Black-Scholes Model 2025: Pricing Options with Precision and Insight

Explore the Black-Scholes model, the cornerstone mathematical formula for valuing options and derivatives. Understand its principles, history, and how it revolutionizes modern finance.

Adam Hayes, Ph.D., CFA, brings over 15 years of Wall Street experience as a derivatives trader and financial expert. With a deep background in economics and behavioral finance, Adam holds a master’s degree from The New School for Social Research and a Ph.D. from the University of Wisconsin-Madison. He is a CFA charterholder and licensed with FINRA Series 7, 55 & 63. Currently, he teaches economic sociology and finance studies at Hebrew University in Jerusalem.

Understanding the Black-Scholes Model

The Black-Scholes model is a fundamental mathematical formula designed to calculate the fair value of financial instruments, especially options. Established in 1973, it remains a pivotal tool in modern financial theory for estimating derivative prices by considering time and various risk factors.

Key Highlights

- Also called the Black-Scholes-Merton (BSM) model.

- Widely used differential equation for pricing options.

- Requires five main inputs: option strike price, current stock price, time until expiration, risk-free interest rate, and asset volatility.

- Provides accurate estimates but relies on key assumptions that may not fully align with real market behavior.

- Primarily applies to European options, which can only be exercised at expiration.

Historical Background

Created by Fischer Black, Robert Merton, and Myron Scholes in 1973, the Black-Scholes model was the first widely recognized mathematical method for pricing options. It integrates variables like current stock price, dividends, strike price, interest rates, time to expiration, and volatility.

The seminal paper, "The Pricing of Options and Corporate Liabilities," was published in the Journal of Political Economy, with Robert Merton contributing extensively to the theory's development. In 1997, Scholes and Merton received the Nobel Prize in Economic Sciences for pioneering this groundbreaking model. Fischer Black, having passed away earlier, was honored posthumously for his contributions.

How It Works

The model assumes that stock prices follow a lognormal distribution, moving randomly with constant drift and volatility. Using this, it calculates the theoretical price of European call options by factoring in six variables: volatility, underlying asset price, strike price, time to expiration, risk-free rate, and option type (call or put).

It presumes that asset prices evolve via geometric Brownian motion, incorporating time value of money and price fluctuations to derive option pricing.

Quick Insight

The Black-Scholes model is often compared to binomial models or Monte Carlo simulations for option valuation.

Core Assumptions

- No dividends during the option's life.

- Market movements are unpredictable and random.

- No transaction costs exist in option trading.

- Constant and known risk-free rates and volatility.

- Underlying asset returns are normally distributed.

- Options are European-style, exercisable only at expiration.

Although originally excluding dividends, the model can be adapted for dividend-paying stocks and is often modified to address early exercise features of American options.

Important Note

For American-style options, alternative pricing models like binomial, trinomial, or Bjerksund-Stensland are preferred.

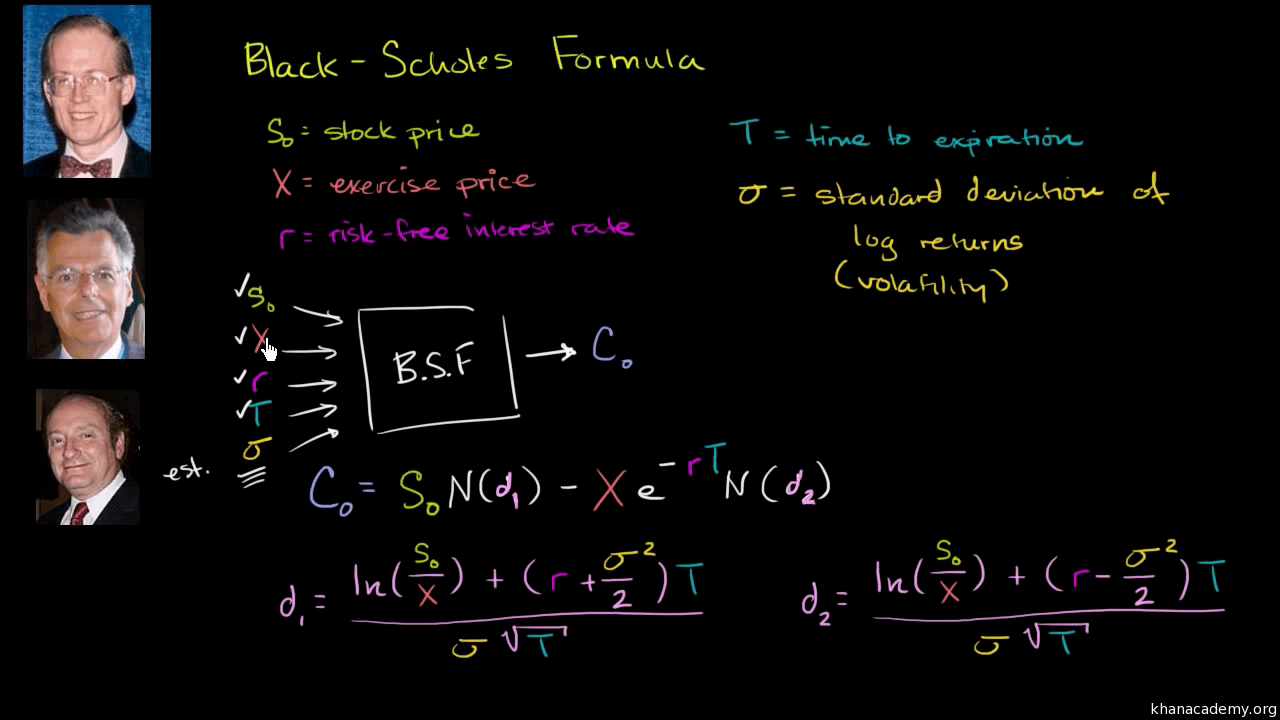

Black-Scholes Formula Explained

While mathematically complex, the Black-Scholes formula is accessible via numerous online calculators and trading platforms. The call option price is computed by multiplying the current stock price by the cumulative normal distribution of d1, then subtracting the discounted strike price multiplied by the cumulative normal distribution of d2.

C = S N(d1) − K e^(-r t) N(d2)

where:

d1 = [ln(S/K) + (r + σ²/2) t] / (σ √t)

d2 = d1 − σ √t

C = Call option price

S = Current stock price

K = Strike price

r = Risk-free interest rate

t = Time to maturity

N = Cumulative standard normal distribution function

Understanding Volatility Skew

The model's assumption of lognormal asset prices means prices can’t drop below zero. However, real-world asset prices often exhibit skewness and fat tails, meaning extreme downturns happen more frequently than predicted.

Since the 1987 market crash, implied volatilities tend to be higher for options deep in or out of the money compared to at-the-money options, producing a volatility skew or smile. This reveals limitations in the Black-Scholes model’s volatility assumptions.

Benefits and Drawbacks

Advantages

- Provides a robust theoretical framework for pricing.

- Helps investors understand and manage risk exposure.

- Enables portfolio optimization based on risk and return metrics.

- Improves market transparency and pricing consistency.

- Streamlines option pricing across markets globally.

Limitations

- Restricted to European-style options.

- Assumes constant volatility and risk-free rates, which may not hold true.

- Ignores transaction costs and taxes, potentially skewing prices.

- Assumes no dividends or early exercise, limiting real-world applicability.

Summary

The Black-Scholes model revolutionized finance by providing a reliable method to price options based on current market variables and theoretical assumptions. Despite its limitations, it remains foundational for derivatives pricing and has paved the way for a diverse range of financial instruments.

Its influence extends across futures, swaps, and options, making it an essential tool for traders, investors, and financial professionals worldwide.

Explore useful articles in Options & Derivatives Trading as of 16-07-2024. The article titled " Black-Scholes Model 2025: Pricing Options with Precision and Insight " offers in-depth analysis and practical advice in the Options & Derivatives Trading field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Black-Scholes Model 2025: Pricing Options with Precision and Insight " article expands your knowledge in Options & Derivatives Trading, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.