Today's Top CDs: Leading Rates Reach New Peaks for 3-Year Terms

Explore the highest CD rates available nationwide today, featuring 6.18% from Bayer Heritage Federal Credit Union, 6.07% from OMB, 5.80% from Seattle Bank and Credit Human, and 5.76% from TotalDirectBank.

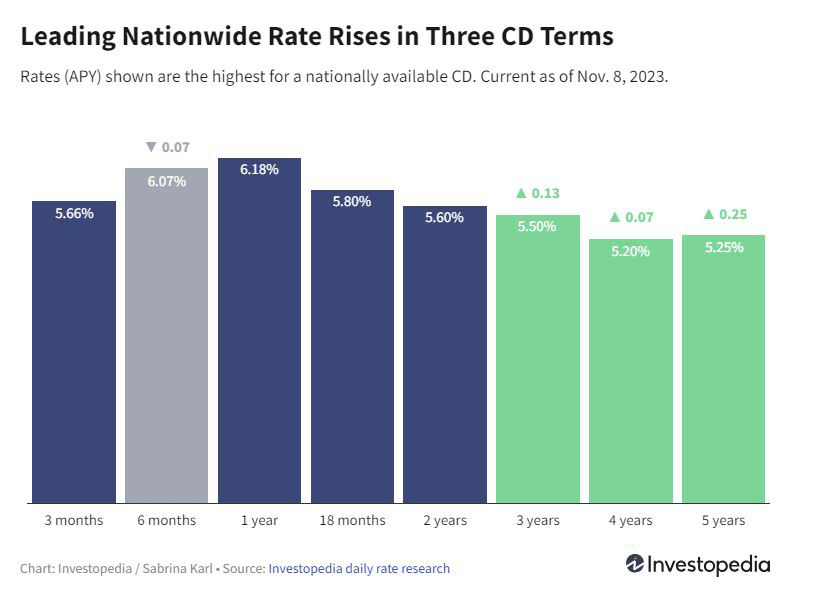

Recent increases from a prominent credit union and a major bank have pushed national CD rates to new heights across 3-year, 4-year, and 5-year terms. Although the 6-month CD leader has changed, the top yield for that term remains competitive.

Workers Credit Union now leads the 3-year CD market with an impressive 5.50% APY, up from the previous 5.37%. Meanwhile, BMO Alto—the online division of BMO, the 12th-largest U.S. bank—introduced a 4-year CD rate of 5.20%, surpassing the prior 5.13%. Both institutions also offer 5-year CDs at 5.25%, improving upon the earlier top rate of 5.00%.

In the 6-month category, the previous leader offering 6.14% APY is no longer available nationwide. However, a newly launched 7-month CD from OMB offers a strong 6.07% APY.

Key Highlights

- Top CD rates have risen in the 3-, 4-, and 5-year terms but slightly dipped for 6-month CDs. Every term now offers at least a 5.20% APY.

- The highest overall CD rate nationwide remains 6.18% on a 1-year term.

- Seventeen nationwide CDs pay at least 5.75% APY, providing ample options for savers.

- Following the Federal Reserve's recent decision to hold rates steady, the door remains open for future hikes.

Below, you'll find featured rates from our partners, followed by a comprehensive list of the best CDs available across the country.

These developments are excellent news for those looking to secure historically high CD rates for multi-year terms. You can now lock in up to 5.25% APY for five years. For mid-term investments, the leading 2-year CD continues to offer a robust 5.60% APY.

If you can make a jumbo deposit of $100,000 or more, you can increase your 2-year CD yield to 5.68% APY or your 30-month CD yield to 5.52% APY.

Investor Insight

A recent survey of Investopedia readers revealed that 1 in 7 would allocate an unexpected $10,000 windfall into CDs, making them the second most popular choice after individual stocks, selected by 15% of respondents.

Important Considerations

Jumbo CDs do not always guarantee higher returns compared to standard CDs. Currently, in six out of eight terms, standard CDs offer comparable or better yields. It’s wise to compare both types before finalizing your choice.

How High Could CD Rates Climb This Year?

The Federal Reserve has aggressively tackled inflation through rapid rate hikes in 2022 and more measured increases in 2023, creating favorable conditions for CD investors and holders of high-yield savings or money market accounts.

Last Wednesday, the Fed maintained its benchmark rate at the highest level since 2001, marking the second consecutive hold. Fed Chair Jerome Powell emphasized that this pause does not rule out future increases.

“Inflation has eased since mid-last year, with favorable summer readings. However, several months of positive data are just the initial step toward ensuring inflation sustainably moves toward our target,” Powell stated.

He reiterated that decisions will be made on a meeting-by-meeting basis, leaving future rate moves uncertain.

Fed officials have expressed mixed views post-meeting; some believe rates have peaked and focus should shift to duration at current levels, while others see potential for another hike.

As always, predicting Fed moves remains challenging. Currently, CD rates are expected to stabilize at elevated levels, but a potential December or January hike could push rates slightly higher.

Best CD Rates for May 2025: Up to 4.50%

Best High-Yield Savings Accounts for May 2025: Two offers at 5.00%

Best Money Market Accounts for May 2025: Up to 4.40%

Note on Rates

The "top rates" featured here represent the highest national rates identified through Investopedia’s daily research of hundreds of banks and credit unions. These differ significantly from national averages, which include all institutions—even those offering minimal interest—making top rates substantially higher than averages.

Rate Collection Methodology

Each business day, Investopedia analyzes rate data from over 200 federally insured banks and credit unions nationwide to rank the highest-paying CDs in all major terms. Eligible institutions must be FDIC or NCUA insured, with minimum initial deposits capped at $25,000.

Banks must operate in at least 40 states. Credit unions requiring donations over $40 for membership are excluded. For full details on our selection process, see our methodology.

Discover engaging topics and analytical content in Personal Finance News as of 14-11-2023. The article titled " Today's Top CDs: Leading Rates Reach New Peaks for 3-Year Terms " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Today's Top CDs: Leading Rates Reach New Peaks for 3-Year Terms " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.