Netflix Stock Price Analysis 2025: Key Levels to Watch After Disappointing Outlook at $642

Explore critical Netflix stock price levels for 2025 as the streaming giant faces a soft outlook despite beating Q2 expectations. Learn which support points investors should monitor in this detailed technical analysis.

Technical Overview Reveals Signs of a Fading Uptrend

Summary Highlights

- Netflix shares slipped in after-hours trading following a cautious outlook that overshadowed better-than-expected Q2 earnings.

- Technical indicators such as a potential double top pattern, bearish divergence on the RSI, and a breakdown below the 50-day moving average suggest weakening bullish momentum.

- Key support levels to watch during possible pullbacks include $638, $550, $500, $440, and $365.

Netflix (NFLX) closed slightly lower in after-hours trading after issuing a tempered forecast, despite surpassing Wall Street’s Q2 expectations.

This analysis dives into Netflix’s chart patterns and technical signals to identify crucial price levels investors should track post-earnings.

Chart Patterns Indicate Momentum Loss

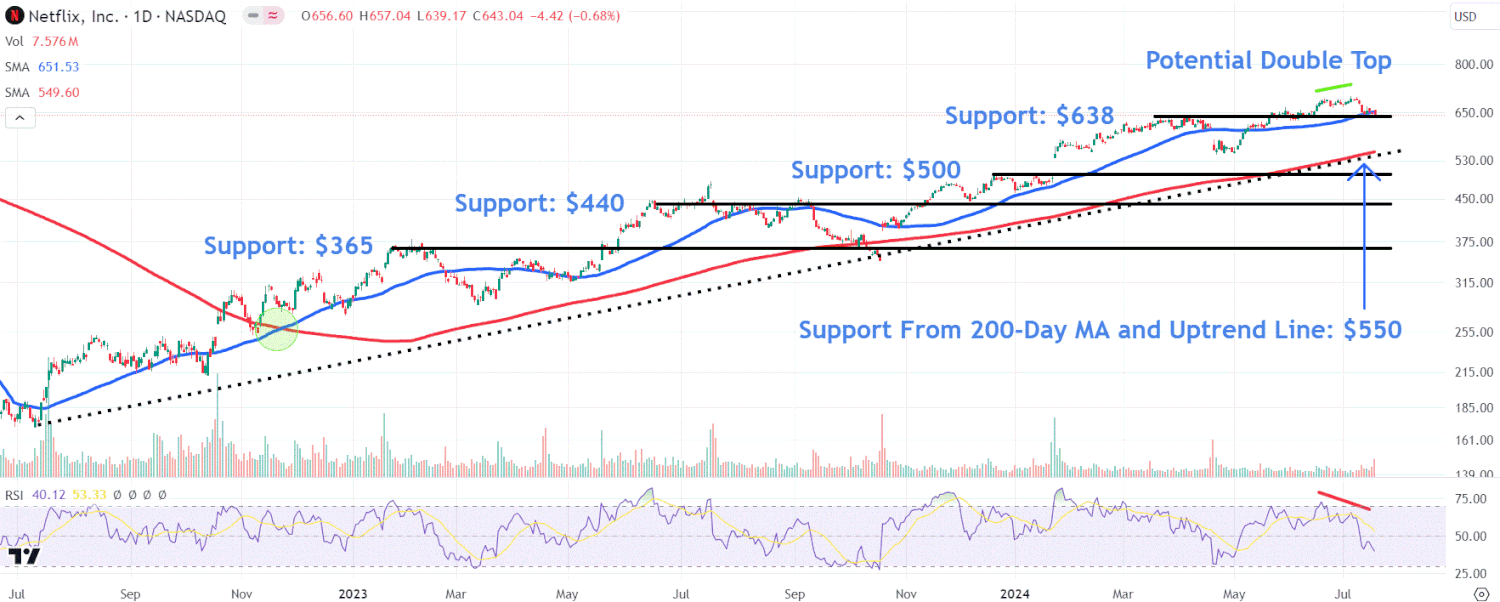

Since mid-2022, Netflix stock has enjoyed a steady climb, strengthened by a bullish golden cross when the 50-day moving average surpassed the 200-day moving average.

However, recent technical signs hint at fading buying enthusiasm.

Two peaks formed during June and July suggest a possible double top, signaling a potential reversal after stock price hits consecutive highs.

As Netflix reached its second peak, the Relative Strength Index (RSI) made a lower high, creating bearish divergence that points to dwindling momentum.

The stock also dipped below the key 50-day moving average ahead of earnings, indicating investors might be preparing for a "sell the news" reaction.

Essential Support Zones to Monitor

Should the stock decline after earnings, investors should watch these five critical support zones where buying interest could emerge:

- $638: Just under 1% below the recent close, this level aligns with multiple price actions over the past five months.

- $550: Near the rising 200-day moving average and a long-term uptrend line dating back to July 2022.

- $500: A consolidation zone before the January gap, offering potential support.

- $440: A historically active area with prior highs from June to September last year.

- $365: Close to the February swing high and October swing low of 2023, likely to attract buyers.

Netflix shares were down 0.2% to $641.89 in after-hours trading.

Note: The insights provided by ZAMONA are for informational purposes only and do not constitute financial advice. Please review our warranty and liability disclaimer.

Author holds no positions in the securities mentioned as of the article’s publication date.

Discover engaging topics and analytical content in Markets News as of 12-07-2024. The article titled " Netflix Stock Price Analysis 2025: Key Levels to Watch After Disappointing Outlook at $642 " provides new insights and practical guidance in the Markets News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Netflix Stock Price Analysis 2025: Key Levels to Watch After Disappointing Outlook at $642 " helps you make smarter decisions within the Markets News category. All topics on our website are unique and offer valuable content for our audience.