Oracle Stock Price Analysis 2025: Key Levels to Watch After $10B xAI Deal Collapse

Oracle's shares dropped 3% after the end of $10 billion server deal talks with Elon Musk’s xAI. Discover crucial support and resistance levels to monitor amid potential price retracement in 2025.

Oracle's stock declined by 3% on Tuesday following reports that negotiations with Elon Musk’s xAI concerning a $10 billion server contract have concluded without agreement. Musk later revealed on X that xAI will develop its own server system to better control the project’s pace.

Highlights to Know

- Oracle shares fell sharply as deal talks with xAI ended.

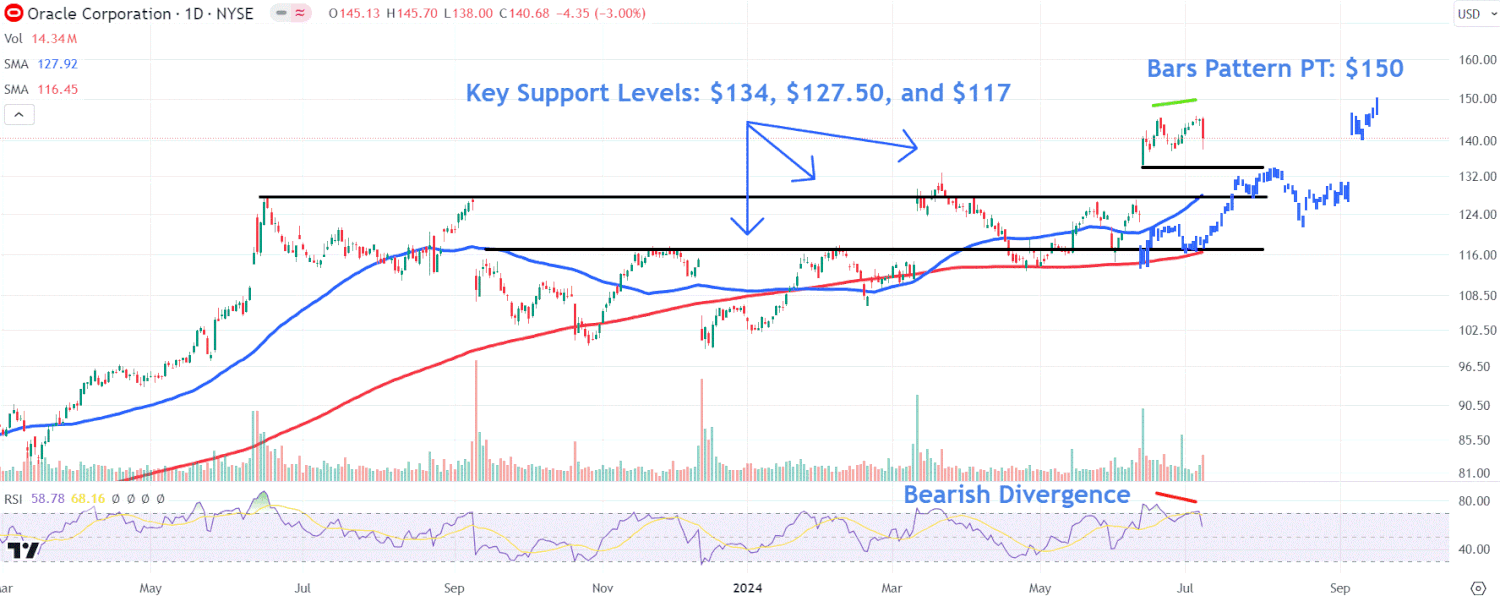

- A bearish engulfing pattern on Oracle’s chart signals a possible slowdown in buying momentum and a trend reversal.

- Key support levels to watch include $134, $127.50, and $117 during any potential pullback.

Following Oracle's earnings-driven surge on June 12, the stock has been climbing steadily. However, the recent emergence of a bearish engulfing candlestick pattern, where a large red candle fully covers the prior green candle, indicates weakening upward momentum and hints at a potential reversal.

Additionally, a divergence between Oracle’s price highs and its relative strength index (RSI) suggests the bullish trend is losing steam.

Using technical analysis, projecting the price path from December 2023 lows through March highs onto the April swing low points to a possible resistance target near $150. This is just slightly above Oracle’s all-time high of $145.79 reached on July 5.

Critical Support Zones to Monitor

If Oracle experiences a retracement, traders should watch these important price levels where buying interest may emerge:

- $134: This marks the earnings gap low and could serve as initial support.

- $127.50: A horizontal support level aligning with multiple swing highs over the past year and the rising 50-day moving average, potentially turning prior resistance into support.

- $117: A deeper support zone that coincides with a trendline, several previous peaks and troughs, and the 200-day moving average, offering strong potential buyer defense.

All insights presented are for informational purposes only. For more details, review the warranty and liability disclaimer on ZAMONA.

The author holds no positions in Oracle or related securities as of the article date.

Explore useful articles in Markets News as of 15-07-2024. The article titled " Oracle Stock Price Analysis 2025: Key Levels to Watch After $10B xAI Deal Collapse " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Oracle Stock Price Analysis 2025: Key Levels to Watch After $10B xAI Deal Collapse " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.