US Dollar Index Poised for a Major Breakout

A robust finish for the U.S. Dollar Index this week could significantly influence commodities, global stock markets, and various asset classes worldwide.

While the U.S. dollar may lack the headline-grabbing excitement of Elon Musk's Tesla tweets or Apple reaching a trillion-dollar valuation, the Dollar Index has been quietly forming a critical pattern all summer. It appears we are on the verge of a decisive breakout. Whether the dollar continues its upward trajectory or reverses, triggering a surge in the euro, the ripple effects across multiple asset classes will be profound and deserve close attention as this trend unfolds.

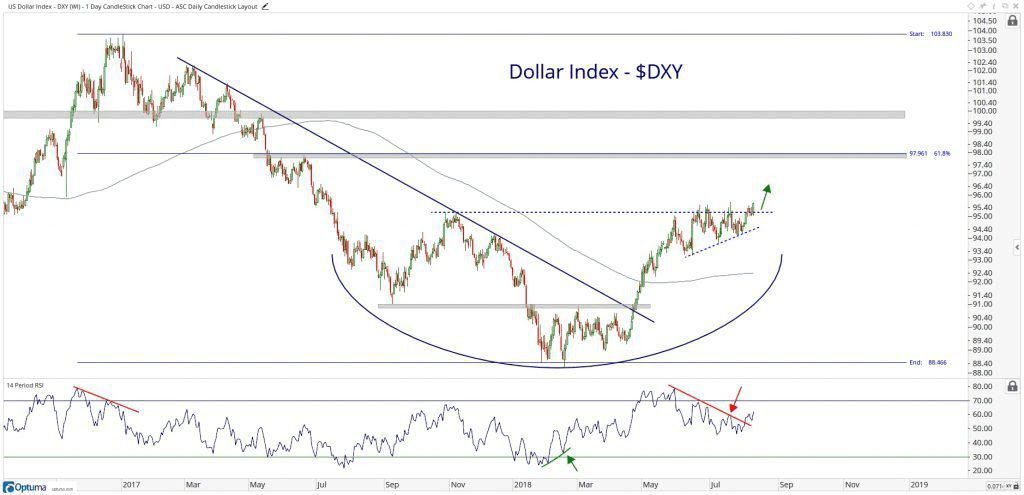

Let’s begin by examining the daily chart of the U.S. Dollar Index. In late April, the index broke above the downtrend line originating from its March 2017 peak, rallying toward the highs set in October, where it encountered resistance. Over the past two months, the price has been consolidating within an ascending triangle, characterized by higher lows and repeated attempts to surpass the October highs. This consolidation has allowed momentum indicators to resolve bearish divergences and the 200-day moving average to level off and begin a subtle upward turn. These are classic signs of a consolidation phase preparing for a bullish breakout, which the price action is now confirming. (For further insights, see: The Pros and Cons of a Strong Dollar.)

From a sentiment analysis standpoint, there is some optimism reflected in options markets, though it’s not as extreme as during the 2014 or 2016 peaks. Commercial hedgers remain net short but not at critical extremes. Qualitatively, few market participants expect the euro to strengthen from current levels, which adds an intriguing angle to this scenario.

[To enhance your trading skills, consider exploring my Technical Analysis course on Investopedia Academy, featuring practical examples and over five hours of video lessons.]

Turning to the euro, the Dollar Index’s largest component, the daily EUR/USD chart mirrors the Dollar Index’s movements. Since late April, the euro has declined sharply from its highs, approaching former support and resistance zones. It has been consolidating in a descending triangle marked by lower highs and unsuccessful attempts to breach 1.1540. Momentum remains bearish, and the 200-day moving average has flattened and started to decline. The recent close at one-year lows confirms the likelihood of continued downward movement.

Quantitative sentiment data indicates that neither options positions nor commercial hedger activity are at extreme levels, implying further downside potential for the euro. (See also: Forex Currencies: The EUR/USD.)

Regardless of the direction this breakout takes, it will have meaningful consequences for commodities—particularly metals—global equity markets (notably ETFs with local currency exposure), and other asset classes worldwide.

While current sentiment in the U.S. dollar and euro markets is not at extremes, precious metals are showing multi-year extremes in options and commercial hedging positions. A confirmed failed breakdown coupled with bullish momentum divergence in beaten-down metals like gold or platinum could spark a significant counter-trend rally, amplified by prevailing negative sentiment.

Since it’s a summer Friday, I’ll keep this brief, but my focus remains on whether the Dollar Index can close the week strongly. I’ll be closely monitoring how this development might influence trends across other markets during my weekend analysis. I’m sure many investors will be watching closely as well.

I'd love to hear your thoughts—participate in JC's Twitter poll or send us your feedback via our contact page.

Thank you for reading!

If you found this analysis valuable and want to stay updated on these chart developments, consider joining the All Star Charts community with a 30-day risk-free trial or subscribe to our "Free Chart of the Week."

Have a news tip for Investopedia reporters? Email us at tips@investopedia.com

Discover engaging topics and analytical content in Markets News as of 30-06-2019. The article titled " US Dollar Index Poised for a Major Breakout " provides new insights and practical guidance in the Markets News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " US Dollar Index Poised for a Major Breakout " helps you make smarter decisions within the Markets News category. All topics on our website are unique and offer valuable content for our audience.