Fed Interest Rate Cuts in July 2025: Why Economists Are Divided on Timing and Impact

Discover why nearly 25% of economists urge the Federal Reserve to cut interest rates this July 2025, ahead of the expected September reduction, as inflation trends and labor market shifts influence monetary policy decisions.

Update, July 24, 2024: Insights from Bill Dudley have been added to this analysis.

Key Insights

- Almost one in four economists advocate for an interest rate cut at the Federal Reserve's July 2024 meeting.

- The majority anticipate the Fed to delay cuts until September, consistent with market expectations.

- Federal Reserve officials emphasize the need for more inflation control data before adjusting the benchmark rate, currently at a 23-year peak.

For a growing group of economists, July 2024 emerges as the ideal moment for the Fed to reduce interest rates rather than waiting until September. They argue that recent data signals inflation is moving closer to the Fed's 2% target.

In a recent survey by The Wall Street Journal, 24.6% of economists supported a July cut. Goldman Sachs Chief Economist Jan Hatzius questioned the delay, noting, “If the case for a cut is clear, why wait another seven weeks before delivering it?”

Despite this, 98.5% of surveyed economists expect the first rate cut to occur post-July, predominantly in September, aligning with financial markets.

Reasons Supporting a July Rate Cut

The Federal Reserve has maintained a historically high interest rate for 12 months to curb inflation and cool economic activity. While inflation has decreased since its June 2022 peak, recent progress has been uneven.

Hatzius highlights that rising unemployment and slower GDP growth could pose risks if not addressed promptly.

Adding to the discussion, former New York Fed President Bill Dudley pointed to "deteriorating labor markets" as a compelling reason for a July cut.

He explained in a Bloomberg opinion piece: "When jobs become scarce, consumer spending declines, economic activity slows, businesses pull back investment, triggering layoffs and further spending reductions."

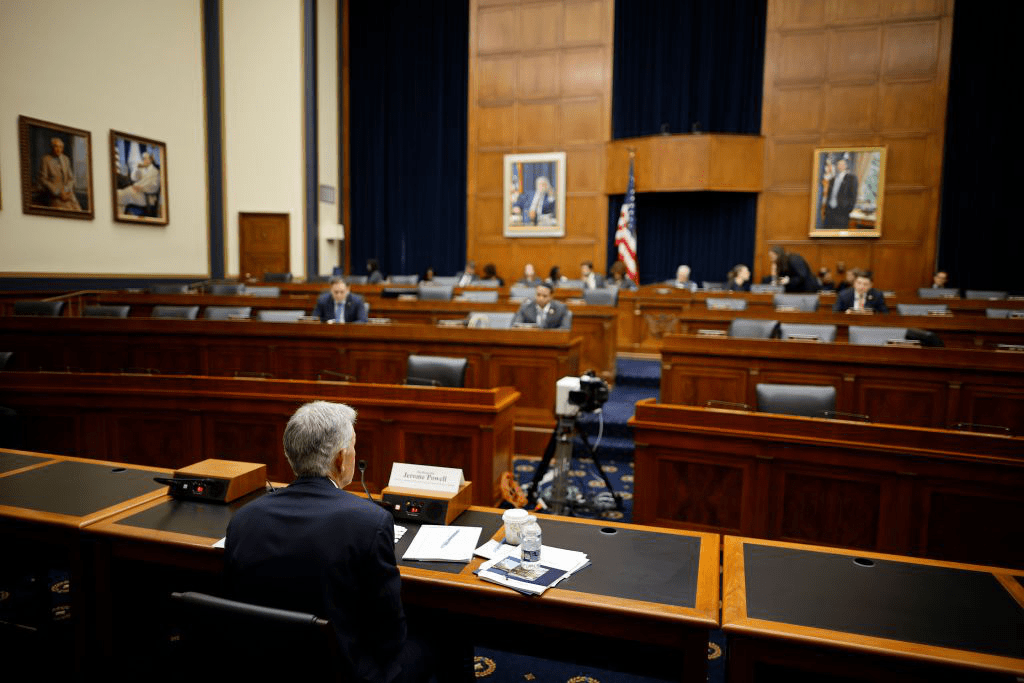

Federal Reserve officials, including Chair Jerome Powell, continue monitoring labor market conditions closely to prevent unwanted unemployment spikes that might trigger a recession.

If you have news tips for ZAMONA's economic team, please contact us at tips@ZAMONA.

Explore useful articles in Economic News as of 29-07-2024. The article titled " Fed Interest Rate Cuts in July 2025: Why Economists Are Divided on Timing and Impact " offers in-depth analysis and practical advice in the Economic News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Fed Interest Rate Cuts in July 2025: Why Economists Are Divided on Timing and Impact " article expands your knowledge in Economic News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.