Why a 3.5% Unemployment Rate in 2025 Could Signal Economic Challenges

Explore why an ultra-low unemployment rate might not always be beneficial for the economy, including its impact on productivity and wage inflation in 2025.

Is low unemployment always a positive indicator? In the wake of the COVID-19 pandemic, the U.S. labor market has experienced dramatic shifts. After peaking near 10% following the 2008–09 financial crisis, unemployment gradually improved to a historic low of 3.5% in February 2020. However, pandemic-related shutdowns caused a spike to 14.7% by April 2020, with millions losing jobs almost overnight.

As the economy recovers, many anticipate a return to low unemployment rates. Yet, some economists question whether a rate as low as 3.5% is truly advantageous. Why might such a low unemployment figure raise concerns?

Key Insights

- Low unemployment generally signals a strong economy.

- Extremely low unemployment can trigger inflation and reduce overall productivity.

- When additional jobs no longer boost output efficiently, the economy faces an output gap or labor market slack.

Understanding Productivity Limits

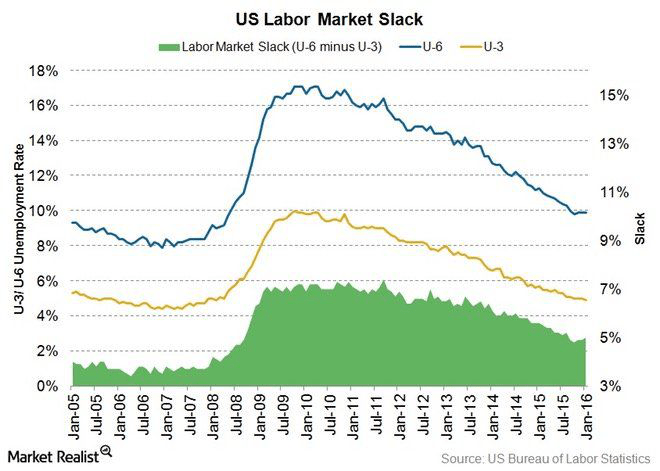

The labor market reaches a point where adding more jobs fails to increase productivity enough to justify their cost, creating inefficiencies known as the output gap or slack. Ideally, an economy operates at full capacity with minimal slack. Economists measure slack by comparing broader unemployment metrics (U6) against standard unemployment (U3), capturing hidden and underemployed workers.

Output gaps fluctuate with economic cycles. A negative gap indicates underused labor resources, while a positive gap—often when unemployment dips below 5%—signals overextension and inefficiency. At 3.5%, the U.S. economy may be operating beyond its optimal capacity, risking diminished productivity.

Wage Inflation and Its Consequences

While rising wages can benefit workers, excessive wage inflation—especially in sectors like industrials and consumer discretionary—can strain businesses. Small-cap companies, with tighter profit margins, are particularly vulnerable. According to Goldman Sachs analysts, a 1% increase in labor cost inflation could reduce earnings per share by approximately 2% for smaller firms, double the impact seen in larger indexes like the S&P 500.

As unemployment falls, labor demand rises, pushing wages higher. This forces some employers to hire less skilled workers to control costs, which can further reduce productivity and efficiency.

Current Unemployment Rate in 2024

As of June 2024, the Bureau of Labor Statistics reports the U.S. unemployment rate at 4.1%, reflecting ongoing economic adjustments.

Why Wage Inflation Matters

Wage inflation disproportionately affects small businesses with limited financial flexibility, often leading to decreased productivity and profitability challenges.

Can Low Unemployment Signal a Recession?

Research from the University of Massachusetts Global suggests that historically, very low unemployment rates have preceded recessions, such as in 1969 when unemployment fell to 3.5% before climbing to 6.1% within a year. However, this pattern may reflect natural economic cycles rather than direct causation.

Final Thoughts

The Federal Reserve faces a delicate balancing act in managing monetary policy to maintain full employment without triggering negative side effects like wage inflation and reduced efficiency. While ultra-low unemployment benefits workers, it also presents complex economic and social challenges that require careful navigation.

Discover engaging topics and analytical content in Economics as of 10-09-2023. The article titled " Why a 3.5% Unemployment Rate in 2025 Could Signal Economic Challenges " provides new insights and practical guidance in the Economics field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Why a 3.5% Unemployment Rate in 2025 Could Signal Economic Challenges " helps you make smarter decisions within the Economics category. All topics on our website are unique and offer valuable content for our audience.