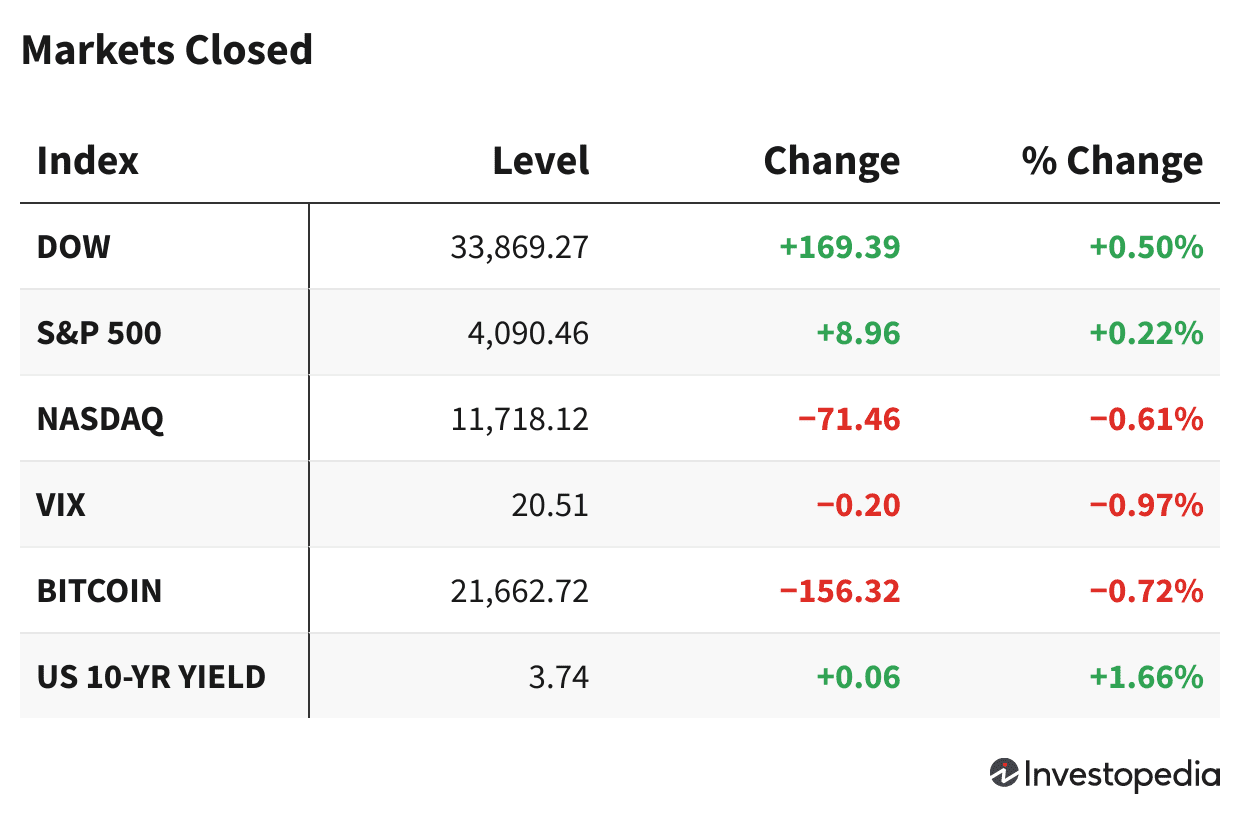

- On February 10, 2023, U.S. stock indices showed mixed results, ending a challenging week influenced by inflation concerns and Fed policy uncertainty.

- The Dow Jones Industrial Average and S&P 500 posted modest gains, while the Nasdaq Composite declined.

- Energy sector stocks, particularly fossil fuel companies, outperformed amid a surge in oil prices driven by Russia's production cuts.

The week concluded with the Nasdaq down 2.4%, the S&P 500 falling 1.1%, and the Dow Jones slipping approximately 0.2%. The initial momentum of 2023's market rally slowed as investor focus shifted to inflation trends and Federal Reserve interventions.

Fossil fuel companies dominated Friday's top performers on the S&P 500, buoyed by a 2% rise in oil prices following Russia's announcement to reduce output. DexCom Inc. (DXCM) led gains with a remarkable 10% jump after surpassing earnings and sales forecasts for its diabetes monitoring devices.

Financial technology firm Global Payments (GPN) saw share appreciation due to strong revenue guidance. Similarly, Motorola Solutions (MSI) shares climbed after exceeding earnings and revenue expectations, accompanied by an optimistic profit forecast.

Conversely, Lyft (LYFT) shares plummeted over 33% after reporting an unexpected fourth-quarter loss and projecting weaker revenue for the current quarter. Expedia Group (EXPE) also suffered losses, impacted by severe winter storms that disrupted travel bookings in December.

Corporate Developments and Market Movers

News Corp (NWSA) shares declined following missed profit and sales targets and the announcement of a 5% workforce reduction. Tesla's (TSLA) eight-day winning streak ended with a 5% drop after a downgrade from CFRA analyst Garrett Nelson.

The Walt Disney Company (DIS) shares fell 2% for a second consecutive day despite earlier gains from its earnings report and restructuring plans. Salesforce (CRM) experienced a downturn in the Dow Jones, reversing gains made after activist investor Dan Loeb acquired a stake.

On the fixed income front, yields on the 10-year U.S. Treasury note increased. Gold futures declined, while the U.S. dollar strengthened against the euro and pound but weakened against the yen. Major cryptocurrencies, including Bitcoin (BTC/USD), fell below key thresholds, with Bitcoin dipping under $22,000 for the first time in three weeks.

Have a news tip for our financial coverage? Reach out to us at tips@investopedia.com.

Discover the latest news and current events in Markets News as of 15-02-2023. The article titled " 2023 Stock Market Update: Inflation and Interest Rate Fears Stall Rally - February Insights " provides you with the most relevant and reliable information in the Markets News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " 2023 Stock Market Update: Inflation and Interest Rate Fears Stall Rally - February Insights " helps you make better-informed decisions within the Markets News category. Our news articles are continuously updated and adhere to journalistic standards.