Super Micro Computer Stock Surges 20% in 2025 Ahead of Quarterly Earnings Report

Super Micro Computer's shares jumped 20% last week as investors anticipate strong quarterly results fueled by booming AI demand. Discover key chart patterns and expert forecasts in this detailed analysis.

Watch the Crucial Chart Movement After Last Week’s Impressive Rally

Highlights to Note

- Super Micro Computer’s stock surged 20% last week, driven by optimism around the company’s upcoming quarterly earnings report, expected Tuesday, backed by soaring AI-related sales growth.

- Analysts project a remarkable net sales increase exceeding 200% compared to the same quarter last year.

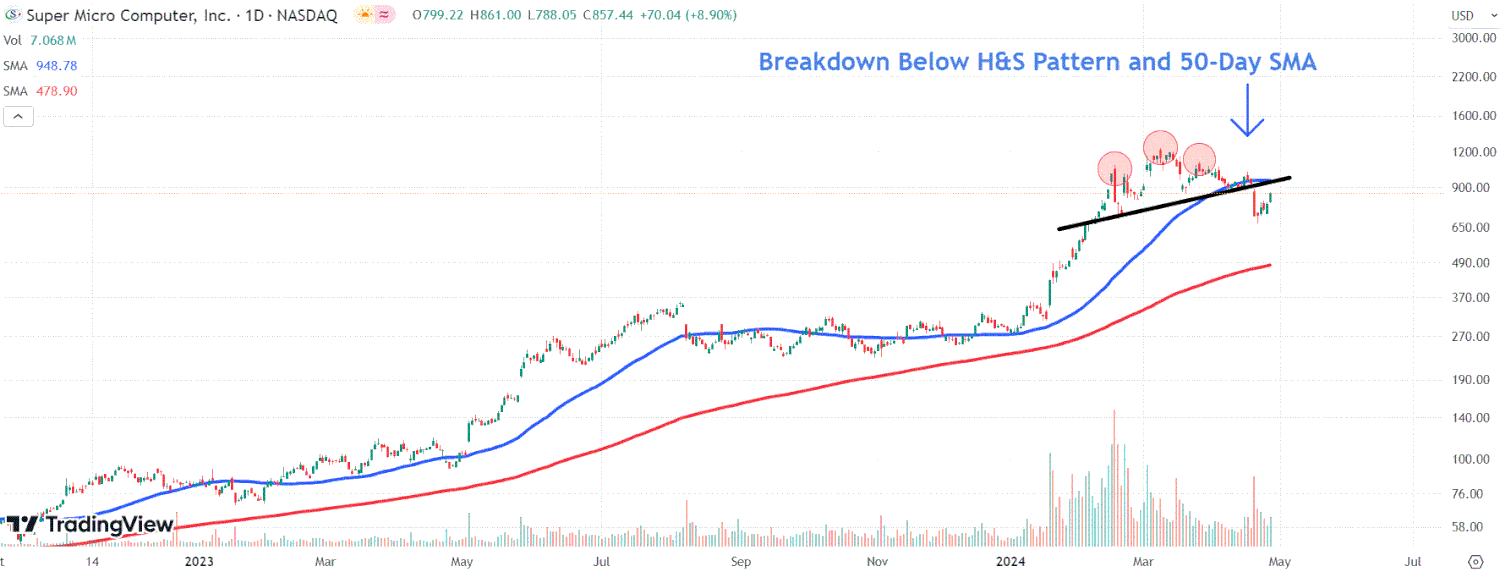

- The stock recently dipped below a significant head and shoulders pattern and the 50-day moving average, with the neckline level becoming critical after the earnings announcement.

Shares of Super Micro Computer (SMCI), a leading provider of servers and data storage solutions, remain in the spotlight after rebounding 20% last week ahead of the company’s quarterly earnings report scheduled for Tuesday evening. This surge is fueled by strong expectations for AI-driven revenue growth.

Following a peak in early March, the stock experienced a sharp decline of up to 45% over two months, as investors reacted to a share offering and the company’s altered approach to preliminary earnings disclosures, prompting profit-taking.

Nonetheless, bullish investor sentiment returned last week, halting a three-week losing streak as SMCI’s shares climbed on the prospect of robust earnings. Analysts anticipate fiscal Q3 net sales of $3.99 billion, marking an extraordinary 212% year-over-year increase and a 9% rise from the previous quarter’s $3.66 billion.

KeyBanc analyst Tom Blakey recently outlined both bullish and bearish scenarios for SMCI, which some market watchers are dubbing the 'next Nvidia (NVDA).' In a positive case, accelerated AI infrastructure demand could push the stock to $1,173 within a year by enabling capacity expansion and market share growth. Conversely, if legacy competitors like Hewlett Packard Enterprise (HPE), Dell (DELL), and Lenovo (LNVGY) intensify competition or AI demand weakens, the stock could fall to $268.

Technically, SMCI’s price recently dropped below a critical head and shoulders pattern and the 50-day moving average, signaling a possible peak. Investors should watch if the stock can close above the neckline around $925 post-earnings, which might prompt a retest of the all-time high of $1,229 hit in March 2024.

Failure to reclaim this key technical level could trigger further selling pressure, potentially driving the price toward the 200-day moving average near $479, approximately 44% below Friday’s close at $857.44.

Note: This analysis is for informational purposes only and does not constitute financial advice. Please review our warranty and liability disclaimer on ZAMONA for more details.

As of this article’s publication, the author holds no positions in the securities mentioned.

Discover engaging topics and analytical content in Company News as of 16-02-2024. The article titled " Super Micro Computer Stock Surges 20% in 2025 Ahead of Quarterly Earnings Report " provides new insights and practical guidance in the Company News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Super Micro Computer Stock Surges 20% in 2025 Ahead of Quarterly Earnings Report " helps you make smarter decisions within the Company News category. All topics on our website are unique and offer valuable content for our audience.